Paytm loan 2024: Paytm is India’s biggest e-commerce and online banking platform, which has been in this business for a very long time. Paytm was the very first to launch payments through its wallet. It has made a lot of success in a short time, and now, as the company is rising more and more with time, it also started providing easy and hassle-free loans to all its customers.

Quick Links

Features of Paytm Loan

Paytm offers a variety of loans for the needs of every individual in India. You can take it depending on your needs. For personal use, you can take a personal loan; for business use, you can take a business loan, and like that, there are many more options available. The entire process is very smooth and easy to apply. The interest rate and processing fee are also minimal. You also have the chance to make an account, which is known as Paytm Payments bank.

| Features | Paytm offers a variety of loans that are accessible directly from its app. You can take loans like personal loans, business loans, and many others without any troubles. The entire process is entirely online, which makes it even more hassle-free. The loan offered by it is at the meagre interest rate and processing fee. You can quickly complete all the processes directly from its app, or you can reach a Paytm store for KYC. |

| Eligibility criteria | The eligibility criteria depend a lot on the type of loan which you want to take from Paytm. For example, if you’re going to take a personal loan, you need to be at least 21 years old. Though there are some standard eligibility criteria available, you need to be a citizen of India, a minimum monthly salary is required, etc. |

| Application process (Online) | The application process to take a loan from the Paytm app is very easy and convenient. Only a few steps are available, such as downloading the app, registering yourself, and linking your bank account. Once the process is over, the loan will be transferred within minutes |

| Documents Required | Identity proof, address proof, income proof, etc., are required during the application process. |

Eligibility criteria

There are some eligibility criteria available that are pretty essential for everyone to know about. Although we are talking about all kinds of loans, the eligibility criteria also change according to the loan type. Every type of loan requires different eligibility criteria.

However, we have mentioned some of the standard eligibility criteria which every kind of loan requires.

- First of all, the applicant must have to be a citizen of India to be able to take a loan from Paytm app.

- You need to have a regular source of income, and a certain minimum monthly salary to begin with.

- Your age is a very big factor and some loans require different age groups and different age limits. Like in case of personal loans, your age should be 21 or more than.

- You also need to have a good credit score and good credit history.

Application process (Online)

The application process to take any loan from the Paytm app is very simple and quickly done. You need to follow a few steps, and you are done with it. This is the easiest and quickest way to take a loan online. You can expect the loan amount to be transferred directly into your bank account within minutes.

We have mentioned all the steps to take a loan from the Paytm app below:

#Step I – first of all, you need to download the Paytm app either from the Play Store or any other app store.

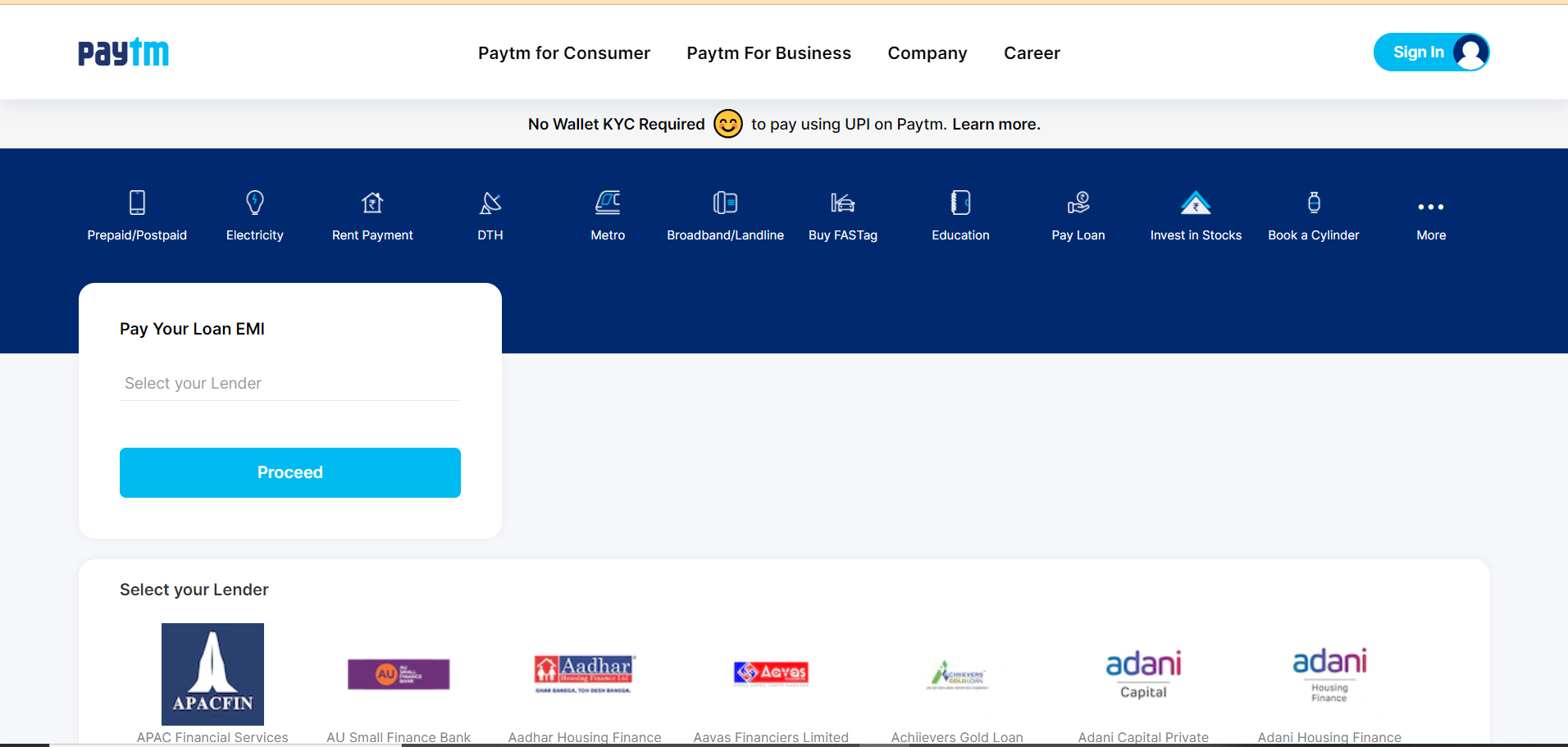

#Step II – you can also visit the official website, www.paytm.com, to know more about loans and other things.

#Step III – after installing the app successfully, you need to get yourself registered if you are using it for the first time. You need to link your phone number and bank account with it. You can also open a zero balance account in it.

#Step IV – once you are registered on the app, you can quickly fill the application form. You need to fill in some essential details and choose the loan type, amount, tenure, and other relevant information. You also need to submit a quick KYC for safety.

#Step V – once the form is filled, you can upload the scanned image of the documents required. After uploading the documents, submit the application form.

#Step VI – Once all the process is over, you can expect the amount to be in your account within a few minutes or at most a day.

Also read about: Send Money Using BHIM App

Documents required

- Identity proof – Aadhaar card, passport, voter ID card, etc.

- Address proof – Aadhaar card, driving license, passport, etc

- Pan card for a successful KYC.

- Income proof, for which you can either submit the bank statement of the last few months or the most recent salary slip.

Frequently asked questions

From Paytm, you can take a maximum of 2 lakhs of personal loan within a few minutes.

No, you don’t need to submit any collateral to take a business loan from Paytm.

Yes, with stores registered with Paytm, you can easily submit your KYC there.

You can check for all queries directly from the Paytm app.