SEBI Overview: The Securities and Exchange Board of India was established on April 12, 1992, by the provisions of the Securities and Exchange Board of India Act, 1992. The first statutory regulatory body that the Government of India set up after the reforms of 1991 was the Securities and Exchange Board of India (SEBI). Recently we have Provided Various Terms of Banking and Stock market…An overview to know about at a Glance.

To regulate the securities market in India, the Govt. of India set up a regulatory body i.e. Securities and Exchange Board of India (‘SEBI’) in 1988. It became an autonomous body by the Government of India on 12 April 1992 and was given statutory powers in 1992 with SEBI Act, 1992 being passed by the Indian Parliament. The Preamble of the Securities and Exchange Board of India is “to protect the interests of investors in securities and to promote the development of, and to regulate the securities market and for matters connected therewith or incidental thereto”

Quick Links

SEBI Overview

| Name | SEBI |

| Full-Form | Securities and Exchange Board of India |

| Founded: | 12 April 1992 |

| Sector: | Securities market |

| Headquarters: | Mumbai |

| Agency executive: | Ajay Tyagi (Chairperson) |

| Type: | Statutory corporation |

| Subsidiary: | National Securities Depository Limited (NSDL) |

| Official Website | www.sebi.gov.in |

Recommended Articles

Objectives of SEBI

- To protect the interests of investors in securities

- To promote the development of

- To regulate the securities market and for matters connected therewith or incidental thereto

History of SEBI:-

- It was officially established by The Government of India in the year 1988 and given statutory powers in 1992 with SEBI Act 1992 being passed by the Indian Parliament.

- SEBI has its Headquarters in the business district of Bandra Kurla Complex in Mumbai and has Northern, Eastern, Southern, and Western Regional Offices in New Delhi, Kolkata, Chennai, and Ahmedabad respectively.

- The controller of Capital Issues was the regulatory authority before SEBI came into existence; it derived authority from the Capital Issues (Control) Act, of 1947.

- Initially, SEBI was a nonstatutory body without any statutory power.

- However, in the year of 1995, the SEBI was given additional statutory power by the Government of India through an amendment to the Securities and Exchange Board of India Act, 1992.

- In April 1988 the SEBI was constituted as the regulator of capital markets in India under a resolution of the Government of India.

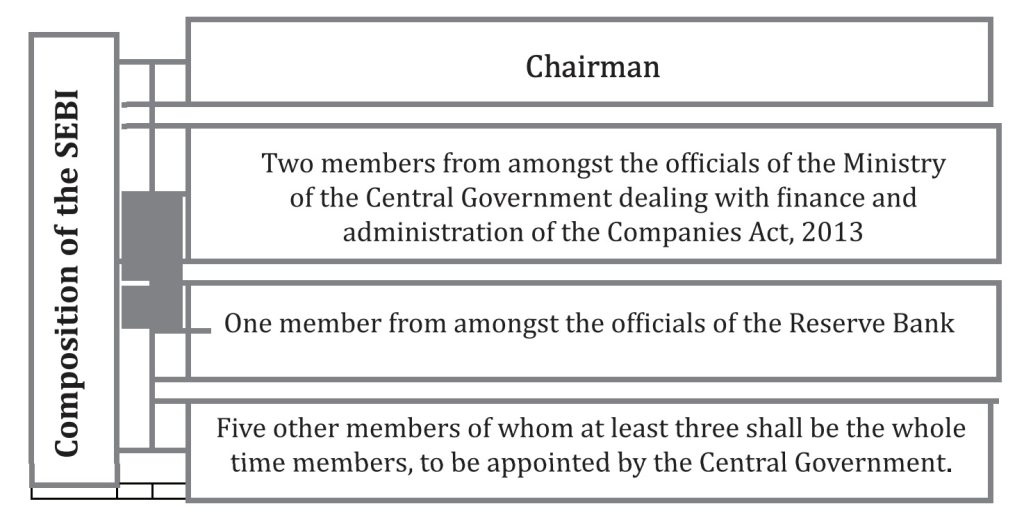

- The SEBI is managed by its members, which consists of the following:

- a) The chairman who is nominated by the Union Government of India.

b) Two members, i.e. Officers from the Union Finance Ministry.

c) One member from The Reserve Bank of India.

d) The remaining 5 members are nominated by the Union Government of India, out of them at least 3 shall be whole-time members.

