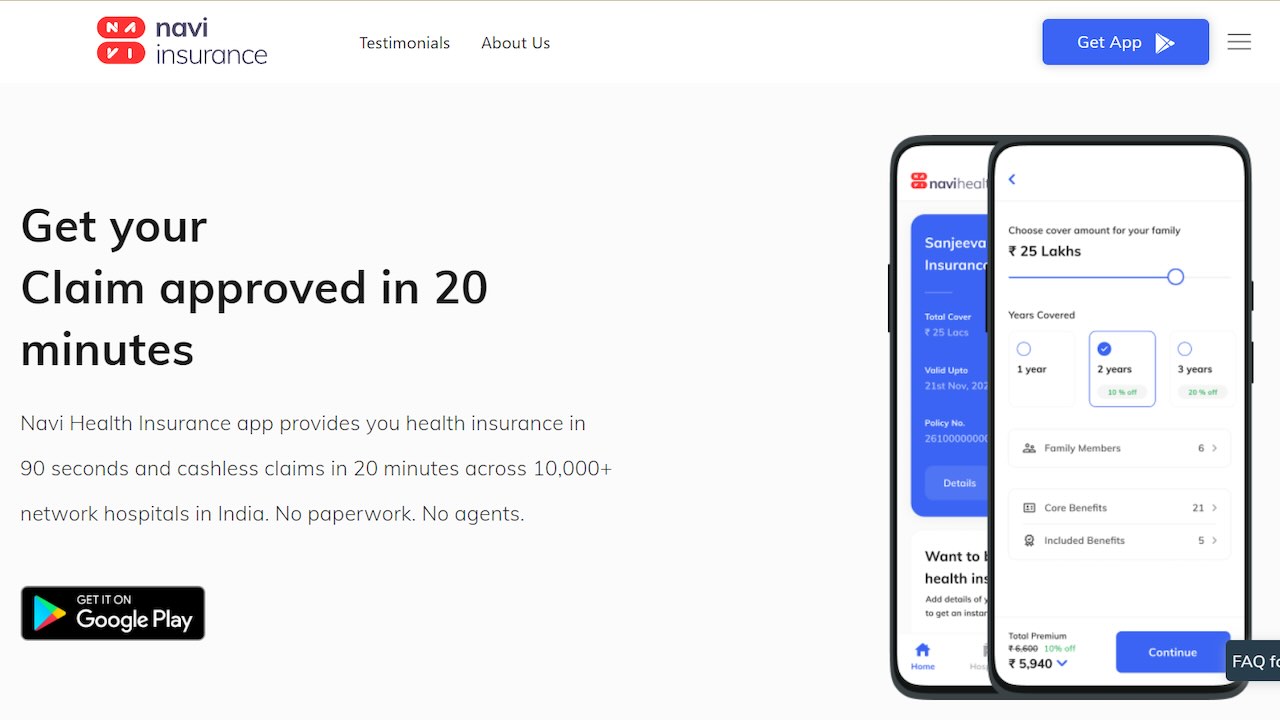

Navi Health Insurance 2024: Navi health insurance instant provides a lot of ease to everyone, especially these days, filled with the constant fear of death, death of not only ours but also the death of our loved ones. With the help of this health loan, you can escape from the heavy bills of hospitals, and if you die, your family will have something to live on. This article gives every detail about Navi health insurance.

Content in this Article

Features Of Navi Health Insurance

Navi Health insurance is the most crucial insurance these days. It has a very high demand, and whoever is filling the customers’ needs has a good deal. With the help of Navi instant health insurance, you can take a loan of 2 lakhs to 1 crore INR. This is a massive help in the time of need. The application also provides a wide variety of health loans which makes it even more helpful.

With its collaboration with network hospitals, anyone can directly get in contact with hospitals and doctors. You don’t need to go to the hospital; you can access all the benefits of hospitals from your house. There are also many features of this application that makes it a phenomenal one.

| Features | Navi health insurance is a reliable and trustworthy company that provides a loan amount ranging from 2 lakhs to 1 crore INR. It is ultimately an online process, and there isn’t any need for a pre-medical check-up. |

| Eligibility criteria | The app provides plenty of Navi health insurance, and each of them has a different set of eligibility criteria. Breach of contract happens when the person insured takes something like alcohol, drugs, plastic surgery, etc. |

| Application process (Online/Offline) | You need to download the application first, either from the play store or from its official website. Then you need to register on the application and provide the application with all the necessary and relevant details about you. |

| Documents Required | You need to submit the original discharge certificate or death certificate, pharmacy bills to get the loan amount. KYC documents like pan cards. Aadhaar card, etc. |

Eligibility criteria

There are eligibility criteria that define a lot about whether you can take Navi health insurance or not. These eligibility criteria are only applicable to those doing something terrible, which will hurt their body. Any physical damage to the body and internal system will be treated as a breach of contract from Navi.

