Mutual Fund Riskometer: Risk Calculation in Mutual Fund, Calculating Risk in Mutual Fund through meter – Mutual Fund Riskometer, this article is talking about the how the risk is calculated for the mutual funds that you have or are planning to buy. This type of riskometer is found when you go through the document provided when you purchase the mutual fund. This helps the investor to get the knowledge about what they are purchasing and is of what risk.

Quick Links

Mutual Fund Riskometer

Before 01st July 2015:

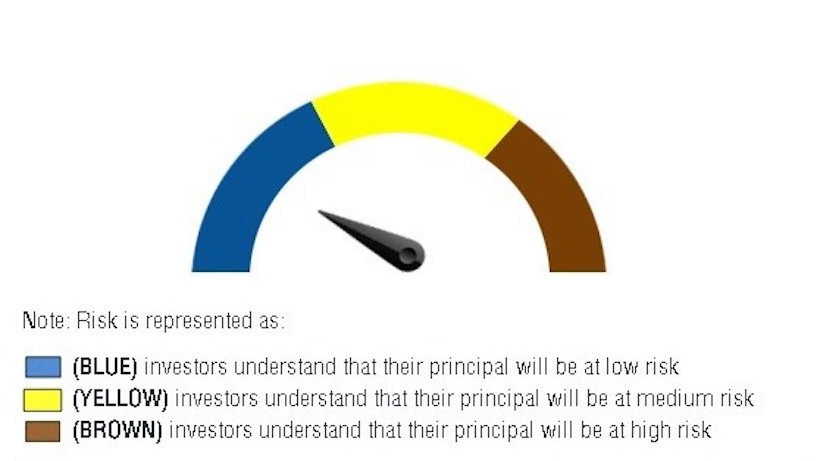

The Riskometer concept came in the Association of Mutual Funds in India (AMFI) in the year of 2013, firstly in the initial period they classified the risk into 3 color types namely,

- Blue Color – This color indicates that the mutual fund is low risk mutual fund and the return will also be low

- Yellow Color – This color indicates that the mutual fund is medium risk mutual fund and the return will also be medium

- Brown Color – This color indicates that the mutual fund is high risk mutual fund and the return will also be high.

Must Read – Postal Life Insurance

What the problems were faced??

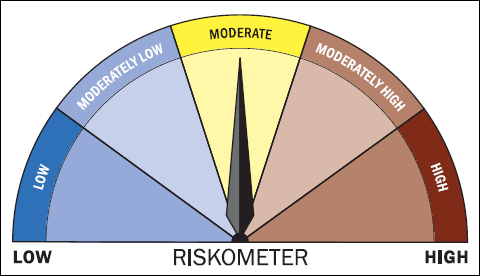

The investors were not able to judge whether it would be beneficial or not because of the narrower classification of the risks and there was need of the broader classification of the risks. So on 01st July 2015, AMFI came up with the new classification of the risks with 5 types of classifications. They are explained in detail below.

After 01st July 2015:

After the specified period the risk were classified into 5 types namely,

- Low Risk – This type of risk is for the term period of 90 days or less. This risk is also known as Ultra Short term Debt.

- Moderately Low Risk – This type of risk have a maturity of more than 91 days and up to 3 years. This is also known as Short Term Debt.

- Moderate Risk – This type of fund have a maturity tem period of 3 years or more. This type of risk is also known as Arbitrage Risk.

- Moderately High Risk – This type of High Risk, which is of big amount. This type of Risk is also known as Large Cap Risk or Multi Cap Risk.

- High Risk – This type of Risk is of extremely high kind in nature.

Must Read – What should be taken – Life Insurance or PPF ??

Usefulness of Change:

Now the question arises that whether there is really need of such change. The answer to it is not much. Because this riskometer is involved in the Mutual Fund Scheme Information Document (MFSID), which is not particularly read by any of the investors wanting to investing any mutual fund. So the change is very subjective matter as it may help someone who is analyzing every prospect of the document and then investing otherwise not useful.

Comments & Disclaimer:

Please give your opinion and comments, any suggestions for improvement in the article in mail inbox at yashshah299@gmail.com. Suggestions from everyone are appreciated.

Recommended Articles