PhonePe Loan: Phonepe is a payment application app in India that was launched by Flipkart in 2015. Phonepe is the most famous and successful online payment application in India. It has even surpassed the Google pay application, which was launched by Google for the same purpose. Phonepe is one of the most reliable and faster mediums to trade your money.

It was launched, to make India cashless, and many are using the application. It has made the life of millions very easy. Now we don’t carry money with ourselves and our life is completely hassled free. You can send money to someone by simply using the application. In this article, we will discuss how to get a phonepe loan in detail.

Quick Links

PhonePe Loan Features

Phonepe App is also providing loans which makes it a league apart from others. The process to take out a loan is very simple and you also need very minimal documents. Though the loan amount is not very huge, it is just the beginning and we need to appreciate their brilliant idea. They are also providing a loan at 0% interest for the first 45 days. This is a very rare thing in this business. No one has provided a loan at 0% interest. Now, phonepe is much more than just an app to make payments. It is growing more and more with time.

| Features | The loan is completely interest-free for the first 45 days. It is the easiest way of taking a loan. It also doesn’t require a lot of documentation |

| Eligibility criteria | Your CIBIL score most have to be more than 700. You can only use the phone number which is linked to your account |

| Application process (Online/Offline) | The application process is available online only online. You need to download the application first and then you have to sign up yourself and link your account with the app |

| Documents Required | Aadhaar card with the same phone no, which has been linked to your bank account and Pan card is required for successful KYC |

Eligibility criteria

There are few eligibility criteria that you must know before applying for a loan in phonepe. You have to have a good record with loans and your age must also be eligible. Phonepe is still very new in this business and they are trying hard to make it more and more successful. As a payment app, phonepe is one of the best.

- Aadhar Card (It must be Attached to your mobile no.)

- Pan Card

- Cibil Score (700+) Must Required

Some of the eligibility criteria are:

- You need to have a CIBIL score of more than 700. If your CIBIL score is less than 700, then the chances of you getting a loan is very less.

- You need to have an account in the bank and for that, your age must be 18. Although they haven’t specified anything related to age.

- Your phone number must be linked to your Aadhaar card and your bank account. Then only you can avail of the benefits.

Interest Rate

No Interest rate for 45 days

Application process (Online/Offline)

The application process is completely online, as you do call the process on the phonepe application. There isn’t any offline branch available for phone. They are growing exponentially and with the inclusion of this loan providing feature, they will be even more successful. The application process is completely hassled free and convenient. You don’t need to do a lot of paperwork for it to be passed. You just need to install two applications and you need to provide the same mobile number in both applications.

Let’s see the steps by which you can easily avail of the phonepe loan:

- #Step I – First of all, you need to download the phonepe application from the play store or any other app store.

- #Step II – Then you need to register in it with the same no. which is linked with your bank account and your Aadhaar card.

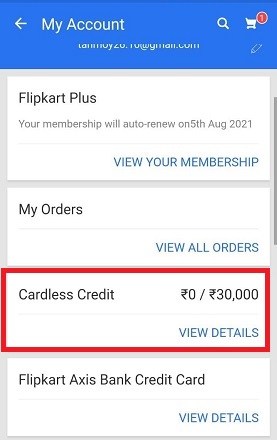

- #Step III – Now you need to install the Flipkart app from the play store or any other app store.

- #Step IV- Now you have to register on Flipkart with the same number with whom you had earlier registered in phonepe.

- #Step V – Then you need to submit all the details about yourself and you need to do a little KYC on the Flipkart application.

- #Step VI – Once your KYC is successful, a credit of any amount ranging from 1000 to 10,000 will be credited to your Flipkart account. It should be named as Flipkart Pay” later. The amount will increase if you remain good with it.

#Step VII – It’s now your turn, you can pay easily pay from the pay later credit via phonepe.

Documents required

There aren’t a lot of documents required to get a phonepe loan. This is a very simple and hassle-free process. Also, the loan is completely interest-free for the first 45 days.

Some of the documents required are:

- Aadhaar card with the same mobile number, which is linked to your bank account.

- Your pan card for a successful KYC in the Flipkart application.

- A CIBIL score of more than 700.

Frequently asked questions

ugh, practically it is a very safe way of taking small loans for your day to day work. Also, there isn’t any interest as well for the first 45 days.

Yes, it is the easiest loan available, and it doesn’t need any income proof. That’s the very reason why they only provide a small amount of loan.

Phonepe provides loans through its parent company, Flipkart. To get the loan you need to connect with both apps.

One can access Phonepe loan in the Phonepe app itself. For example, you can pay credit card bills, Mobile bills, Recharge, Flipkart shopping, Electricity Bill Payment, Loan EMI, etc available on the app. One cannot transfer the loan amount into their bank accounts.

Give me one lakh loan plz