Truncated Cheques: The current system of cheque clearing is paper based, involves the physical exchange of cheques. This movement has necessitated clearing cycles of 3 to 7 days. Even though 90% of the cheques clear in 3 days, these cycles are rather long and delay the receipt of value by bank customers. A shortened clearing cycle through the Cheque Truncation will make it possible for customers to realise the proceeds of cheques early. know more about Truncated Cheques…

Quick Links

Meaning of Truncated Cheques:

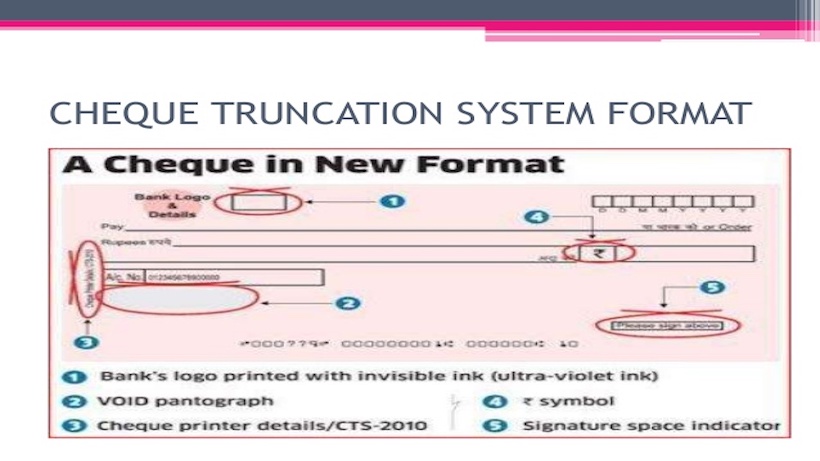

Truncation means, stopping the flow of the physical cheques issued by a drawer to the drawee branch. The physical instrument is truncated at some point enroute to the drawee branch and an electronic image of the cheque is sent to the drawee branch along with the relevant information like the MICR fields, date of presentation, presenting banks. etc.

It is the process in which cheque details are captured by the payee bank (or its clearing agent) and electronically presented in an agreed format to the drawee bank (the bank on which it was drawn) for payment. Unlike the more common form of presentment, where a cheque is physically presented to the drawee bank, a truncated cheque is stored by the payee bank.

Expected Benefits :

For Banks:

Banks can expect multiple benefits through the implementation of CTS like faster clearing cycle means realization of the proceeds of cheques possible within the same day. It offers better reconciliation/verification process, better customer service, and enhanced customer window. Operational efficiency will provide a direct boost to bottom lines of banks as clearing of local cheques is a high cost low revenue activity.

Besides, it reduces operational risk by securing the transmission route. Centralised image archival system ensures data storage and retrieval is easy. Reduction of manual tasks leads to reduction of errors. Customer satisfaction will be enhanced, due to the reduced turn around time (TAT). Real-time tracking and visibility of the cheques, less fraudulent cases with secured transfer of images to the RBI are other possible benefits that banks may derive from this solution.

For Customers :

CTS / ICS substantially reduces the time taken to clear the cheques as well enables banks to offer better customer services and increases operational efficiency by cutting down on overheads involved in the physical cheque clearing process. In addition, it also offers better reconciliation and fraud prevention. CTS / ICS uses a cheque image, instead of the physical cheque itself, for cheque clearance thus reducing the turn around time drastically.

The benefits will be evident if one compares the present system of cheque clearance with the new system. The current system which is paper-based, involves the physical exchange of cheques. This movement has necessitated clearing cycles of 3 to 7 days. Even though 90% of the cheques clear in 3 days, these cycles are rather long and delay the receipt of value by bank customers

A shortened clearing cycle through the CCC with CT will make it possible for customers to realise the proceeds of cheques early. The benefits could be summarised as :

- a) Faster clearing cycle; 2 days (eventually 1day) for Clearing of all cheques nationwide.

- b) Timely availability of funds to beneficiaries.

- c) Better reconciliation/verification process.

- d) Status of the cheque will be known on the next business day.

- e) There are no additional costs to customers.

Recommended Articles