Personal loan: Personal loan is an unsecured loan that is sanctioned with no collateral security to meet the unplanned financial needs. It comes with the flexibility to use the funds as per the borrower’s convenience. They are the best sources for instant cash requirements. know more details for Personal Loan versus Loan against PPF from below…

Quick Links

Loan against PPF:

Besides being a good social security scheme, PPF comes with many more facilities. One such feature is the loan against PPF. With the interest rates being cheaper than regular personal loans, PPF loans are attract many customers across the spectrum.

A comparison between PPF loan & Personal loans:

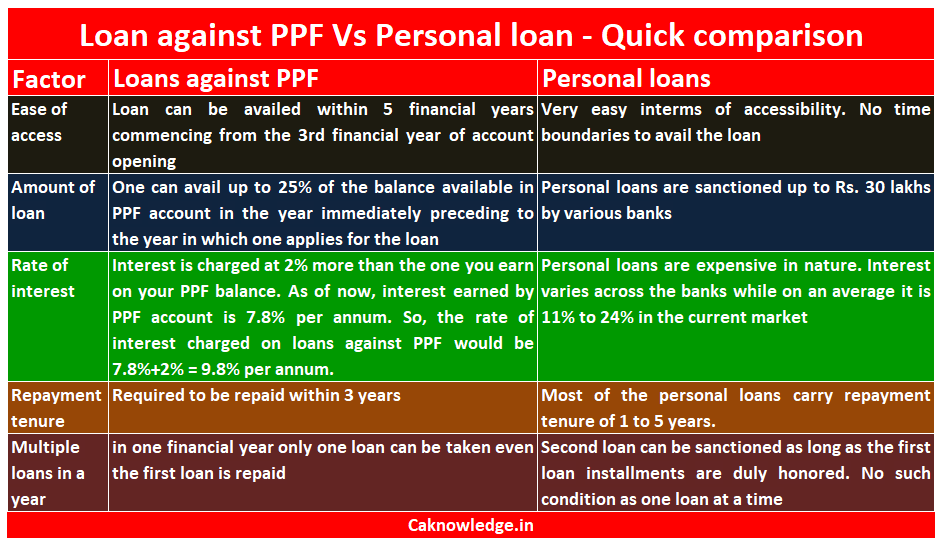

1. Ease of access:

In case of PPF loan, Loan can be availed only after completion of 1 financial year apart from the year in which it has been opened. This Eligibility for availing loan will be available for next 5 financial years from the year it becomes eligible.

When it goes to personal loans, one can get the loan sanctioned without any such work time ceiling provided he/she has a good credit rating besides a fixed source of income.

So, here personal loans have an edge.

2. Amount of loan:

In case of loan against PPF, One can avail up to 25% of the balance available in PPF account in the year immediately preceding to the year in which one applies for the loan. Personal loans are sanctioned up to Rs. 30 lakhs by various banks. So, when it comes to total amount of loan, personal loans beat the PPF loans.

3. Rate of interest:

Interest in case of loans against PPF is charged at 2% more than the one you earn on your PPF balance. As of now, interest earned by PPF account is 7.8% per annum. So, the rate of interest charged on loans against PPF would be 7.8%+2% = 9.8% per annum.

Personal loans are expensive in nature. Interest varies across the banks while on an average it is 11% to 24% in the current market.

So, here loans against PPF clearly earn more marks beating personal loans.

4. Repayment tenure:

Loans taken against PPF are required to be repaid within 3 years while most of the personal loans carry repayment tenure of 1 to 5 years. So the flexibility of choosing a pocket friendly installment is available only in personal loans.

5. Multiple loans in a year:

Repaying the existing loan is must to think about a second loan in case of PPF loans. However, in one financial year only one loan can be taken even the first loan is repaid. When it comes to personal loans, there is no such thing as one loan at a time. The second loan can be sanctioned as long as the first loan installments are duly honored. So, here personal loan wins against PPF loan

6. Collateral:

PPF loan and personal loan both do not require any collateral security.

Bottom line for Personal Loan versus Loan against PPF:

So, while deciding which loan you should go for, you must think what your requirement is. In case you need a loan of moderate amount with relatively less interest and can be repaid before 3 years, then you must go for loans against PPF. If you need a huge amount without bothering much about the interest, you must go for personal loans. Especially when you are offered a pre-approved personal loan, think twice and compare it with PPF loan before a you take the final call.

Related Articles