Mortgage: It is defined in Transfer of Property Act as, transfer of interest in specific immovable property (land, benefits arising out of land, things attached and permanently fastened to earth) to secure an advanced loan, or an existing debt or a future debt or performance of an obligation. Once the amount due is paid to the lender, the interest in the property is restored back to the borrower.

Lender gets right to recover the dues in case of default but does not become owner of the property. A mortgagor is the transferor of interest in the property and Mortgagee is the transferee. The principal money and the interest of which payment is secured is called the mortgage money and the instrument by which the transfer is affected is called the mortgage deed.

The mortgagor has right to redeem the document relating to mortgage property, where possession has been given, to get back the possession and where title has been transferred, to get retransferred, on liquidation of money borrowed. This right of redemption can be exercised before the decree for sale or foreclosure is passed by a court.

On default by the mortgagor, the mortgagee has right to obtain a decree from a court to the effect that the mortgagor be debarred forever to redeem the mortgage. This is called right of foreclosure.

Quick Links

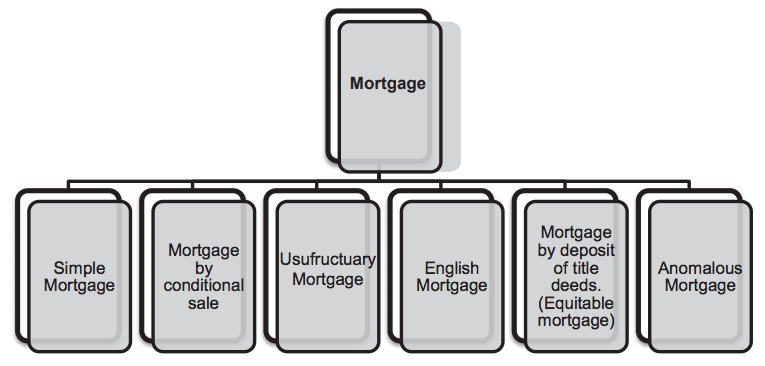

Types of Mortgage

The transfer of Property Act contemplates following six types of mortgages:

1. Simple Mortgage

- Court intervention required for mortgagee to sell the property.

- Rent and produce on the property, is not the right of mortgagee.

- Registration is compulsory.

- Mortgagor retains the possession of the property.

- Mortgagor is personally liable too.

2. Mortgage by conditional sale

- Mortgagor is not personally liable for repayment of money borrowed.

- Mortgagee by applying to court can get decree in his favor and can sue for foreclosure.

3. Usufructuary mortgage

- Mortgagee has legal possession of the property till the borrower repays the money borrowed, however sale is not allowed.

- Mortgagee has right to receive rent and benefits accruing from the property.

- Mortgagor is not liable personally.

- Law of limitation not applicable.

4. English Mortgage

- Mortgagee gets absolute transfer of property on condition that the same will be retransferred if the debt is fully paid.

- Mortgagor personally liable to pay debt on a specified date

5. Mortgage by deposit of title deeds (Equitable mortgage)

- Property can be located anywhere but the deposit of title deeds has to be made at towns notified by State Government.

- The title deed deposited should be original. In case original title deed is lost or not in existence, a certified true copy by the sub-registrar can be deposited.

- The intention should be to secure debt.

- Registration not required.

6. Anomalous Mortgage

- Any mortgage other than one described above, falls in this category.

The mortgagor can create subsequent mortgage(s) on the same property. The rule of priority is in the order of time they are created. The limitation period for filing suit for sale of mortgaged property is twelve years from the date mortgage debt becomes due. For filing a suit for foreclosure, limitation is thirty years from the date mortgage debt becomes due. Enforcement of mortgage is governed by the Code of Civil Procedure. Suit for sale of mortgage properties should be filed in the court, within whose jurisdiction the mortgaged property is situated.

7. Reverse Mortgage

It is a type of home loan for older homeowners that require no monthly mortgage payments. The amount of loan is determined on the basis of borrower’s age, value of property, rate of interest and norms of lending institution. Borrowers are still the owners of property and responsible for property taxes and homeowner’s insurance. A reverse mortgage allows elders to access the home equity they have built up in their homes now, and defer payment of loan until they die, sell or move out of the home.

Because there are no required mortgage payments on a reverse mortgage, the interest is added to the loan balance each month. Over the loan’s life, the homeowner’s debt increases and home equity decreases. When the homeowner dies or moves, the proceeds from the home’s sale go to the lender to repay the reverse mortgage’s principal, interest, mortgage insurance and fees.

Must Read –