Types of Debit Cards: Debit card is an instrument issued by banks or other financial institutions which can be used instead of cash when buying products or availing services.

Quick Links

How Debit Cards are different from Credit Cards

Debit cards are linked to the bank account. For every transaction through a debit card, the bank account is debited whereas credit cards are not directly linked to the bank account. One can get instant credit without the debit of a bank account although the credit availed is repayable after a pre-defined specified credit period.

Types of Debit Cards

The major issuers of debit cards around the world are American Express, Discover Card, Master Card, and Visa. Countries also have specific cards that are popular in those countries such as RuPay in India.

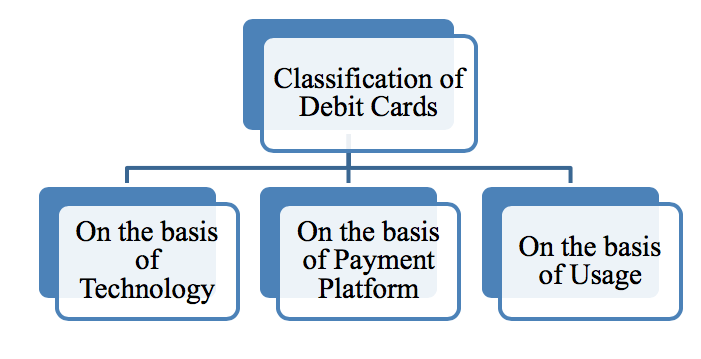

Classification of Debit Cards

A) On the basis of Technology

1) Contactless Cards: Such cards use radio-frequency identification (RFID) or near field communication (NFC) for making secure payments. Since no PIN or signature is required for verification, the cards are used in close proximity. Countries have also set the floor limit on payments made through such cards. Mobile had developed similar technology in 1997 and was using it across Mobil gas stations.

2) Magnetic Stripe Debit Cards: The cards use the technology of tiny iron-based magnetic particles on a band of magnetic material. The card is read by swiping past a magnetic reading card. The prototype of magnetic stripe card was created in 1969 by IBM engineer Forrest Parry.

3) Chip and PIN Debit Card: The cards store data on integrated circuit chips. The cards need must be physically inserted into the reader and verified by using PIN which is typically 4 to 6 digits in length.

B)On the basis of Payment Platform

1) Visa Debit Card: The cards are branded by Visa. The cards are accepted by businesses across 200 countries. The cards use the Visa network and offer verified by Visa platform for online transactions. The first Visa card was issued in 1982 by Bendigo Bank, Australia.

2) Visa Electron Debit Card: The cards are another product of Visa. The only difference is that, electron card accounts cannot be overdrawn. Funds should be available at the time of payments. The cards were introduced in 1985. The cards are generally issued to customers with poor credit ratings. The electron cards are not so popular (because businesses cannot verify fund availability) and hence its usage is declining.

3) Master Debit Card: The cards are branded by Master Card.The cards use the Master Card network for processing the transactions.

4) Maestro Debit Card: The cards are product of Master Card which was first introduced in 1991. The non-contactless cards requires PIN to transfer the funds.

5) RuPay Debit Card: The cards were launched under the scheme by National Payments Corporation of India (NPCI) in 2012. The cards were introduced in 2014. The card uses Discover network. In financial year 2019, RuPay had reported 100 crore transactions through both offline and online mode.

C) On the basis of Usage

1) Prepaid Debit Card: Although a debit card, but not linked to the bank account. It is similar to prepaid mobile number. You have to add money in advance to the card before effecting the transactions.

2) International Debit Card: As the name suggest, such cards can be used outside India to withdraw money as well as for effecting transactions without being worried about currency conversions. Although individuals need to pay some charges for the same. The charges would differ bank to bank.

3) Business Debit Card: As the name suggests, the cards are issued to corporates to be used for their business purposes.

4) Virtual Debit Card: Virtual Debit cards are the online cards. They are not the physical plastic cards. A randomly sixteen digit numbered card is generated along with CVV which is linked to the bank account. The transactions using virtual cards can be made using internet. The cards can be used only once.

Frequently Asked Questions

What are Platinum Debit Cards etc.?

Are debit cards and pre-paid debit cards same?

Who are the major issuers of debit cards?

What are contactless debit cards? Do such cards have any floor limit?

Recommended: