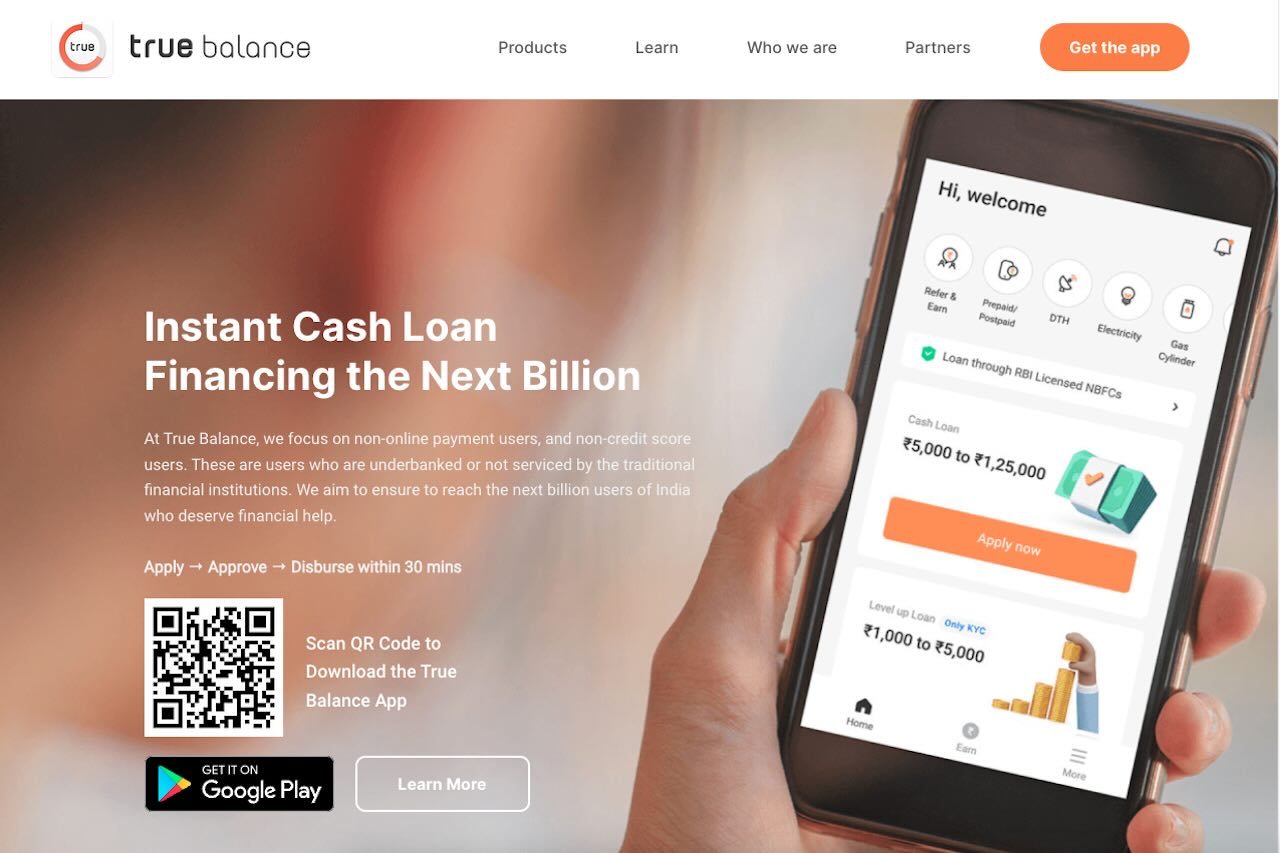

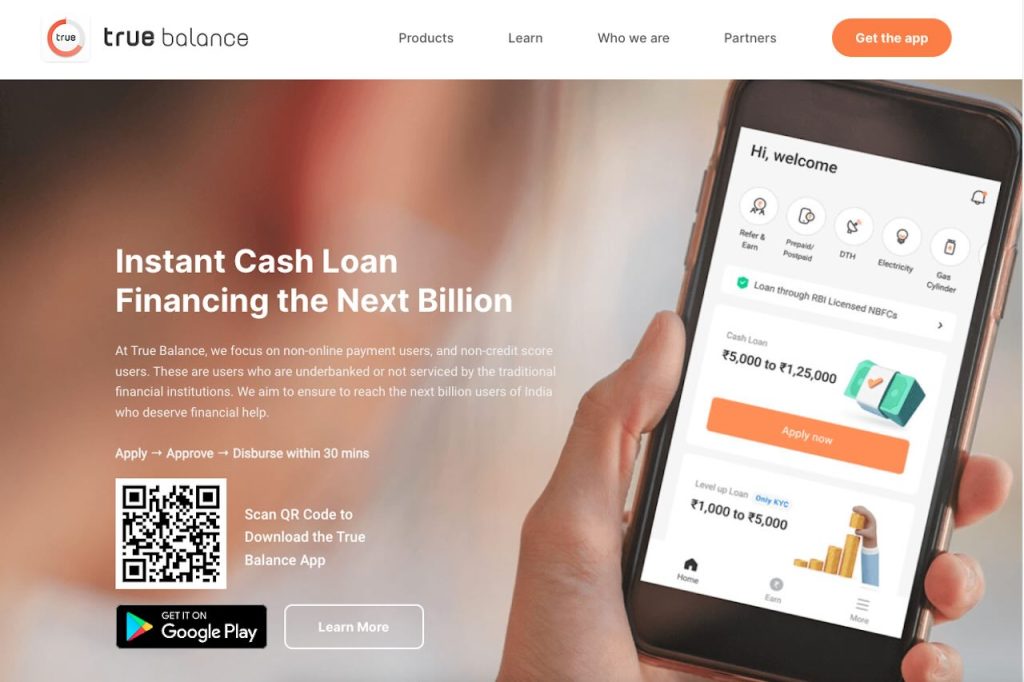

True Balance 2024: True Balance is one of the most successful and widespread applications for loans and financial services. The process to get the loan is straightforward and hassle-free. As the process is online, you don’t have to be worried about the long lines in banks and the discomfort of visiting the lenders repeatedly. You can directly fill the application from your home, and the loan will be transferred to your account now.

Read more about Suryoday Bank RD Interest Rates

Quick Links

Features of True Balance

In true balance, you can get the loan from its official website as well. It provides very excellent service after the loan approval. You can take the loan as many times as you want with the help of True Balance. Also, there is a feature by which you can take multiple loans by only submitting the documents once. The interest rate is also very reasonable, and the processing fee is relatively low as well. You can easily take a loan amount ranging from 1,000 to 60,000. However, for the maximum amount, you need to have a perfect credit score.

| Features | True balance provides loans in a very simple and convenient wayIt is available for everyone with proper documents and eligibility. Quite loan disbursement is one of its best features. The company is approved by RBI, and it is very safe and secure |

| Eligibility criteria | It would help if you were an Indian to take benefits of True Balance loan and credit. You age must have to be within the limit to be able to take the loan. You need to have a regular source of income so that you can repay the loan in time. |

| Application process (Online/Offline) | There are only five easy steps by which you can take the loan. The application process is entirely online and hassle-free. You can get a loan without any need for paperwork, and the documentation is also minimal. |

| Documents Required | You need to have identity proof, address proof, pan card and many other documents. Without proper documentation, you can’t take a loan from True Balance. |

Eligibility criteria

Some eligibility criteria must be looked at to know about. You can either check about these criteria directly from the app or its official website. However, we have discussed all the eligibility criteria which are asked of you during the loan approval.

- First of all, True Balance only provides loans to the citizens of India, so if you are not a citizen then you can’t take out a loan.

