Retail Investors and Mutual Funds in India 2024. The economic liberalisation of the early 1990s paved the way to develop the financial securities market in India. Several alternative investment products were introduced in the market besides the traditional ones, and mutual funds evolved as a new instrument for investors in the post-liberalisation era.

The mutual fund sector, up to 1986, was monopolised by Unit Trust of India (UTI). Several public sector banks joined the fray since 1987. These included State Bank of India (SBI-MF) and Canara Bank (CANBANK) in June and December, 1987, respectively; Life Insurance Corporation of India (LIC-MF) and Punjab National Bank (PNB) in June and August, 1989, respectively; and ICICI and others. 1993 was a watershed year for the mutual funds sector because private players were given the green signal for deposit mobilisation.

Must Read – What is Mutual Fund

Quick Links

Retail Investors and Mutual Funds in India

The country’s investment sector was flooded with products from several private asset management companies (AMCs) like Birla (December, 1994), DSP BlackRock (formerly DSP Merrill Lynch, December, 1996), Franklin Templeton (February, 1996), Tata (June, 1995), and others. They were later joined by fund houses like HDFC (June, 2000), Deutsche Bank (October, 2002), and JP Morgan (February, 2007). The Association of Mutual Funds of India (AMFI) has 44 registered AMCs operating in the country as on 31 March, 2015.

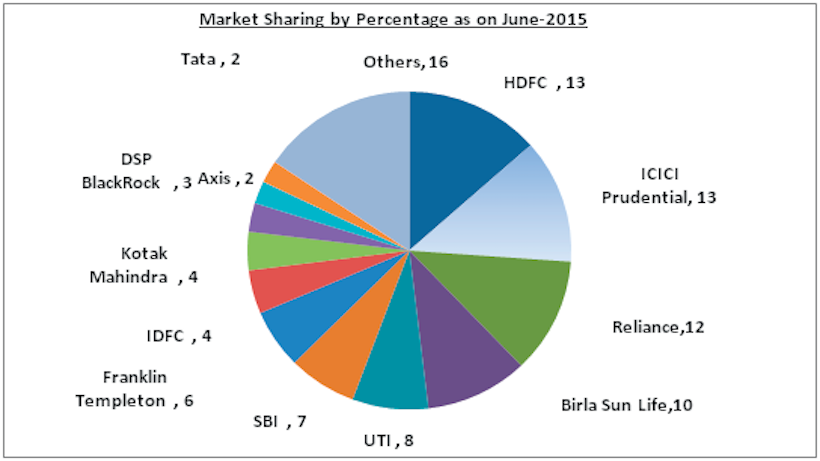

The total assets under management (AUM) was ₹11,87,477 crore against ₹92,957 crore ason 31 March, 2001. The market has witnessed nearly 12 times growth in AUM over the last 14 years. The market share of AMCs as per AUM, in June 2015, is shown in diagram 1. It is evident that the market is dominated by 12 leading AMCs, contributing nearly 85 percent of the gross AUM.

The growth story has continued year-on-year and mutual funds have now been accepted in the Indian financial system. Securities and Exchange Board of India (SEBI) data (table 1) show how investors gradually started to believe that mutual funds are capable to grow their hard-earned money

AUM mobilisation by mutual funds (in ₹ crores)

Classification of mutual funds

Mutual funds have two basic categories – open-ended and close-ended. The first sells and purchases units all the time and the corpus of such a fund is not fixed. The latter carries out a one-time sale of new/fresh units via a public issue or a new fund offer (NFO) and the corpus remains fixed.

AGENTS AND DISTRIBUTION HOUSES PLAY PIVOTAL ROLE TO BUILDING FUND CORPUS BECAUSE MUTUAL FUNDS ARE A COLLECTIVE INVESTMENT VEHICLE. ACTIVE INTERACTION BY THE AGENTS LEAD TO LARGER RETAIL PARTICIPATION.

Over the years, three more basic mutual fund categories have evolved. These are equity funds, debt or bond funds, and balanced funds. In the first, the portfolio consists of equity shares according to the norms declared in the NFO, while the second essentially invests the pooled money mostly in bonds, money market instruments and fixed income securities, and a nominal portion (around five percent) in equities. Balanced funds are a hybrid variety where the money is invested in a mix of equity and debt assets, usually in a 40:60 ratio.

Must Read – Types or Classification of Mutual Funds

Mutual funds are also classified on the basis of market capitalisation. In the Bombay Stock Exchange (BSE) trading parlance, large-cap, mid-cap, and small-cap stocks are those that contribute 80, 15, and five percent of the total market capitalisation respectively. Largecap, mid-cap, and small-cap mutual funds are the ones that invest likewise. The classifications and the subclassifications are shown in diagram 2.

Equity funds invest in shares, while a growth fund parks money only on the blue-chip companies. Diversified equity funds invest in companies spread across various sectors. Index funds are designed according to the equity compositions of an index. Sector funds invest money on equities of companies in specific sectors, like power and energy, petroleum, heavy engineering, and others. Money market funds target liquidity generation and adequate capital protection. These are also called liquid funds. Gilt funds essentially invest in government securities with zero default risk so that a steady and regular income is assured.

Fixed maturity plans (FMPs) are a new product in the Indian market where the money is invested in fixed income securities of the Union or state governments with a fixed maturity time. Lastly, the fund-of-fund (FOF) is a scheme which invests in other mutual funds. It allows investors to get a wider range of diversification in terms of both domestic and foreign markets, various fund management styles and expertise, and more balanced capital appreciation.

MUTUAL FUNDS, IRRESPECTIVE OF THEIR CATEGORIES, CANNOT GENERATE COMMON RETURNS ON INVESTMENTS OR HAVE AN EQUAL DEGREE OF RISK. HIGHER RISKS ARE USUALLY INVOLVED IN EQUITY FUNDS COMPARED TO DEBT OR BOND FUNDS. AT THE SAME TIME, THERE’S NO SPECIFIC CLASS OR TYPE OF MUTUAL FUND, WHICH IS UNIVERSALLY SUITED FOR ALL INVESTORS.

Recommended Articles