Difference Between Convertible and Non-Convertible Debentures: Check What is the Difference Between Convertible and Non-Convertible Debentures. Debentures are long-term debt instruments issued by various institutions and companies. There are many types of debentures in the market based on their convertibility, security, redemption, etc., Here we are discussing about convertibility.

In this article, you can complete details for Convertible debentures and Non-Convertible Debentures like – Benefits or advantages of Convertible Debentures, Disadvantages of Convertible Debentures, Benefits for Non-Convertible Debentures, Disadvantages of Non-Convertible Debentures (NCD), Review of Non-Convertible Debentures. Now you can scroll down below and check the difference between Convertible and Non-Convertible Debentures. Must Read How to Read or Analyse a Balance Sheet.

Based on the ability to convert the debentures after a certain period into shares, they are said to be of 2 types:

- Convertible debentures

- Non – convertible debentures.

Quick Links

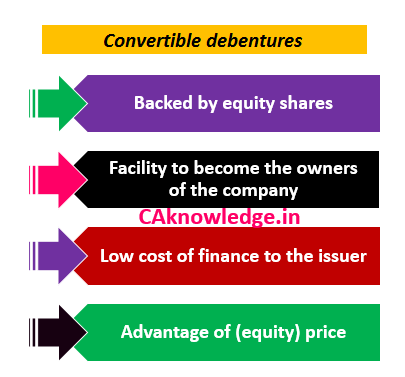

1. Convertible debentures:

Debentures which facilitate the owner of these instruments to convert them into shares after a particular period are known as convertible debentures.

Benefits:

- Since they are backed by a facility of converting into equity, at the times of conversion if the market value of that particular company’s equity is doing well then it will give a huge return.

- As they carry a lower rate of interest compared to non – convertible debentures, the cost to the issuer is comparatively low.

- Along with the performance of the equity in the financial markets, the rate of interest and the demand for these convertible debentures fluctuate often. One can take the price advantage when the equity is on an increasing trend.

Disadvantages:

- Unlike non – convertible debentures these are not backed by any assets of the issuer agency. They are secured only by the equity of the company which is highly vulnerable. Thus they are less secure comparatively

- A major disadvantage for the issuing company is that convertible debentures bring the risk of diluting the EPS of the company’s common stocks, and also the control of the company.

- Investors of these bonds usually receive substantially lower yield to maturity in comparison to the non-convertible bonds. You may also like the Acid Test Ratio or Quick Ratio.

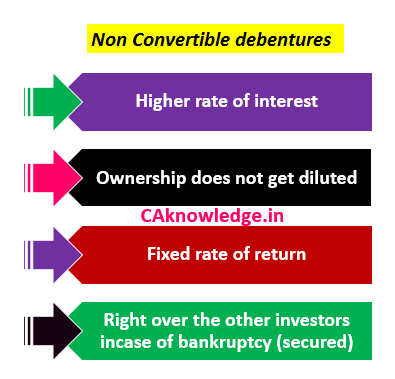

2. Non Convertible Debentures:

Debentures that cannot be converted into equity are known as non – convertible debentures.

Benefits:

- They carry a good rate of return when compared to convertible debentures.

- Non – convertible debentures (secured) are backed by the assets of the company. So in the case of financial bankruptcy, the holders of these instruments have an overriding right in claiming the proceeds of the assets of the issuer.

- To the issuer, the major advantage is that the ownership does not get diluted. Hence his (shareholders) control remains the same in the company.

- Unlike convertible debentures, these offer a fixed rate of interest whereas the rate of interest earned by the convertible debentures is highly affected by the performance of the equity in the market.

Disadvantages:

- Their inability to get them converted into equity does not give a facility to become the owners of the company by becoming a shareholder.

- The rate of interest is higher than that is paid on convertible debentures which is a disadvantage to the issuer.

- In case of unsecured non-convertible debentures, they will be at very high risk at the times of bankruptcy in realizing the claims from the proceeds of the assets of the company which are reserved to the secured instruments. Must Check Steps to Locate Errors.