Kredivo loan app 2024: Kredivo app is one of the very best applications which provides one of the personal loans of all. Its service is phenomenal and the application is also very reliable and secure. The app is authentic and it is also authorised by RBI. let’s know everything about the Kredivo app through this article. Also, check out PhonePe Loan.

Quick Links

Features of Kredivo

The Kredivo app provides loans from 1,000 to 10,000 without any paperwork, as the process is completely online. You can easily escape from all the documentation and hassle. With the help of Kredivo, you can easily submit all your documents by simply scanning them.

The tenure is also very helpful, as it provides an ample amount of say to the customers to be able to repay the loan. The option of having a variety of ways to repay the loan makes this application even handier. The interest rate and processing fee are also very low and they can be easily ignored. More than anything, the app provides a loan to every Indian, who has all the documents.

| Interest rate | 20 % to 35 % per annum |

| Processing fee | 5 % to 20 % plus tax |

| Features | You can get a loan within minutes and the process is completely hassled free. It’s Completely an online process and you don’t have to go anywhere. Service is available 24*7 and you can view all the details directly from the official website |

| Eligibility criteria | You need an Indian to take the loan from this app. Your age must have to be either equal to or more than 21 years, but less than 60. You need to have a regular source of income |

| Application process (Online/Offline) | The application process is completely online. You can download the application either from the play store or directly from its official website. Registration is very easy to do and apply for a loan is also very fast and secure |

| Documents Required | You need to have identity proof, address proof, income proof, and few other documents |

| Download Link | Click Here |

Eligibility criteria

Few eligibility criteria are involved in the process of the loan application. Without going through these criteria no one can take a personal loan from Kredivo. These eligibility criteria are important for the security and safety of everyone. You can take a loan only if are eligible for it.

Now we will discuss the eligibility criteria:

- First of all, you need to be an Indian if you want to take a loan from the Kredivo app.

- You need to have a regular source of income, so that you can repay the loan amount in future.

- Minimum age must have to be 21 and maximum age should be less than or equal to 60.

- A good credit score is a must if you want to take out a loan. Apart from that, all your early loans and history must have to be clear.

- ICICI Personal Loan

Application process (Online/Offline)

The application process to apply for a loan from Kredivo is very simple and secure. Anyone with proper documents and eligibility can take the loan within minutes. This is a very simple and hassle-free process. As the process is completely online, it becomes even easier to apply. These days everything is going digital and nobody wants to get in line to do something. This saves time as well as money. This also helps the old agers a lot.

Now we will discuss the steps to take a loan:

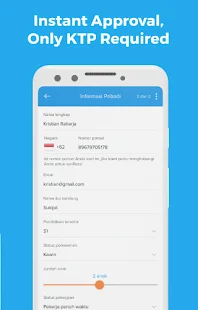

#Step I – first of all you need to download the application either from the play store or from its official website.

#Step II – then you need to register yourself on the application if you are doing it for the first time.

#Step III – Now you need to fill the application form and choose the amount of money you want to borrow and the tenure in which you want to repay the amount.

#Step IV – now you will be asked to submit the scanned image of all the documents with the application form.

#Step V – once you have submitted the documents, and everything is verified, you can expect the loan to be in your account within minutes.

Documents required

The documents which you need to have if you want to take a loan from the Kredivo app are mentioned below:

- Identity proof – Aadhaar card, passport, voter ID card, etc.

- Address proof – Aadhaar card, driving license, etc.

- Income proof, for that you can either use the bank statement of the last few months or you can also use the recent salary slip.

- You need to submit your credit score and all the records of your earlier loans.

- Pan card is also required for a successful KYC.

Frequently asked questions

No, you can’t take more than one loan, but you can take a loan just after the repayment of the previous one. This way, you can easily take out a loan as many times as you want.

No, you at least need to have experience of 1 year, if you are a salaried team member and you need to have experience of 3 years if you are a self-employed person.

The interest rate: 0% interest for Pay later up to 3 months, then it goes up to 2.6% interest per month for 6 and 12 month installment or a maximum annual rate of 53.36%

Kredivo is Offered By PT FinAccel Finance, Indonesia.