How to categorize Ledgers groups in Tally Prime? After setting up your company and creating a ledger account, the next step is to create Ledger groups. But first, let’s understand categorizing groups. Groups in Tally are collections of ledgers of the exact nature. Account groups in Tally are maintained to determine the hierarchy of Ledger Accounts. It helps select and present meaningful and compliant reports. In this article, we have explained about creation of Groups in tally prime and other details about it.

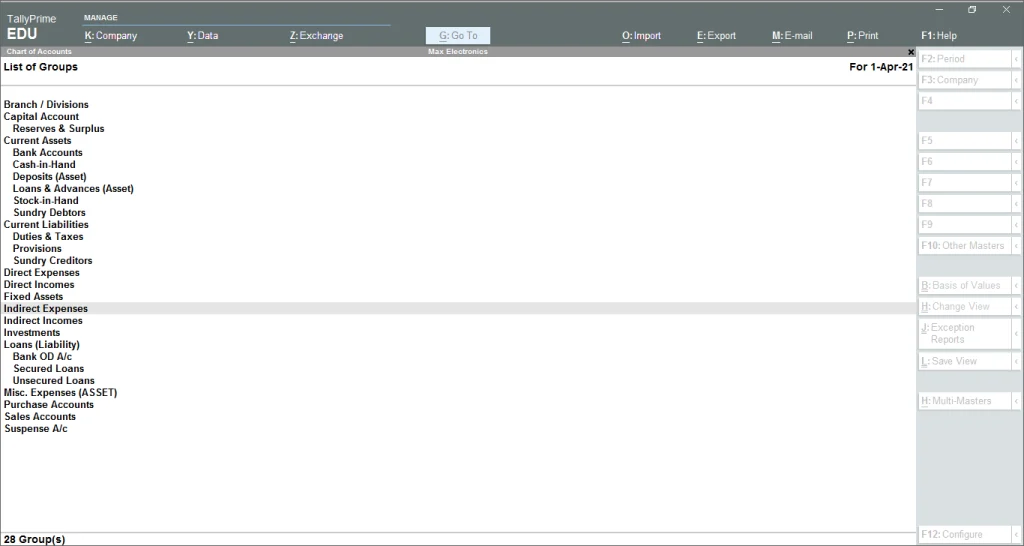

The main accounts are classified into intoCapitalorRevenue– and sub-categories divided into assets, Liabilities, and expenditures. Groups in Tally Prime have already set 28 pre-defined Groups in Tally. Out of which, Of these, 15 are primary Groups, and 13 are Sub-Groups. Users can group the Ledger accounts under the necessary Groups while creating the chart of statements or alter/change them later. also, check How to Create Ledgers in Tally Prime.

Quick Links

Primary and Sub Groups In Tally

Primary Groups: These are the main Groups in Tally with a top-level hierarchy. In these 15 groups, six are profit and loss a/c items, and nine are balance sheet items. These groups in Tally Prime cannot be deleted.

| 1. Branch/Division | 6. Current Assets | 11. Indirect Income |

| 2. Capital Accounts | 7. Fixed Assets | 12.Misc. Expenses |

| 3. Loans | 8. Investments | 13. Purchase Accounts |

| 4. Suspense Account | 9. Sales Accounts | 14. Direct Income |

| 5. Current Liabilities | 10. Indirect Expenses | 15. Direct Expenses |

Sub Groups: It is a part of primary groups in Tally that is divided into 13 items.

| 1. Sundry Creditors | 6. Secured Loans | 11. Bank Accounts |

| 2. Stock in Hand | 7. Deposits | 12. Cash in Hand |

| 3. Duties and Taxes | 8. Banks OD Accounts | 13. Loan and Advances (Assets) |

| 4. Unsecured Loans | 9. Provisions | |

| 5. Reserves and Surplus | 10. Sundry Debtors |

The sub-groups in Tally that form a part of the balance sheet are:

| Pre-defined Subgroups | Under Category |

| Bank Accounts | Current Assets |

| Bank OD A/c | Loans (Liability) |

| Cash-in-hand | Current Assets |

| Deposits (Asset) | Current Assets |

| Duties and Taxes | Current Liabilities |

| Loans and Advances (Asset) | Current Assets |

| Provisions | Current Liabilities |

| Reserves and Surplus | Capital Account |

| Secured Loans | Loans (Liability) |

| Stock-in-hand | Current Assets |

| Sundry Creditors | Current Liabilities |

| Sundry Debtors | Current Assets |

| Unsecured Loans | Loans (Liability) |

Various Entries under Groups in Tally Prime

There are various default groups, and these groups in Tally can be used for various entries such as:

| Expense Entries | Purchase Entries |

| Expense – Direct/Indirect Expense To Party – Sundry Creditors | Purchase – Purchase Account To Party – Sundry Creditors |

| Party – Sundry Creditors To Bank – Bank Account To Cash – Already Created | Party – Sundry Creditor To Bank – Bank Account To Cash – Default |

| Income Entries | Sales Entries |

| Party – Sundry Debtors To Income – Direct/ Indirect Income | Party – Sundry Debtors To Sales – Sale Accounts |

| Cash/ Bank – Bank Account To Party – Sundry Debtors | Cash/ Bank – Bank Account To Party – Sundry Debtors |

