Equitas Bank Saving Account: up to 7% Interest Rates. Elevate your Banking experience with Equitas. We at Equitas have gone that extra mile to ensure that our products suit your needs, are hassle-free, digital, and easily accessible. Why Choose Equitas Bank Savings Account? Through its network of branches in India and overseas, Equitas Bank provides a range of financial products including the Equitas Bank Savings Account. The savings account has a variety of benefits and services. The most attractive features are that the savings account does not require a minimum balance and provides ATM/Debit card, net banking and mobile banking facilities.

Equitas Small Finance Bank have designed for Savings Account Product bouquet with the philosophy built on relevance. Each variant in our Savings Account offering represents our philosophy & aims to cater to a differentiating & significant demographic aspect of one’s life. Whether you are yet to begin your savings journey or are retired from work, whether you are a salaried individual or professional settled abroad, whether you are a student or an ambitious woman pursuing her dreams, we ensure that we, at Equitas Bank, genuinely add value to your banking experience!

Quick Links

Special Features of Equitas Bank Saving Account

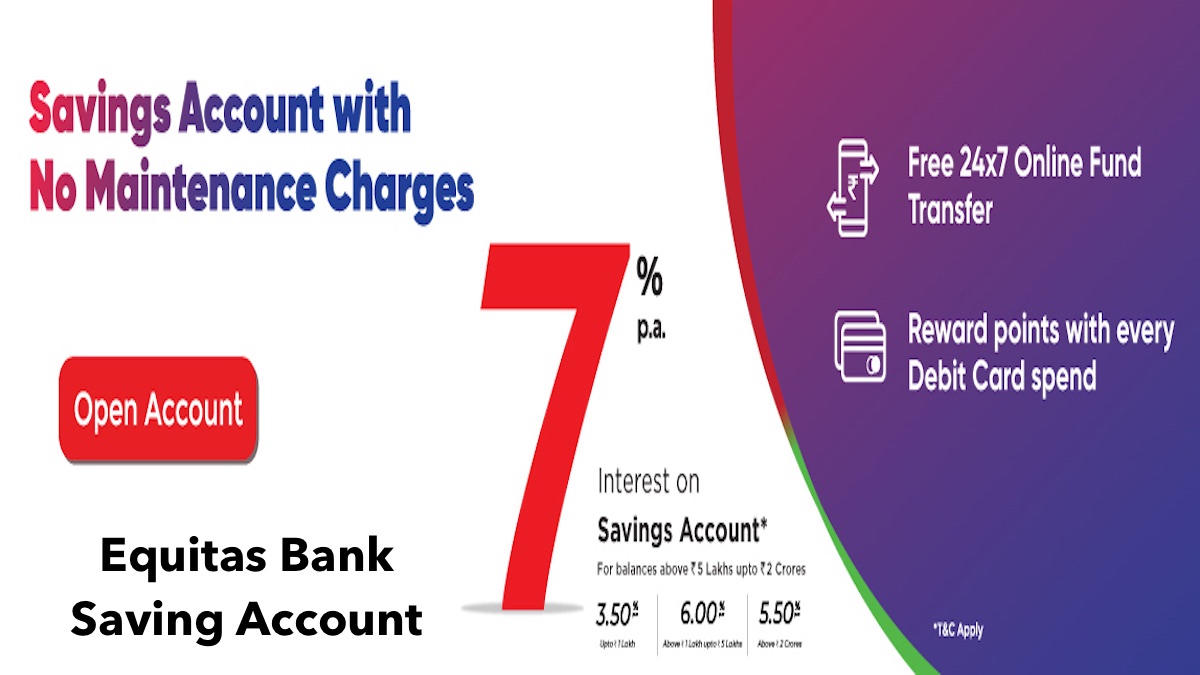

- Equitas Bank offer higher interest rates, upto 7.00%*, for your savings ensuring that you always save more.

- Equitas Bank offering you a quarterly interest payout so you realize the interest benefit of your savings every month.

- As your banking relationship grows, we offer you a complimentary Equitas to upgrade to the next level of deserved banking privileges and service benefits.

Interest Rates on Equitas Bank Saving Account

Mentioned below are the applicable Interest Rates for Savings Account balances for Domestic Savings Accounts.

Interest Rates on Standard Savings Account, Savings Account Interest Rate w.e.f. 14 December 2022

Savings Account Interest rates

| Daily Closing Balance | Rate Slab |

|---|---|

| Up to ₹ 1 lakh | 3.50% |

| Above ₹ 1 lakh and upto ₹ 5 lakhs | 5% |

| Above ₹ 5 lakhs | 7.00% |

- TDS will be deducted as applicable

- Please check all terms and conditions applicable on FD/RD for premature withdrawal

- 0.60% extra for Senior Citizen (not applicable for NRE/NRO)

How to Apply

Click here to apply online for Equitas Bank Saving Account

The Equitas Bank online savings account opening procedure is simple.

- Any Indian resident can open a Equitas Bank savings account online by visiting the Equitas Bank website. Under personal banking, go to “Deposit schemes”, you will find the option of savings bank account.

- It is important to read the benefits, rules and regulations before clicking on the “apply online” option.

- Fill in all the details in the online application form.

- A TCRN (Temporary Customer Reference Number) will be generated and sent to the registered mobile number.

- Visit the nearest Equitas Bank branch within 30 days with the required original documents and your account will be opened.

Types Equitas Bank Saving Account

- Yellow Army Savings Account

- Wings Savings Account

- Basic And Small Savings Account

- Standard Savings Account

- Regular Savings Account

- Value Plus Account

- My Savings Account

- SelfeSavings Account

Key Benefits Of Equitas Bank Savings Account

Equitas Bank provides a range of financial products including the Equitas Bank Savings Account, through its network of branches in India and overseas. The savings account has a variety of advantages and many easy to use services. The most beneficial and useful features are that the savings account does not require a minimum balance and provides ATM/Debit card, net banking and mobile banking facilities.

- Transfer accounts to any Equitas Bank Branch without changing the account number

- Passbook issued free of charge

- No inter core charges for transfer transactions

- Multicity cheques

- Safe Deposit lockers

- Internet Banking, Mobile Banking, Kiosk Banking

- Nomination facility

- Personal Accident Insurance available at a nominal premium

- Multiple variants of ATM/Debit Cards like Gold Card, International ATM/Debit Card, etc.

- Can be linked to Multi Option Deposit (MOD) Account

Documents Required for Equitas Bank Saving Account

- Account Opening Form (AOF)

- Proof of identity and address ( Aadhar card, NREGA card, PAN card, Passport, Voter’s ID, Driving Licence)

- 2 recent passport-size colored photographs

- In the case of minors below the age of 10, ID proof of the person who will operate the account is required. If the minor can operate the account independently, the regular procedure will be applicable

Recommended:

I am equte bank already saving customer

But I have to change the password