Various Types of Sources of Finance. Dear friends, it is very important to manage financial liquidity in a business concern. The funds should be neither too much nor too less. So, we should have a detailed knowledge about the various sources of finance. In order to understand the sources of finance we need to understand some basic terms:

Quick Links

What is Business?

Business refers to the state of being busy in some commercial or Professional work. It refers to being busy in some Profession, Trade or Business. As per PETER F. DRUCKER, “PROFIT MAXIMISATION has a little significance and should be replaced by the words WEALTH MAXIMISATION”. Every business has some objectives like Survival, Stability, Making Customers, Efficiency, Profitability, and Growth.

GROWTH refers to improvement in something. Every organization to continue in the long run should grow in its operation. Thus, it becomes necessary to analyze business environment and go for new projects for continual expansion and diversification. A major consideration for above is determining the total cost of project and means for financing it.

Every business needs finance for meeting its long term financial needs, medium term financial needs and short term financial needs.

Let us suppose we need to buy plant, machinery, Buildings etc.

In such case, we will need funds for greater period say 7 years or more.

Here we can say finance required for meeting such needs are “long term” in nature.

In order to sale goods we need to advertise our product which requires fiancé. Here we can say finance required for meeting such needs are “Medium term” in nature.

We need to buy stocks of raw material and other consumables for production. Here we can say finance required for meeting such needs are “Short term” in nature.

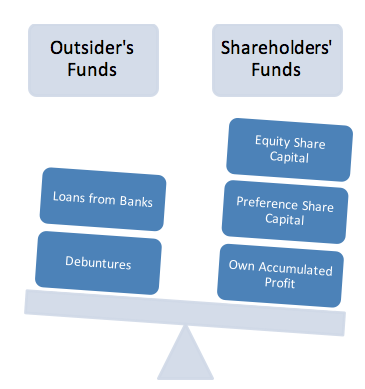

Now we Need to discuss what the sources of finance are.

Equity Share Capital:

Equity capital is the source of finance in which least risk is involved. Share holders are the owner of the company. Being owners they have a right such as dividend. Dividend will only be paid if there is a distributable profit. However, no organization is required to pay any mandatory payment to share holder. It is a permanent source of Finance for any organization. Company can also issue further shares in the form of Rights Issue.

Preference Share Capital:

Preference shareholders will be given priority for payment of dividend and repayment of capital. that is Preference share holders do not have managerial control as equity shareholders have. If organization wants not to dilute Earnings per share further they should issue preference shares. Preference shares bear a fixed charge.

Accumulating Own Profit:

Every Organization can raise funds by accumulating its own profit and introducing it into the business whenever need arises. Organization can save money in the form of Interest by reducing the amount of loan. It will help to maintain net worth of the Shareholders.

Loans from Banks OR Financial Institutions:

Term loans by banks depend upon anticipated income of the Borrower. The repayment is generally scheduled over a longer period of time. Term loans are generally taken for purchase of fixed assets or expansion activity.

ICICI, IDBI are some of the financial Institutions which provide loans to the organization. Organizations requiring loans need to give a detailed report about the project for which the loan is to be raised. There are various schemes by such institution carrying different rate of Interest.

Bridge Finance:

Sometimes organizations may take loan from Commercial Banks for short period against loan issued by financial institution which is yet to be cleared. Such finance may be referred as a Bridge Finance.

Debentures:

Generally debentures are considered less risky as compared to equity shares and preference shares. Thus organizations are required to pay less return against these secured investments by investors. Debenture Interest is an obligatory payment by organizations. Issuing debentures for raising long term finance may be helpful especially in the period of recession.

The above can be summarized using the following table:

Recommended Articles

- Sovereign Gold Bond Scheme

- Sukanya Samridhi Yojana

- Post Office Monthly Income Scheme Account

- Senior citizens savings scheme

- Jan Aushadhi Scheme

- Revised interest rates for Small Savings Schemes

- National Pension Scheme

- Pradhan Mantri Mudra Yojana

- Balance enquiry number

- Types of loans

- Bank Holidays in India