Union Bank of India NEFT Form: With National Electronic Funds Transfer (NEFT) you can transfer funds and make Credit card payments to any bank across India. With this service your transactions are easier, and, with fewer restrictions, they reach further than before.

Quick Links

What is NEFT?

National Electronic Funds Transfer (NEFT) NEFT is electronic funds transfer system, which facilitates transfer of funds to other bank accounts in over 63000 bank branches across the country. This is a simple, secure, safe, fastest and cost effective way to transfer funds especially for Retail remittances.

- Click here to know more details for NEFT

Who can avail Union Bank of India NEFT facility

- Customers of the branch where they are having Savings/Current Accounts

- Walking customers for below Rs. 50,000.

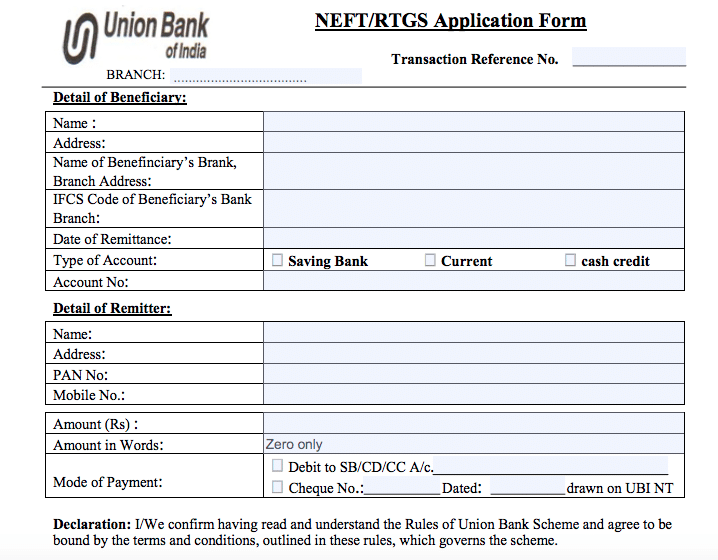

Union Bank of India NEFT Form

Minimum and Maximum Amount for Transfer

- Minimum Amount : Rs.1

- Maximum Amount : Rs 2 Lakhs

Union Bank of India NEFT Charges

Please Note New RBI news – There will be no charge from January 1, 2020 on National Electronic Funds Transfer (NEFT) used for online fund transfer (Net Banking). The Reserve Bank of India (RBI) has given this exemption for account holders with savings bank accounts.. This means that payments via NEFT would become either free or charges would be drastically reduced.

Please Note – Union Bank NEFT is available for 24hours, Now you make NEFT Payment Anytime from 1st January 2020

UBI NEFT Charges at Bank Branches

- For transaction amount up to Rs. 10,000 : Rs. 2.50 + taxes

- For transaction amount above Rs. 10,000 & up to Rs. 1 Lac : Rs. 5.00 + taxes

- For transaction amount above Rs. 1 Lac & up to Rs. 2 Lacs : Rs. 15.00 + taxes

- For transaction amount more than Rs. 2 Lacs : Rs. 25.00 + taxes

How to Send Payment via NEFT

There are two ways to send payment via NEFT and one of them is 1. NEFT via Online Internet Banking and 2nd is 2. NEFT via Bank Branch..

NEFT via Bank Branch : If you want to make NEFT via offline mode i.e from Bank Branch then you need to visit your nearest Union Bank of India Branch and Request for NEFT Form or Slip and Fill all the require details asked in NEFT Form and submit to Cashier, Now you bank brach send payment to another person within 2 working hours

NEFT Via Internet Banking : You may also send money via NEFT by using your Union Bank of India Internet Banking Service, for using Internet banking, you need to login at Union Bank of India Website and then you will require to add new Beneficiary and then you are able to make payment via NEFT. Online NEFT is enabled for all customers of Union Bank of India (Internet Banking) with full transaction right.

Android Application

If you would like to avail Union Bank of India NEFT Facility then please download the application form or visit to your Union Bank of India Brach and submit the duly filled form to your base branch. If you are already a Union Bank of India Connect customer with “view right” and would like to avail full transaction right, please resubmit your application form (can download from above URL) to you base branch.

- Login to Union Bank of India NetBanking

- On the left hand side navigation bar, click on “Other Bank Transfer – NEFT” under the Funds Transfer section.

- Fill in all details like transfer amount, destination account number, IFSC Code, beneficiary name & payment details. After these details are filled in correctly, a unique transaction confirmation number would be generated. This number is to be quoted for any query related to this particular transaction.

What the customer must have for remittance

- IFSC of the bank branch to which the remittance to be made (IFSC is 11 characters code)

- Beneficiary account number, Name and Address (to whom the remittance is intended to )

- Approach the branch with the above details

When is the amount credited in the beneficiary account?

- Union Bank of India NEFT is open 24×7, 365 days.

- Transactions, once confirmed will be immediately debited from the source account and taken up for processing. Transactions initiated before the cut off time shall be processed on the same day.

- All transactions initiated outside the NEFT hours and on NEFT holidays will be processed (for onward transfer to beneficiary bank) only on the next working day. Please ensure that there are sufficient funds in your account to process the transaction. In case you are retrying, please check the status of your previous transaction

- Please note that once the amount is debited and processed from Union Bank of India, the credit into the beneficiary account is completely dependent on the destination bank

Importance Account Number

Outward : While remitting the funds, Account Number of the beneficiary is to be mentioned correctly in the voucher (to whom the remittance is intended to ).

Inward : While seeking remittance from other bank Customers it is mandatory to quote your 15 Digit Finacle Account Number compulsorily.

What is the difference between RTGS and NEFT?

- Both RTGS (Real Time Gross Settlement) & NEFT are facilitated by RBI for doing online funds transfer between various member banks.

- Effective 15th November 2010, as per RBI guidelines, RTGS (Real Time Gross Settlement) is available only for transactions of Rs.2,00,000/- and above. For any transaction below Rs.2,00,000/- NEFT should be used

Can I Stopped NEFT Payment be initiated?

No. Once the transaction is put through, payment cannot be stopped

Important Instructions for Union Bank of India NEFT

- The actual time taken to credit the account depends on the time taken by the Payee’s Bank to process the payment

- The money will reach the Payee’s bank within the time stipulated by the Reserve Bank of India

General notes for Union Bank of India NEFT

- The funds transfer option is applicable for all beneficiary bank branches participating in the NEFT scheme.

- Kindly ensure that the Beneficiary Details are correct before the execution of the transfer.

- Please note down the transaction reference number for any clarifications/communications with regards to NEFT transactions. This reference number should be used to follow-up with the destination bank for credit into recipients’ account.

- Please note that NEFT transactions are to be used only for transferring funds from Union Bank of India to other banks. For transferring funds to another Union Bank of India account, please use the Third Party Transfer option.

Union Bank of India NEFT Contact Details

NEFT Cell, 11th Floor,

Union Bank of India,

239, Union Bank Bhavan,

Nariman point

Mumbai – 400021

022-22896587/ 22896510

Email: [email protected]

Recommended Articles

sir,pl.make clear whether CASH can be remitted for NEFT fund transfer? if so ,what’s the limit? How can account holder without CHEQUE FACILITY do NEFT transaction?