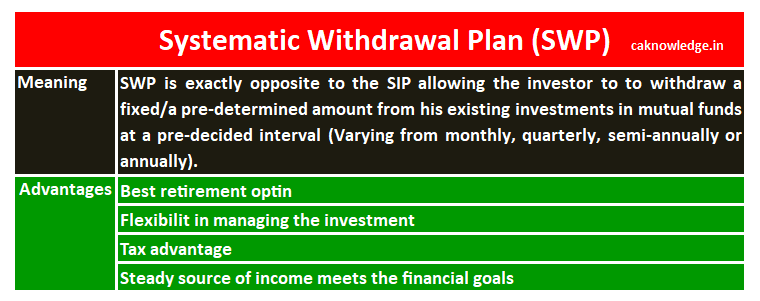

Systematic Withdrawal Plan (SWP): Systematic Withdrawal Plan allows an investor to withdraw a fixed/a pre-determined amount from his existing investments in mutual funds at a pre-decided interval (Varying from monthly, quarterly, semi-annually or annually). In a sense, SWP is a mechanism similar to SIP, but the only difference is SWP gives the investor an option to withdraw a portion of his investment. SWPs are relatively unpopular in India.

Quick Links

Example:

You hold 10,000 units in a mutual fund scheme and have given instructions to the fund manager to arrange for withdrawal of Rs. 5,000 every month through.

On 1 April, the NAV is Rs.100 and withdrawal of Rs 5000 is made for the 1st time, the amount would be divided by the NAV and the units so arrived would be deducted from the total number units in your holding. Rs 5000/100=50 units, thus the balance units = 9950. The same is repeated at every withdrawal considering the amount of withdrawal and the NAV as the basis for determining the corresponding units redeemed in the form of Rs. 5000 payment.

Advantages of Systematic Withdrawal Plan:

Best retirement option:

SWP helps in generating a regular cash flow for the investors at the pre-decided intervals; hence it is one of the best choices for leading a peaceful life after retirement. Usually, a huge sum of money received at the time of retirement which can be invested in mutual funds with SWP facility. As the time goes on, the investor gets an appreciation in his capital along with periodical receipt of fixed amount for meeting the day to day financial needs.

Flexibility:

SWPs are very flexible in terms of managing your investment. Instructions given at the beginning can be changed at any time. If you have suddenly got another source of income such as rent etc., you can instruct your fund manager to stop the withdrawal option for a specific period. You can even make an additional investment in the existing scheme.

Tax advantage:

Lon term capital gains (gains arising on sale/redemption of mutual funds that are held for a period of more than a year) are exempted in case of investments in equity mutual funds. But the same is taxed at 20% in case of debt funds.

In case of short term capital gains (If an investor sells/redeems units of an equity mutual fund scheme within 1 year of purchase), tax has to be paid at 15%. In case of debt funds, short term capital gain is taxed at the investors tax slab.

Steady source of income meets the financial goals:

Financial goals such as children’s education, periodical health care bills can be met through the steady source of income we receive on pre-determined intervals. A well planned investment would leave the investor with no worry to bother about the future financial goals.

De-merits:

- If not carefully chosen, certain SWPs attract exit loads if the withdrawal option is set up immediately after making the investment.

- Mutual funds are subjected to market risks. This is the inherent demerit of mutual funds. So, if you worry about losing the capital amount in the times of market crisis, you should evaluate your risk appetite before making any investment.

Recommended Articles: