All About NACH (National Automated Clearing House). NPCI (National Payment Corporation of India) has introduced NACH for various financial institutions like banks as well as companies and government organizations. The primary intention for NACH implementation is to ensure standard set of rules as well as introduce best practices in electronic transactions. This article will explain NACH, its objectives, and other relevant concepts. Now check more details about “All About National Automated Clearing House” from below.

Quick Links

What is NACH?

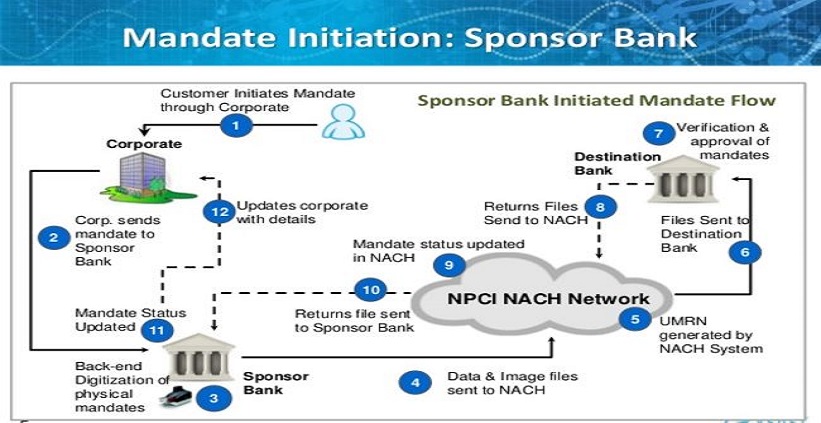

- NACH refers to National Automated Clearing House(both debit and credit facility) , which has been implemented by the NPCI.

- The banks who are registered members of RBI have to enter into mutual agreement with NPCI for the purpose.

- Such registered banks , known as Sponsor banks, are allowed to carry on transactions in NACH system.

- There are also Destination banks who have mutual agreement with NPCI and which are RBI registered.

- Such banks are permitted to process transactions and also process mandates and update Adhar Mapping.

- Other corporates and government departments will have to register themselves as user in National Automated Clearing House system.

Objectives of NACH

- Devising of system having PAN India coverages for processing digital payment instructions.

- Provision of digital platform to banks for processing transactions by using IFSC , MICR etc. codes as determined.

- Direct Corporate Access (DCA) for preferred users.

- Efficient system for handling the debits, credits, reversals, refunds, rejections, dispute handling etc.

- Improving Governance system by linking AADHAR to IIN (Institution Identification Number) and introducing mandate management.

Steering Committee for ACH (Automated Clearing House)

Operational issues with respect to NACH services would be discussed and dealt by this committee.This committee shall meet at least once in one quarter.Half of this committee will be constituted by Non promoter banks.

NPCI audit

The NACH participants need to adhere to Procedural Guidelines as issued by NPCI. These mandates require audits to be conducted by participants. This audit report has to be submitted to NPCI , which is later also shared with RBI. Also NPCI reserves the right to audit documentation with respect to NACH services.

Dispute Resolution Mechanism

NPCI has set up PRD (Panel for Resolution of Disputes)which will handle interbank settlement disputes as per directive issued by RBI.Arbitration cases are referred to PRD which are processed and resolved for prescribed fees.

Mandate Management System (MMS)

This facility known as MMS, is an integral part of NACH system. This system is necessary from view point of processing NACH transactions.This system captures mandates information on standard cheque which will streamline the process of electronic tansactions processing.This MMS is characterised with following features.

- Automatic processing of mandate information electronically in timely manner.

- Exchange of Mandates information for confirmation electronically.

- Each mandate can be easily tracked by unique number , which will be useful in case of multiple mandates.

- Facilitate use of standardized mandate forms.

- Improved synchronization of information between service providers and banks.

- Defined and SLA (Service Level Agreements) which would facilitate better governance and defined time limits.

Dispute Management System (DMS)

Disputes with respect to on Mandates or ACH payment transactions services can be raised.It ensures creation , escalation as well as resolution of such disputes. This is a digital platform for raising and resolving disputes relating to ACH payment transaction or mandate transaction.

Conclusion

NACH is basically introduced and implemented with basic objective to support huge burden of interbank transactions , which may contain low value transactions at a high rates.Such low value transactions are mostly recurrent in nature. NACH facilitates speedy and convenient way to process such transactions through NPCI service.

Recommended Articles

- SBI Balance Enquiry Number

- ICICI Balance Enquiry Number

- SBI Balance Enquiry Number

- Andhra Bank Balance Enquiry Number

- HDFC Balance Enquiry Number

- Karnataka Bank Balance Enquiry Number

- Axis Bank Balance Enquiry Number

- Federal Bank Balance Enquiry Number

- Canara Bank Balance Enquiry Number

- Zero balance savings account

- A Quick guide to credit card loans in India