What is Debit and credit explained with an accounting equation? We often come across the words Debit and credit in many situations like while reading accounting theory or while applying this theory, which means recording the accounting entries…

If we ask someone about what’s a debit and what’s a credit then they may say that the left-hand side of an account is a Debit and the one on the right-hand side is a credit aspect. This may sound like correct…Yeah, it’s a correct answer. But it’s more than that. The answer could be more elaborate. Here I’m going to discuss a few lines about these. Must Read How to Read or Analyse a Balance Sheet.

Quick Links

What is Debit and credit explained with an accounting equation

What’s a Debit?

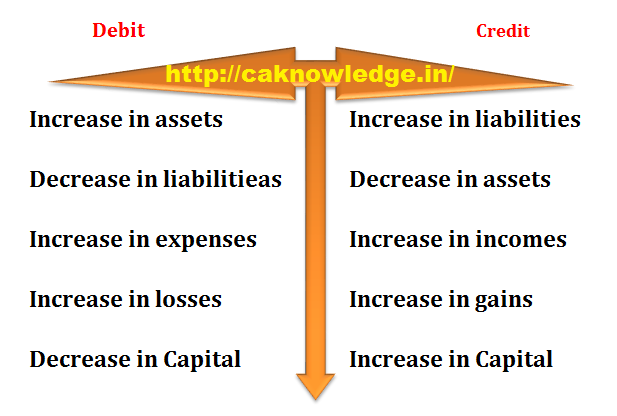

(1) The term Debit is used in the context of recording a transaction that increases the value of an asset or decreases the amount of liability.

(2) Here we have to remember that the above-stated transactions are recorded on the left-hand side of an account when we put together the two sides of an account in ‘T’ form.

What’s a credit?

(1) The term credit is used to record the transactions which result in a decrease in assets and an increase in liability.

(2) Thus, while recording the above-stated transactions we enter them on the right-hand side of an account.

These can be better explained with the elements of the accounting equation.

Assets = Liabilities + Capital

First of all, to decide which aspect of an accounting transaction is Debit and which is credit we have to see how they affect the elements of this accounting equation. You may also like the Acid Test Ratio or Quick Ratio.

(1) On Assets :

Always a Debit item increases the value of an asset and a credit item decreases the value of that asset.

(2) On Liabilities :

A Debit aspect decreases the liability and a credit aspect increases the liability.

(3) Capital :

A Debit entry decreases the capital and a credit item increases the capital.

And the impact on expenses and incomes:

(1) A Debit item increases the expenses and decreases the income.

(2) A credit item increases the income and decreases the expenses.

Illustration

Mr Ajay has commenced a new business alongside of his job and brought 50lakhs cash into business as initial capital. And expended 30lakhs for building and infrastructure.

Here when he brings cash into business, this activity increases the value of assets in the business so it is to be debited. Must Check Steps to Locate Errors.

When he spends some amount on a building the payment made towards the building will decrease the current assets (cash) so it is to be credited as it results in a decrease in. the value of an asset as said above. And the value of fixed assets (building) will increase so it is to be debited.