The eligibility criteria are mentioned below:

- You need to be an Indian to take the loan. Also you can take the loan if you’re a NRI.

- Cases in which the contract of yours with Navi gets broken are – if you try to get yourself injured of your own will, if you’re under a heavy dose of alcohol or drugs, if you are having any physical disorders, plastic surgery, involvement in dangerous sports or any kind of dangerous stuff, etc.

- All the policies of Navi health insurance include different eligibility criteria, so it’s difficult to mention all of them. There is an age limit for newborn and for adults.

Application process (Online/offline)

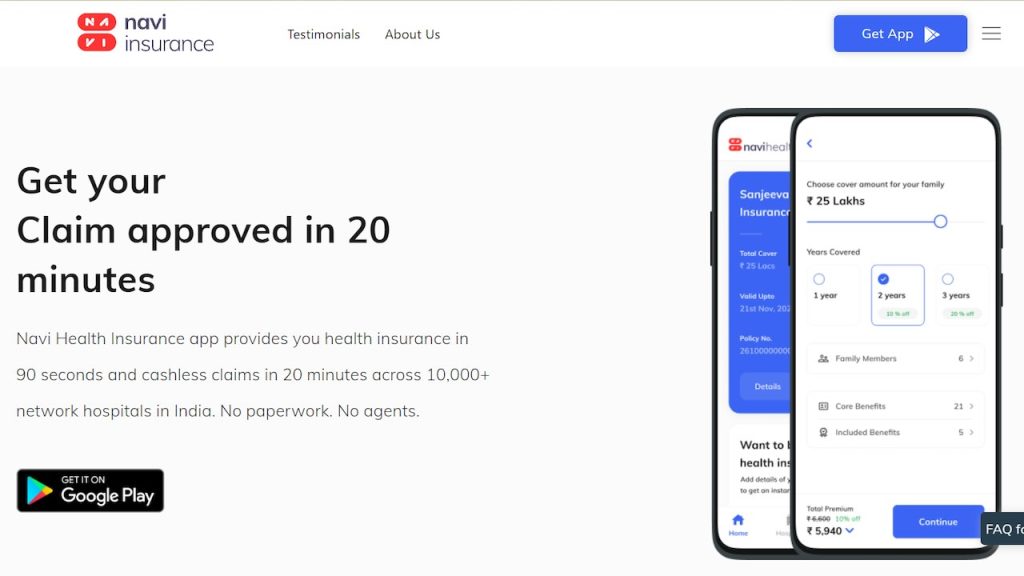

The application to take a loan from Navi is easy to fill. You can either fill the application directly on your own after installing the application on your device. Or you also have the option to go to the agent or broker who will do this for you. In both cases, the application process for Navi health insurance is very easy. It also provides a variety of types and features, which is simply exceptional.

Official Site: https://navi.com/insurance

The steps to fill the application form are mentioned below:

#Step I – you can either download the application or go to some agent or broker to do this for you. Although we are talking here about the self-application of health insurance.

#Step II – you need to get yourself registered on the Navi application. You need to provide the app with all the details about you. You also need to choose the amount and know the details about it.

#Step III – you need to upload all the scanned images of the relevant documents with the application form.

#Step IV – After successfully submitting the documents and application form, you can expect the process to be completed.

Documents required

The documents which you need to have before applying for the Navi health insurance are:

- You need to submit an id proof like, aadhaar card, passport, voter id card, etc.

- You also need to submit the address proof like, Aadhaar card, driving license, etc.

- You need to provide details about your earlier health conditions and reports of your early health. Although there aren’t any pre medical check ups, so you don’t have to worry a lot.

- KYC documents like. PAN card and aadhaar card are necessary as well.

Frequently asked questions

You can get the claim by providing your pharmacy bills, hospital bills, discharge certificate, etc. If the insured person dies, then you need to show the death certificate. According to your loan, a total of 88 % to 97 % will be transferred to your account.

Suppose you do anything out of the ordinary to ruin your body physically and mentally. If the contract gets breached would help if you read all the contracts breaching boundaries from the official website or the app.

You may submit the Claim Form along with the documents for reimbursement of the claim to Our / TPA office. The address of the designated TPA is shared in Health Card / Policy Schedule.

You will have to wait for 30 days (waiting period) before your policy starts covering you. Furthermore, you will have to serve the waiting period (depending on the plan) before enjoying the coverage in case of a pre-existing disease or specific disease.