This article is all about the delisting of shares, how it works, what is the procedure, statutory requirements, and types of delisting of shares. Delisting of shares means removal of shares and securities of a listed company from a recognized stock exchange.

If you liked this article please like us on Facebook so that you can get our updates in the future………and subscribe to our mailing list “freely”

Must read: Difference between shares and stocks

Quick Links

When Delisting is required ??

Delisting means if a company gets delisted from both the recognized stock exchanges, it means if a company gets delisted from any one stock exchange then it will not be considered as delisting. Delisting is generally done when the listing fee has become a burden for them as their securities are not able to meet the buying and selling of shareholders. The company has the option to sell any class of securities and there is no restriction on the class of securities that the company cannot delist through buyback of shares, but the types of delisting are mainly two :

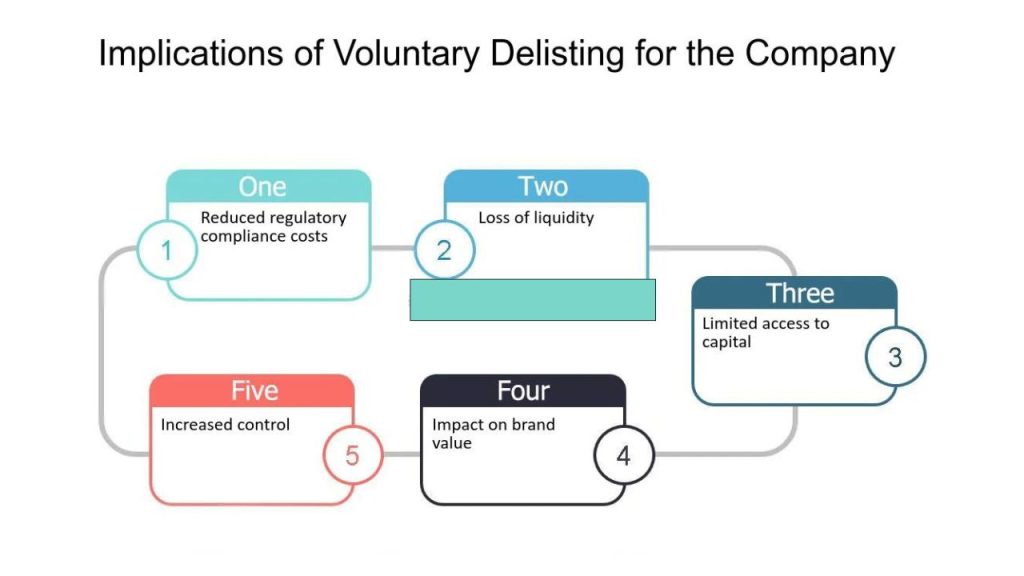

Voluntary Delisting :

(i) Definition:

When the promoter, acquirer, or the person having major control over the company claims the delisting of shares, it is called voluntary delisting, which does not require any law.

(ii) When it is required:

There can be many reasons behind the delisting of shares, mainly quarrels between members over some matter, negligible trading on the stock exchange, merger, amalgamation, suspension of business, listing fee becoming a burden, etc. See insider trading.

(iii) Conditions for voluntary delisting:

- Minimum listing period 3 years

- Delisting through the book-building process.

(iv) Formalities:

- Approval of all members

- Filing of form with ROC

- Board approval

- Auditor certificate

- Listing fee dues

- Application for delisting of shares

- Intimation to the Stock Exchange

- Mentioning in the director’s report

- Purchase price

- Exit price for shareholders

Also, check: ADR and GDR Complete Guide

Compulsory Delisting :

(i) Definition:

When a listed company is forced by a recognized stock exchange to delist its securities for one or more reasons, it is called compulsory delisting.

(ii) Reasons for compulsory delisting:

- Reduction in the number of shareholders beyond the minimum required under the Companies Act

- Listing fee dues

- Investors’ complaints are not resolved promptly.

- Compliance procedures are not followed

- Unfair trade practices and malpractices

Must Read – Earning Per Share

How the Exit price is decided ??

The exit price should be fixed in such a way that the investors and shareholders are satisfied with the price offered to them for exit from the company. There are mainly two ways through which the exit price is fixed

(1 ). When the securities are frequently traded:

In this case, the exit price or offer price shall be the average of the 26 weeks of trading price in whichever stock market they are traded and should be the same price before the announcement is made.

(2). When the securities are not frequently traded:

Here the exit price or offer price shall be fixed as any one of the following:

- Earnings per share

- The highest price paid by the acquirer

- Return on net worth

- Book value of shares

It is also necessary to make a public announcement that the following named company has been permanently delisted from the stock market and shall not be traded.

Recommended Articles:-

- Systematic Investment Plan (SIP)

- Electronic Fund Transfer (EFT)

- Need of Technology of Banking

- Small Finance Banks

- gifting of shares

- first Step to Enter in Market by A CA Students

Delisting of Shares: Introduction, When?, Voluntary Delisting