Group Name and Ledger Account

Below we have mentioned the group Name with their Ledger Accounts:

| Groups in Tally Name | Ledger Name | Groups in Tally Name | Ledger Name |

| Purchase Accounts | All types of Purchase Accounts like Purchase Local 12 % Purchase Interstate 12% Purchase Local 0% Purchase Interstate 0% Purchase (Composition) Purchase Exempt (Unregistered Dealer) Purchase Local (Exempt Registered) Purchase Taxable (Unregistered Dealer) Purchase Nil Rated (Unregistered Dealer) Purchase Reverse Charge Purchase Import Taxable 12% Purchase Import Exempt Purchase Import Nil Rated Purchase (Own Branch) Purchase Return | Direct Expenses OR Expenses(Direct) | All Indirect Expenses like Rounded Off Salary Advertisement Expense Maintenance Expense Rent Expense Director Remuneration Expense Bad Debts Printing Expense Stationary Expense Foreign Exchange fluctuation Audit Fees Professional Charges Legal Expenses/Charges Depreciation Expenses Interest Expense Penalty Royalty Bank charges Commission allowed Discount allowed Donation and charity Free sample Insurance premium Interest on loan Legal charge Loss by fire Postage and courier Repair charge Taxi fare Telephone charge Traveling expenses Outstanding expenses Accrued expenses Bad debt Loss on theft depreciation Coffee Expenses Coke Expenses Manager’s Commission UPTT Fuel Expenses A/c Liability of Expenses Preliminary Expenses A/c Professional Fees |

| Sales Account | All types of Sales Accounts like Sales Local 12 % (Registered) Sales Interstate 12% Sales Local Nil Rated Sales Interstate Nil Rated Salers Export With Bond Salers Export Taxable Export (0%) Sales Local (Exempt Registered) Sale To Consumer (Taxable 12%) Sale To Consumer (0%) Sale To Consumer (Exempt) Sales (Own Branch) Sale Return | Indirect Expenses OR Expense(Indirect) | All Indirect Expenses like Rounded Off Salary Advertisement Expense Maintenance Expense Rent Expense Director Remuneration Expense Bad Debts Printing Expense Stationary Expense Foreign Exchange fluctuation Audit Fees Professional Charges Legal Expenses/Charges Depreciation Expenses Interest Expense Penalty Royalty Bank charges Commission allowed Discount allowed Donation and charity Free sample Insurance premium Interest on loan Legal charge Loss by fire Postage and courier Repair charge Taxi fare Telephone charge Travelling expenses Outstanding expenses Accrued expenses Bad debt Loss on theft depreciation Coffee Expenses Coke Expenses Manager’s Commission UPTT Fuel Expenses A/c Liability of Expenses Preliminary Expenses A/c Professional Fees |

| Duties and Taxes | All types of Taxes like INPUT CGST SGST IGST CESS OUTPUT GST SGST IGST CESS Excise Duty Payable etc Service Tax Payable TDS Payables Input Vat Accounts Output Vat Accounts Cenvat Accounts Sale tax Income Tax VAT Payable | Provisions | All Provisions except Provisions for bad debts Provision for Tax Provision for Expense Provision for Sinking Fund All types of Payables like Salary Payable, Audit fees Payable, |

| Reserve and Surplus | Any reserve like General Reserve Capital Reserve Capital Reserve A/c Investment Allowance Reserve A/c Share Premium A/c Reverse and Surplus | Sundry Debtors | Any Party to Whom Sales Made Provision for Bad Debts |

| Indirect Income OR Income(Indirect) | All kinds of Capital Accounts like Share Capital Partner Capital Account Partner Current Account Drawings Proprietor Account Life insurance Equity Capital A/c Partners Capital A/c |

| Already Created in Tally | Only 2 Accounts Already Created like Cash Profit and Loss Account |

| Bank Account | All Bank Current Account All Bank FD Account (Personal Savings Account and FD not recorded) |

| Deposit Account | All types of deposits like Security Deposit Electricity Deposit Rent Deposit |

| Capital A/c | General Reserve, Share Premium, and Any other Reserve |

| Current Assets | Prepaid Maintenance Expense Prepaid Expense Prepaid Rent Prepaid Insurance Charges Interest Receivables Bill receivable Accrued income Mutual Fund CGST SGST IGST Credit |

| Current Liabilities | Bill drawn Bill Payable CGST SGST IGST Payable |

| Sundry Creditor | Any Party from Whom Goods Purchased Party from Whom any Bill of Expense Received |

| Loans and Advances (Assets) | All Fixed Assets on which Depreciation is charged like Furniture, Machine, Plant and Machinery, Mobile Computers, Furniture and Fittings, Cars, laptops, land building, Goodwill, etc Accumulated depreciation |

| Loans Liabilities | Any Party from whom we take a loan. We can also put group Secured loan or Unsecured loan Debenture A/c Loans From Bank Loans From Outside Party Loans From Aravind(Friend) |

| Fixed Assets | Any Branch whose Separate Accounting is Done (If branch account is maintained by head office only, then this account is not required) Delhi Branch and Branch in division |

| Bank OCC | Cash Credit Limit (CC) taken from the bank |

| Bank OD | Overdraft Limit (OD) taken from the bank |

| Branch/Divisions | Any Party to whom we gave a loan like loans given to Friends Relatives/Related Companies Any Party to whom we gave Advance like Advance to Supplier |

| Cash in Hand | Imprest Account (Cashkept with Employee), Petty Cash |

| Stock-in-hand | Like Short-term loans from directors Loans are taken for whom no Security is given or loan from friends /relatives |

| Misc. Expense (ASSET) | Preliminary Expenses are NOT yet written off |

| Suspense A/c | Suspense Account – Any payment or receipt from the party whose name is not known, Suspense |

| Secured Loan | Stock- Closing, opening, and consignment of stock. |

| Unsecured Loan | Loans for whom Security is Given like loans from bank/ Financial Institutions |

| Retained Earring | General Reserve, Share Premium and Any other Reserve |

| Direct Incomes OR Income(Direct) | Any Income from the leading service like- Freight Charges Income Delivery Charges Income Transportation Charges Income Professional Charges Income Consultancy Charges Income Maintainance Service Income |