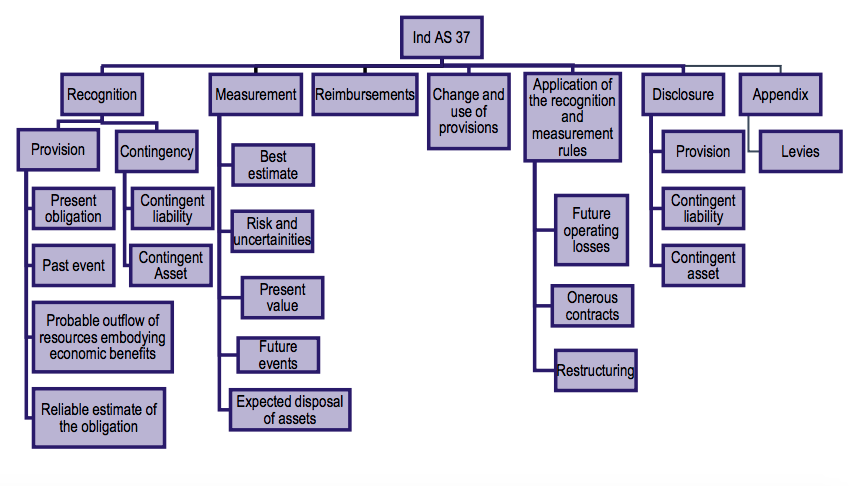

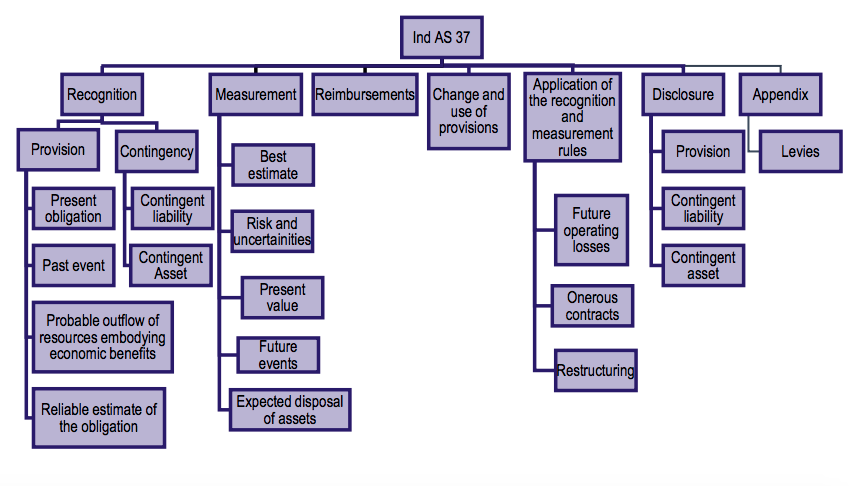

Ind AS 37: The objective of Ind AS 37 is to ensure that appropriate recognition criteria and measurement bases are applied to provisions, contingent liabilities, and contingent assets and that sufficient information is disclosed in the notes to enable users to understand their nature, timing, and amount.

Ind AS 37 prescribes the accounting and disclosures for provisions, contingent liabilities, and contingent assets, except:

- those resulting from executory contracts, except where the contract is onerous; and

- those covered by another

Ind AS 37 also does not apply to financial instruments (including guarantees) within the scope of Ind AS 109, Financial Instruments.

Some amounts treated as provisions may relate to revenue recognition, for example, where an entity gives guarantees in exchange for a fee. Ind AS 37 does not address the recognition of revenue. Ind AS 18, Revenue, identifies the circumstances in which revenue is recognized and provides practical guidance on applying the recognition criteria. Ind AS 37 does not change the requirements of Ind AS 18. Must Check Limitations of Accounting.

Quick Links

Provisions

A provision is a liability of uncertain timing and amount. A provision shall be recognized when:

- an entity has a present obligation (legal or constructive) that is a result of a past event;

- an outflow of resources embodying economic benefits will probably be required to settle the obligation; and

- a reliable estimate can be made of the amount of the obligation. If these conditions are not met, no provision shall be recognized

Provisions shall be reviewed at the end of each reporting period and adjusted to reflect the current best estimate. If it is no longer probable that an outflow of resources embodying economic benefits will be required to settle the obligation, the provision shall be reversed.

Present Obligation

In rare cases, it is not clear whether there is a present obligation. In these cases, a past event is deemed to give rise to a present obligation if, taking account of all available evidence, it is more likely than not that a present obligation exists at the end of the reporting period. You may also like Accrued Liabilities.

Measurement

The amount recognized as a provision shall be the best estimate of the expenditure required to settle the present obligation at the end of the reporting period. The best estimate of the expenditure required to settle the present obligation is the amount that an entity would rationally pay to settle the obligation at the end of the reporting period or to transfer it to a third party at that time.

Where the provision being measured involves a large population of items, the obligation is estimated by weighting all possible outcomes by their associated probabilities. Where a single obligation is being measured, the individual’s most likely outcome may be the best estimate of the liability. However, even in such a case, the entity considers other possible outcomes.

Risks and uncertainties

The risks and uncertainties that inevitably surround many events and circumstances shall be taken into account in reaching the best estimate of a provision.