- a) The chairman who is nominated by the Union Government of India.

- The office of SEBI is situated at SEBI Bhavan, Bandra Kurla Complex, Bandra East, Mumbai- 400051, with its regional offices at Kolkata, Delhi, Chennai, and Ahmadabad.

- It has recently opened local offices in Jaipur and Bangalore and is planning to open offices at Guwahati, Bhubaneshwar, Patna, Kochi, and Chandigarh in the Financial Year 2013 – 2014.

SEBI Agency overview:-

- Formed 12 April 1992

- Jurisdiction Government of India

- Headquarters Mumbai, Maharashtra

- Employees 643 (2012)

- Agency executive U. K. Sinha, Chairman

Management of SEBI

Section 4(1) of the SEBI Act provides that the SEBI shall consist of the following members (appointed by the Central

Government), namely:

- The general superintendence, direction, and management of the affairs of the Board shall vest in a Board of members, which may exercise all powers and do all acts and things which may be exercised or done by the Board.

- The Chairman shall also have powers of general superintendence and direction of the affairs of the Board and may also exercise all powers and do all acts and things which may be exercised or done by that Board.

- The Chairman and the other members shall be persons of ability, integrity, and standing who have shown capacity in dealing with problems relating to the securities market or have special knowledge or experience of law, finance, economics, accountancy, administration, or in any other discipline which, in the opinion of the Central Government, shall be useful to the Board.

Functions and responsibilities:-

1. The Preamble of the Securities and Exchange Board of India describes the basic functions of the Securities and Exchange Board of India as to protect the interests of investors in securities and to promote the development of, and to regulate the securities market and for matters connected therewith or incidental thereto.

2. SEBI has to be responsive to the needs of three groups, which constitute the market:

- a)the issuers of securities

- b)the investors

- c)the market intermediaries.

3. SEBI has three functions rolled into one body: quasi-legislative, quasi-judicial, and quasi-executive.

4. It drafts regulations in its legislative capacity, conducts investigation and enforcement action in its executive function and it passes rulings and orders in its judicial capacity.

5. Though this makes it very powerful, there is an appeal process to create accountability.

6. There is a Securities Appellate Tribunal which is a three-member tribunal and is presently headed by Mr. Justice J P Devadhar, a former judge of the Bombay High Court.

7. A second appeal lies directly to the Supreme Court.

8. SEBI has taken a very proactive role in streamlining disclosure requirements to international standards.

Powers of SEBI:-

For the discharge of its functions efficiently, SEBI has been vested with the following powers:

- to approve by−laws of stock exchanges. Sebi

- to require the stock exchange to amend its by−laws.

- inspect the books of accounts and call for periodical returns from recognized stock exchanges.

- inspect the books of accounts of financial intermediaries.

- compel certain companies to list their shares in one or more stock exchanges.

- registration brokers.

there are two types of brokers.

- circuit broker

- merchant broker

Recommended Articles

SEBI Committees:-

- 1. Technical Advisory Committee

- 2. Committee for review of the structure of market infrastructure institutions

- 3. Members of the Advisory Committee for the SEBI Investor Protection and Education Fund

- 4. Takeover Regulations Advisory Committee

- 5. Primary Market Advisory Committee (PMAC)

- 6. Secondary Market Advisory Committee (SMAC)

- 7. Mutual Fund Advisory Committee

- 8. Corporate Bonds and Securitization Advisory Committee

List of former Chairmen:-

- C. B. Bhave – 18 February 2008 to 18 February 2011

- M. Damodaran – 18 February 2005 to 18 February 2008

- G. N. Bajpai – 20 February 2002 to 18 February 2005

- D. R. Mehta – 21 February 1995 to 20 February 2002

- S. S. Nadkarni – 17 January 1994 to 31 January 1995

- G. V. Ramakrishna – 24 August 1990 to 17 January 1994

- Dr. S. A. Dave – 12 April 1988 to 23 August 1990.

- U.K Sinha – chairman (incumbent)

If you have any queries or suggestions regarding “SEBI Overview – History, Powers, Functions and Responsibilities” then please tell us via below comment box below.