PNB Net Banking 2024: Punjab National Bank Net Banking and Mobile Banking are the facilities that enable you to perform banking transactions at your choice of place and time. You can access Net Banking via personal computer or laptop and Mobile Banking via mobile or tab, subject to the availability of an internet connection. Internet Banking is a convenient way to access your bank account Anywhere and Anytime. With this facility, customers can view their accounts, apply for new accounts(like FD, RD, PPF), transfer funds to other accounts (within Bank, other Bank), book tickets (railway/airlines), make donations, pay taxes etc.

Quick Links

Special features of PNB Net Banking

Available 24 hours a day, 365 days a year and you can operate your account anytime, anywhere at your convenience. Internet Banking indicates banking facilities offered to the customers, on Internet. Using this you can access your bank account, take statement of your account, transfer fund instantly, online purchased and payments and many more from your office/ house using computer/ device with internet connections

- Net Banking and Mobile Banking services are secure

- Provide dashboard view of your entire relationship with the Bank

- Allows you to view recent and past transactions (Debits & Credits)

- Allows you to book deposits online

- Transfer money through various payment modes such as Internal Funds Transfer, Own Account Transfer and other Bank Transfer via. NEFT, RTGS & IMPS.

- Helps you place stop cheque instructions

- Allows you to order for a new cheque book

To know more, please visit nearest branch of Punjab National Bank.

How to Activate PNB Net Banking Online

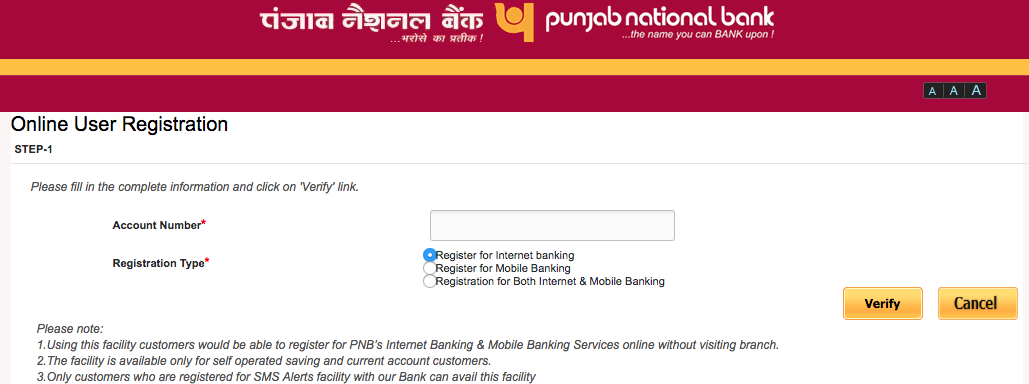

Step 1: Visit PNB’s official website and from the sidebar click on retail (orange color link), you can find that link under internet banking. Or directly visit PNB internet banking website by following link (click here)

The eligible customers may get registered for the Internet Banking Services by trying to register through online mode using New User option on Retail Login Page or through branch.

Please keep following information ready before using the facility of online registration –

- a. Account Number (For which Internet/Mobile banking is to be registered)

- b. One Time Password (OTP) which will be delivered on your registered mobile number during the process.

- c. Debit Card No. and ATM PIN (Linked with the account number for which Internet banking is being registered)

- d. Your Mobile ( registered with the bank) for receiving One Time Password (OTP)

Step 2: From PNB net banking homepage, click on “New User” button.

Step 3: Now Enter your bank account number and registered mobile number. After entering captcha security text, click on continue. (Please note – Before starting the registration process, please ensure that you have the following handy: Account Number, ATM/Debit Card linked to the account number, ATM/Debit Card Credentials, Mobile number registered for the account number)

Note: Prefix country code to your mobile number without sign(+) e.g.- 9199*******33 not +9199******33.

Step 4: In the next step, you will require to enter one time password (OTP) that you will receive on your registered mobile number. enter OTP received on your mobile and then click on continue button.

