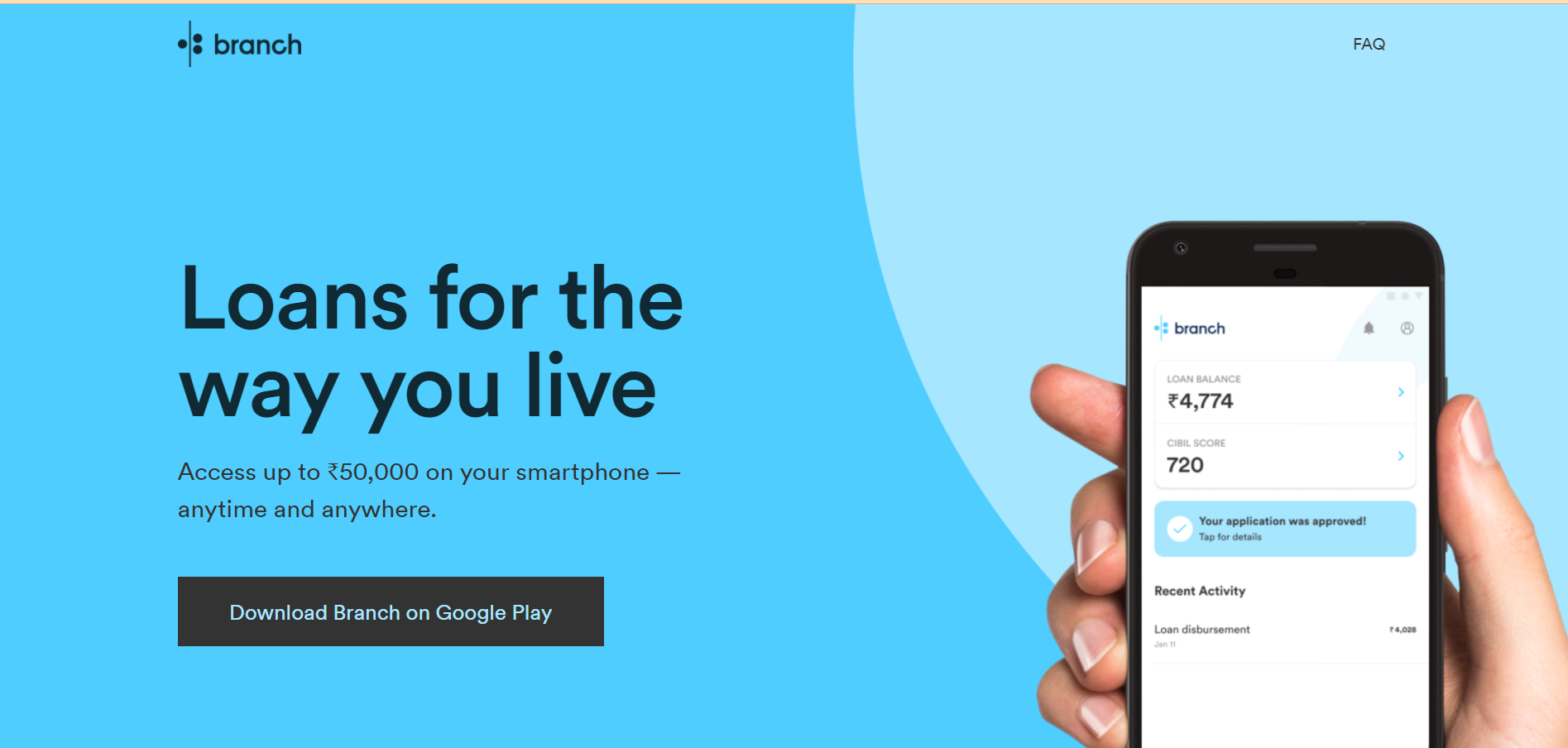

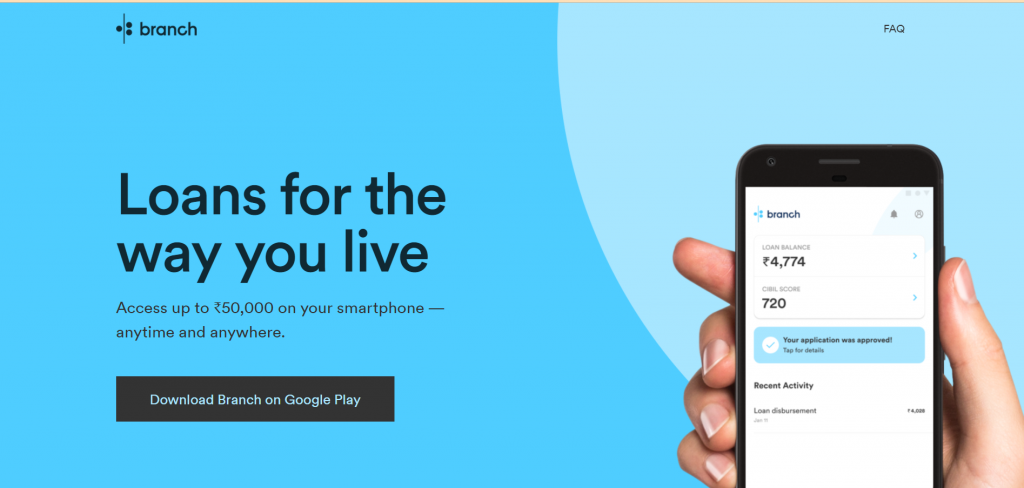

Branch loan 2024: The Branch is a very famous and successful application that provides easy loans to all the citizens of India who are in desperate need of a loan. The app offers a lot of loans, and most of the process to get a loan is quite simple and hassle-free. The entire process is entirely online, and it doesn’t require any paperwork. The option to have a loan with minimal documentation adds a lot of benefits for the customers.

Content in this Article

Features of Branch Loan

From a Branch loan, one can take a loan amount ranging from 500 rupees to 100,000 rupees INR. The loan amount adds a lot of flexibility to the customers, and you can choose the amount from a wide range. You can take a loan according to your needs. There is also no penalty if you will pay the loan before the tenure ends. There is also no late fee, an exceptional feature that makes the Branch app different from anyone else.

You can take a loan without any collateral as well, but for that, you need to have a perfect credit score. Maintaining a good credit score is very important, and it will surely help you in the future as well.

| Interest rate | 3% to 35% per annum and 2.8% to 3.1% per month |

| Processing fee | The processing fee is not mentioned by the application |

| Features | Branch app is a very famous and successful application that provides loans directly to your bank account without the hassle of getting into long lines of banks or waiting for the lenders. |

| Eligibility criteria | You need to be an Indian if you want to take the loan, you also need to be over 20 years old, but at the same time, you can’t Surpass the higher age limit, which is 55 |

| Application process (Online/Offline) | You need to download the application first, available on the play store and its official website. Later, you can submit all the documents and application forms and get your desired loan within minutes. |

| Documents Required | You need to have some essential documents like an Aadhaar card, driving license, pan card, and many more. Without these, you can’t take the loan. |

Eligibility criteria

There are some eligibility criteria that you need to know as an applicant. Otherwise, you won’t be able to take the loan properly. Without being eligible for the loan, you can get the Branch app’s benefits to its customers. Although these eligibility criteria are nothing special and most of are already aware of them, but still, you can take a look if you don’t know about them:

