Do’s and Don’ts during Buy back of shares: Buy back of shares is the process by which a company can repurchase its own shares from the market. Buy back will result in reduction in number of shares outstanding in the market. In this post we list out the Do’s and Don’ts during ‘Buy back of shares’:

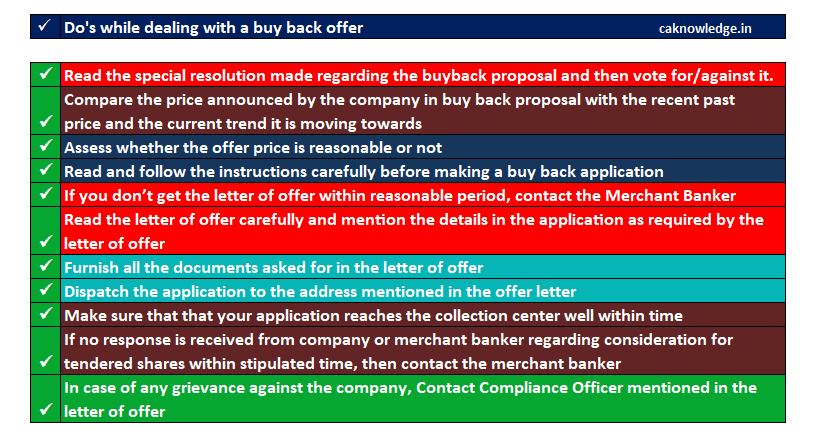

Do’s during Buy back of shares:

- While participating in the voting on buy back decision put forth by the management, read the special resolution made regarding the buyback proposal and then vote for/against it.

- Compare the price announced by the company in buy back proposal with the recent past price and the current trend it is moving towards.

- Assess whether the offer price is reasonable or not. Go ahead only if you find it to be a fair price

- Read and follow the instructions carefully before making an application to offer your shares for buy back.

- If you fall under the small retail investors, then decide upon how much you want to offer the company out of your holdings for buyback.

- If you don’t get the letter of offer within reasonable period, contact the Merchant Banker

- Read the letter of offer carefully and mention the details in the application as required by the letter of offer.

- Furnish all the documents asked for in the letter of offer

- Dispatch the application to the address mentioned in the offer letter. Follow the mode of specified in the offer letter while doing so.

- Make sure that that your application reaches the collection center well within time.

- If no response is received from company or merchant banker regarding consideration for tendered shares within stipulated time, then contact the merchant banker.

- In case of any grievance against the company, Contact Compliance Officer mentioned in the letter of offer.

- You can Contact the Registrar of Companies in case you feel that provision of the Companies Act has been violated in this entire consideration of buy back process.

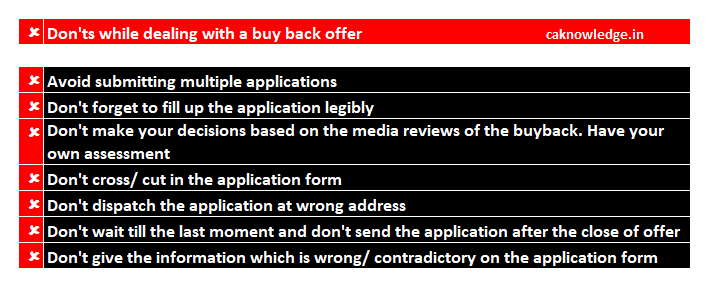

Don’ts during Buy back of shares:

- Avoid submitting multiple applications

- Don’t fail to ensure that your hand writing on the application is legible

- Don’t make your decisions based on the media reviews of the buyback. Have your own assessment of the proposal.

- Don’t cross/ cut in the application form.

- Don’t dispatch the application at wrong address

- Don’t wait till the last moment and don’t send the application after the close of offer

- Don’t give the information which is wrong/ contradictory on the application form.

- Don’t fail to ensure that you have signed wherever it is necessary.

Recommended