Present value

Where the effect of the time value of money is material, the amount of a provision shall be the present value of the expenditures expected to be required to settle the obligation.

Future events

Future events that may affect the amount required to settle an obligation shall be reflected in the amount of a provision where there is sufficient objective evidence that they will occur.

Expected disposals of assets

Gains from the expected disposals of assets shall not be taken into account in measuring a provision. These are not recognized even if the expected disposal is closely linked to the event giving rise to the provision.

Reimbursements

When some or all of the expenditure required to settle a provision is expected to be reimbursed by another party, the reimbursement shall be recognized when, and only when, it is virtually certain that reimbursement will be received if the entity settles the obligation. The reimbursement shall be treated as a separate asset. The amount recognized for the reimbursement shall not exceed the amount of the provision. In the statement of profit and loss, the expense relating to a provision may be presented net of the amount recognized for a reimbursement.

Onerous contracts

If an entity has an onerous contract, the present obligation under the contract shall be recognized and measured as a provision. This Standard defines an onerous contract as a contract in which the unavoidable costs of meeting the obligations under the contract exceed the economic benefits expected to be received under it. The unavoidable costs under a contract reflect the least net cost of exiting from the contract, which is the lower of cost of fulfilling it and any compensation or penalties arising from failure to fulfill it.

Restructuring obligations

A provision for restructuring costs is recognized only when the general recognition criteria for provisions are met.

Concerning restructuring obligations, the Standard guides the application of general recognition conditions that need to be complied with for recognition of restructuring provisions and identification of expenses that are like restructuring costs. Must Check List of Ind AS.

Appendix A of Ind AS 37 guides (a) how a contributor accounts for its interest in a fund and (b) when a contributor must make additional contributions, for example, in the event of the bankruptcy of another contributor or if the value of the investment assets held by the fund decreases to an extent that they are insufficient to fulfill the fund’s reimbursement obligations, how that obligation be accounted for.

The Appendix prescribes that the contributor shall recognize its obligation to pay decommissioning costs as a liability and recognize its interest in the fund separately unless the contributor is not liable to pay decommissioning costs even if the fund fails to pay. When a contributor must make potential additional contributions, this obligation is a contingent liability that is within the scope of Ind AS 37. The contributor shall recognize a liability only if it is probable that additional contributions will be made.

Appendix B of Ind AS 37 guides the recognition, in the financial statements of producers, of liabilities for waste management under the European Union’s Directive on Waste Electrical and Electronic Equipment (WE and EE), concerning sales of historical household equipment. This Appendix addresses neither new waste nor historical waste from sources other than private households. The liability for such waste management is adequately covered in Ind AS 37.

However, if, in national legislation, new waste from private households is treated similarly to historical waste from private households, the principles of this Appendix apply by reference to the hierarchy in paragraphs 10-12 of Ind AS 8. Ind AS 8 hierarchy is also relevant for other regulations that impose obligations in a way that is similar to the cost attribution model specified in the EU Directive.

Appendix C to Ind AS 16 addresses the accounting for a liability to pay a levy if that liability is within the scope of Ind AS 37. It also addresses the accounting for a liability to pay a levy whose timing and the amount are certain. The Appendix prescribes that an obligating event that gives rise to a liability to pay a levy is the activity that triggers the payment of the levy, as identified by the legislation.

An entity does not have a constructive obligation to pay a levy that will be triggered by operating in a future period as a result of the entity being economically compelled to continue to operate in that future period. The liability to pay a levy is recognized progressively if the obligating event occurs over some time

Difference Between AS 29 and Ind AS 37

AS 29 vs Ind AS 37

| Particulars | Ind AS 37 | AS 29 |

|---|---|---|

Constructive obligations and Change in the Definition of Provision and Obligating Event | AS 29 requires the creation of provisions in respect of constructive obligations. It requires the creation of provisions arising out of normal business practices, customs and a desire to maintain good business relations or to act in an equitable manner | AS 29 requires the creation of provisions in respect of constructive obligations. It requires the creation of provisions arising out of normal business practices, customs and a desire to maintain good business relations or to act in an equitable manner |

| Discounting | When the effect of time value of money is material, discounting is required. | Discounting is not permitted except for decommissioning, restoration and similar liabilities associated with property, plant and equipment |

| Contingent asset | Contingent assets are not recognised but disclosed in the financial statements when an inflow of economic benefits is probable. | Ind AS 37 makes it clear that before a separate provision for an onerous contract is established, an entity should recognize any impairment loss that has occurred on assets dedicated to that contract following Ind AS 36. |

| Onerous Contracts: | Ind AS 37 makes it clear that before a separate provision for an onerous contract is established, an entity should recognise any impairment loss that has occurred on assets dedicated to that contract in accordance with Ind AS 36. | There is no such specific provision in the existing standard |

| Future Operating Losses: | Ind AS 37 gives an exception to this principle viz. such losses related to an onerous contract. | AS 29 states that identifiable future operating losses up to the date of restructuring are not included in a provision. |

| Additional guidance | Ind AS 37 gives guidance on: (a) Rights to Interests arising from Decommissioning, Restoration and Environmental Rehabilitation Funds (b) Liabilities arising from Participating in a Specific Market — Waste Electrical and Electronic Equipment (c) Levies (imposed by government). | AS 29 does not give such guidance. |