What is Net Salary, Concept of Net Salary and Gross Salary? Calculation of Net Salary and Gross Salary. When we become professionals, most of us go for jobs. To be frank, our work profile is as important to us as our pay package is! But, very few of us understand the true meaning of various terms like Gross Salary, CTC (Cost to Company), Take Home Salary, Net Salary, etc. Must Check How to Export Tally Data.

Quick Links

What is Net Salary, Concept of Net Salary

So, let us here try to attempt to understand the various terms associated with Income under the Head ‘Salary’.

Cost to Company: It is the cost incurred by the company on hiring and sustaining the employee. Generally, it is similar to Gross Salary except for the difference between gratuity and Provident Fund. CTC includes all Allowances, Perquisites, Provident Funds, Medical Insurance, Gratuity, Pension etc.

The CTC also includes free meal coupons, or concessional meal coupons, money spent on their refreshments and entertainment, as well as, if any cab services are being provided by the company for the employees.

The CTC covers both Direct Benefits, Indirect Benefits, and Savings Cover.

The following is a diagram that gives us an illustrative list of the things covered under Cost to the Company and their bifurcation into Direct and Indirect Benefits as well as savings for their future. You may also like Opening Balance in Tally.

| Direct Benefits | Indirect Benefits | SavingsContribution |

| Basic Salary | Medical and Life Insurance premiums paid by the employer | Superannuation benefits |

| Dearness Allowance (DA) | Food Coupons/Subsidized meals | Employer Provident Fund (EPF) |

| Conveyance Allowance | Company Leased Accommodation | Gratuity |

| House Rent Allowance (HRA) | Medical and Life Insurance premiums paid by employer | – |

| Medical Allowance | Income Tax Savings | – |

| Leave Travel Allowance (LTA) | Office Space Rent | |

| Vehicle Allowance | ||

| Telephone/ Mobile Phone Allowance | ||

| Incentives or bonuses | ||

| Special Allowance/ City Compensatory allowance, etc. |

Gross Salary is the total salary inclusive of all allowances and perquisites that are paid by the company to and for a particular employee. It includes Basic, Dearness Allowance, other Allowances, and Perquisites and includes the cost of all services borne by the company for the employee. Gross Salary is employee provident fund (EPF) and gratuity subtracted from the Cost to Company (CTC).

It includes bonus, overtime pays, etc.

Net Salary / Take Home Salary:

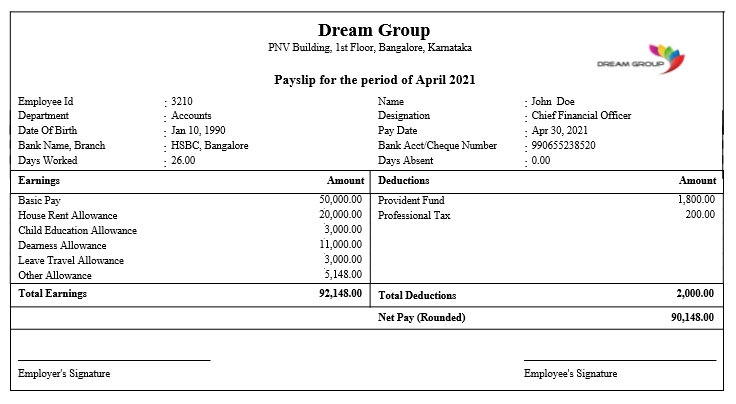

The net salary is the same as the take-home salary. As the name suggests, it is that salary that the employee actually gets in hand. TDS and other required deductions are made from the Gross Salary to arrive at this figure. Thus, this is the salary that an employee actually takes at home.

We can calculate Net Salary by doing the following calculations:

Gross Salary – TDS – Contribution towards PF – PT (Professional Tax)

In this way, we can analyze what we will actually earn if we are just aware of the Cost to the Company. Also, make sure you do all these calculations if you get an offer from a company and then decide to accept or reject the offer.

Difference between Gross Salary and Net Salary?

The difference between gross salary and net salary is that while gross salary is your salary before any deductions are made from the salary, net salary is the salary an employee takes home after all deductions have been made. Must Check How to Pass Payment Entry in Tally.