Step 5: In the next step, you’ll have to enter your ATM card details. After entering your Debit-cum-ATM card credentials, hit continue button.

Step 6: Now click on Read and accept terms and conditions of using e-banking facility of the bank. Click on check-box “I agree to the above mentioned Agreement-cum-Indemnity” then press accept to proceed.

Step 7: In the next page, you will be asked to enter a password for your internet banking. Simply create a password containing special characters, alphabets, and numbers e.g.-@a2ab_12Z, and click on continue.

Step 8: Upon clicking on continue, the following pop-up message will appear on your computer screen “Your request to create Internet Banking User ID is successful.” Click on “OK” and then note down your reference number, customer id, and login user id.

Important! Note down all details before pressing any key.

Step 9: This service takes one working day to activate, now you are able to access your account after 24 Hours.

PNB Net Banking Login and Register

- Click here to login at PNB Net Banking

- Click here to register at PNB Net Banking

Important Requirements

PNB Retail Internet Banking

How do I get User Id and password for the Internet Banking Services?

The user Id for Internet Banking Services is the Customer ID given to customer after account opening.There are two ways of getting Password:

- a) If you try registering the customer ID through branch, the password(s) are sent to the branch and to ensure the highest security and safety, you have to collect your printed password from your base branch. While collecting password from the base branch, please submit the acknowledgement letter duly signed in the branch.

- b) If you try registering online, the Customer ID initially received from branch acts as your User ID and the Password may be set through the registration process

Within how many days will I get my password?

If you apply through branch, you may expect the password to reach the branch within 6 working days after giving request at the branch. An SMS is also sent to this effect, if you have provided the mobile number. If you want your password to be set instantly, you may choose the online mode.

How to change passwords?

Passwords can be changed any time and any number of times through Change Password options after you login to your IBS account. In fact bank recommends frequent change of passwords for securing access through internet.

I am unable to login with the Password and allotted User Id, communicated to me by the Bank.

Passwords are case sensitive. Kindly be a little more careful while typing the system-generated passwords for the first time.

It is also possible that your Internet Banking account has not been activated. Please attempt logging in after 24 hours of receiving the password. If the problem persists, please get in touch with the branch.

I am not able to open Internet Banking Page / I am getting a “Page cannot be displayed” page.

Please check the cipher strength of your system. You may check cipher strength of your computer by clicking “About Internet Explorer” in the “Help” menu option of Internet Explorer. If it does not show cipher strength of 128-bit then please update the same by clicking “Update Information” button.

What happens if I forget my password?

Nothing to worry, just click on “Forgot Password” in the login page and reset the password(s) instantly by following the validation steps.

Otherwise you may submit request at the Branch for resetting of the passwords. The passwords will be sent to the branch and same may be collected by submitting acknowledgment.

Can I transfer funds between my own accounts/other accounts or to other bank accounts?

Yes, you can transfer funds within your accounts or other accounts within PNB. Funds may be transferred in other banks using RTGS/NEFT option available. These transactions are self serviced transactions and once done cannot be reversed.

Can I transfer funds between my own accounts/other accounts or to other bank accounts?

Yes, you can transfer funds within your accounts or other accounts within PNB. Funds may be transferred in other banks using RTGS/NEFT option available. These transactions are self serviced transactions and once done cannot be reversed.

How can I transfer funds through Internet Banking?

Transfer of funds is available under the following two options:

- Self Transfer ( within your own accounts)

- Transfer/RTGS/NEFT (to other accounts within PNB or other Banks).

If you have chosen option 1 then you are shown a list of your deposit accounts. You may choose the relevant account and click on Transfer button and confirm the payment by entering transaction password.

If you have chosen option 2 then you have following options:

- Transfer to accounts within PNB

- Transfer to other bank accounts using RTGS (for amount above Rs.200000/-)

You would be required to register the beneficiary before initiating any transfer of funds in the above scenario. The transfer of funds would be allowed after 24 hours of creation of the payee/beneficiary.

All transfer of funds is to be confirmed by using transaction password.

Recommended Article