- A regular monthly income is very essential to get a loan. This is the security which the company needs. It also shows your credibility for loan repayment.

- You need to be either a self employed person or a salaried employee.

- Your age must have to be more than 21, and you also need to have a work experience of at least one year, if you are a salaried employee, and a work experience of 3 years, if you’re a self-employed person.

Application process

The application process is straightforward and convenient. You can fill the application form within minutes, and the loan approval also takes significantly less time than others. True balance has a very successful history with credit, and they have always impressed the customers with their phenomenal service and hassle-free process.

The steps by which you complete the application process are mentioned below:

#Step I – First of all, you need to install the application or repeat the same steps if you are using its official website. Play store link

#Step II – In step II, you need to get yourself registered on the application. From here, you can also choose the loan amount and loan type. Also, the interest rate and tenure will be shown there.

#Step III – Now, you can fill the application form. You can check the details online if you find any difficulties in filling the application form.

#Step IV – You can now upload the scanned image of all the required documents. Once the documents are uploaded, you can submit the application form.

#Step V – The application form and documents would be placed under check, and once the review is over, the loan amount will be transferred directly into your bank account.

Documents required

There are some documents that you need to have with yourself when you are applying for the loan. The list of required documents are mentioned below:

- Identity proof – Aadhaar card, passport, voter ID card, etc.

- Address proof – Aadhaar card, driving license, etc.

- Income proof, for that you can either use the bank statement of the last few months or the most recent salary slip.

- You also need to submit your credit score with all the documents.

- A pan card is also very essential for loan approval and KYC.

Frequently asked questions

Yes, True Balance is verified by the RBI, and you can take out a loan without any worries. True balance also provides a very safe and secure environment for all your transactions.

Yes, you can take out a loan daily as well as every month. True balance provides a lot of flexibility in its service.