- You can’t take a loan from the Branch app if you are not a citizen of India. The app doesn’t provide loans to foreigners and NRIs.

- There is an age barrier as well, which is a must. You need to be over the age of 20 or you need to be below the age of 55.

- You need to maintain a very good credit history and credit score.

- You need to have a bank account, so that the money will get transferred there directly.

Application process (Online/Offline)

The application process to apply for a loan is very simple and convenient. Anyone can apply for a loan without having to worry about the paperwork and documentation. The entire process is entirely online, which gives the customers a lot of ease. You need to follow the few steps which we have mentioned below for your convenience:

#Step I: before applying for the loan from the Branch app, you need to download the app from the play store or its official website.

#Step II: You need to get yourself registered on the app to reach the next step. During the registration, the app should ask for some permissions, which you must need to provide it.

#Step III: now, fill the application form and choose the required loan amount and tenure you want to repay the loan.

#Step IV: Once you have reached this point, you need to upload the scanned image of the required documents and attach that with the application form. You can now submit the form.

#Step V: once the check is over, your loan amount will be directly credited into your bank account.

Documents required

Some of the documents which you need to have before applying for the loan form Branch app are mentioned below:

- Identity proof – Aadhaar card, passport, voter id card, etc.

- Address proof – Aadhaar card, driving license, etc.

- Income proof, for that you can either use the bank statement of the last few months or you can also use the most recent salary slip.

- You need to have a pan card for a successful KYC.

Frequently asked questions

Yes, Branch has an office in India which is located in Mumbai. The company has offices all around the world.

Factors like credit score, credit history, your credibility to repay the loan define a lot about your pre-approved loan amount. There are some other factors as well, which you can check directly from the app.

Currently, Branch operates in India, Kenya, Tanzania, and Nigeria.

You can follow this link and click Update. Or you can go to Google Play, search for “Branch International” then click “Update”.