Padho pardesh yojana for minorities – Study abroad Yojana: In today’s day and age, education has become costlier. Not to blame anyone, one can attribute the causes for that to the increasingly improving facilities at the universities that involve huge costs. And the number of aspirants travelling abroad for education has been increasing year by year. Except in few European countries such as Germany, Italy and few scandanian countries, the university courses have become very costly making it a dream for an average earning family to send their children to study abroad.

The same would be a distant dream for the poor and minorities who are deprived of financial resources. With a view to support and encourage the deserving students belonging to the minority community, Government has initiated a scheme called “Padho Pardesh Yojana”. This post gives you the comprehensive insights about this scheme.

Quick Links

Eligibility for Padho pardesh yojana:

- Minority community:

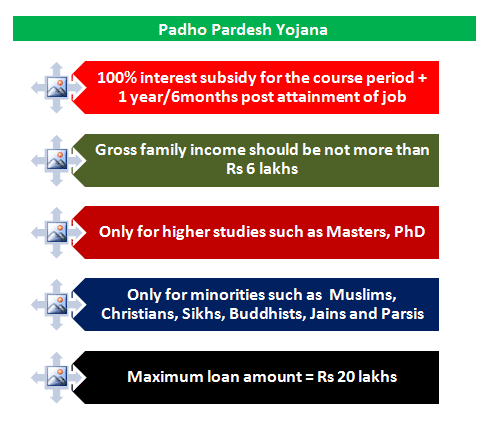

One should belong to a minority community as notified under National Commission for Minorities Act 1992 (Such as Muslims, Christians, Sikhs, Buddhists, Jains and Parsis). And a self declaration should be submitted to the ministry declaring the same. A minority certificate should be submitted.

- Only for higher studies:

This scheme can be availed for only higher studies such as masters, PhD, MBA and other such courses which are generally post bachelors.

- Income limit:

Candidates having a yearly family income of Rs 6 lakhs or less are eligible for this scheme. Family income means gross parental income in case of unmarried students and gross income of spouse incase of married students

- Should have received an admission in recognized foreign university for a higher studies program

Features of Padho pardesh yojana:

- Amount of loan:

Maximum amount of loan that can be sanctioned under this scheme is Rs 20 lakhs.

- Enlisted banks:

Loan can be obtained under this scheme only form those banks which have been enlisted by the central government for this purpose. It was said that all the banks which are members of Indian banks association are eligible for the consideration under this scheme.

- Interest:

100 % interest subsidy will be provided by the government for the period of moratorium.

- Moratorium period:

Moratorium period is ‘Course period + one year after completion of course or six months after getting employment whichever happens earlier’.

- Under this scheme, the subsidy is only with respect to interest for the moratorium but not any other component of the loan such as principal amount, processing charges, penalties etc.

Documents required Padho pardesh yojana:

Following documents are required along with the loan application

- Aadhar card

- Minority certificate

- Income certificate

- Admission letters/any documents evidencing the admission in the recognized foreign university in higher studies.

- Any other document as required by the lending bank such as periodical progress reports/documents as the course progresses.

How to apply?

- Once a candidate gets an admission letter/email from a foreign university he/she can approach any Private Bank, Public Sector Bank, Scheduled commercial Bank and member urban Co-operative Banks etc. which is a member of IBA and discuss with the bank personnel about the scheme.

- Later, he should attach the above listed documents to the loan application duly filled and signed before submitting it to the bank. Once the bank processes the application and documents, you might receive the loan amount.

Recommended