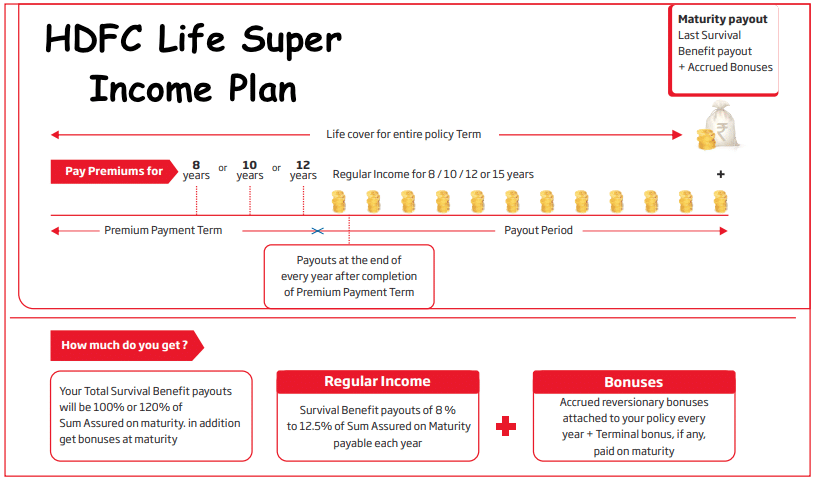

HDFC Life Super Income Plan is a participating plan that offers guaranteed income for a period of 8 to 15 years. It also offers an opportunity to participate in the profits of participating fund of the company by way of bonuses. The plan is ideal for individuals who need regular income at their disposal so that they don’t have to worry about future expenses and fulfil their financial goals uninterrupted.

Quick Links

Eligibility for HDFC Life Super Income Plan

| Min- Max Entry Age (years) | 2 years (for policy term of 16 years 30 days (for policy terms of 18 to 27 years) | 59 (for policy term 16 years) 57 (for policy term 18 years) 55 (for policy term 20 years) 53 (for policy term 22 years) 51 (for policy term 24 years) 48 (for policy term 27 years) |

| Min- Max age at Maturity (years) | 18 | 75 |

All ages mentioned above are age last birthday.

Sum Assured on Maturity/Death is the absolute amount of benefit which is guaranteed to be payable in the form of survival benefit/Death Benefit during the policy term as per the terms and conditions specified in the policy

Key product features

- Enjoy regular income for period of 8 to 15 years after premium payment term.

- Guaranteed Base Income varying from 8.0% to 12.5% of Sum Assured on Maturity payable each year during payout period.

- Boost your regular income at maturity with reversionary bonuses and terminal bonus*, if any.

- Range of premium payment and policy term options to meet your income goals.

- Insurance coverage throughout the policy term.

- This plan is available with a Short Medical Questionnaire (SMQ) based underwriting#

* For conditions please refer to the section on Benefits in the Prouduct Brochure

# For more details on risk factors, terms and conditions, please read the Product Brochure carefully and/or consult Financial Consultant before taking a decision.

Benefits of the Product

- Limited premium paying term of 8, 10 or 12 years

- Guaranteed Income# every year for a period of 8, 10, 12 or 15 years.

- Financial Protection against untimely demise, throughout the premium payment term as well as the payout period

- You can opt for hassle-free issuance on the basis of a Short Medical Questionnaire#eliminating tedious medical tests

- Lumpsum Payout on diagnosis of specified Critical Illnesses*

# For more details on risk factors, terms and conditions, please read the Product Brochure carefully and/or consult Financial Consultant before taking a decision.

* This is applicable with the HDFC Life Critical Illness plus Rider. A lump sum benefit equal to the Sum Insured shall be payable, if the life assured survives for a period of 30 days following the diagnosis of any of the specified 19 critical illnesses.

PLAN OPTIONS

This plan offers range of options which you can select at inception based on your financial goals

| Options | Premium payment term (years) (A) | Payout period (years) (B) | Policy term (years) (A+B) |

|---|---|---|---|

| Option 1 | 8 | 8 | 16 |

| Option 2 | 8 | 10 | 18 |

| Option 3 | 10 | 10 | 20 |

| Option 4 | 10 | 12 | 22 |

| Option 5 | 12 | 12 | 24 |

| Option 6 | 12 | 15 | 27 |

For more details on risk factors, terms and conditions, please read the Product Brochure carefully and/or consult Financial Consultant before taking a decision.

HOW DOES THE PLAN WORK?

Tax Benefits:

- Premiums paid by an individual or HUF under this plan are eligible for tax benefits under Section 80C of the Income Tax Act, 1961, subject to the conditions/ limits specified therein.

- Under Section 10 (10D) of the Income Tax Act, 1961, the benefits received from this policy are exempt from tax, subject to the conditions specified therein.

Please note that the above mentioned benefits are as per the current tax rules. Your tax benefits may change if the tax rules are changed. You are requested to consult your tax advisor

Buy this Policy

- To buy: 1800-227-227 (Toll free) (Available Mon-Sat 9:30am to 6:30pm)

- Visit us at www.hdfclife.com

- Click Here to Download Prospects or Brochure for More details

Alterations:

Alteration to premium frequency is allowed, subject to the terms and conditions