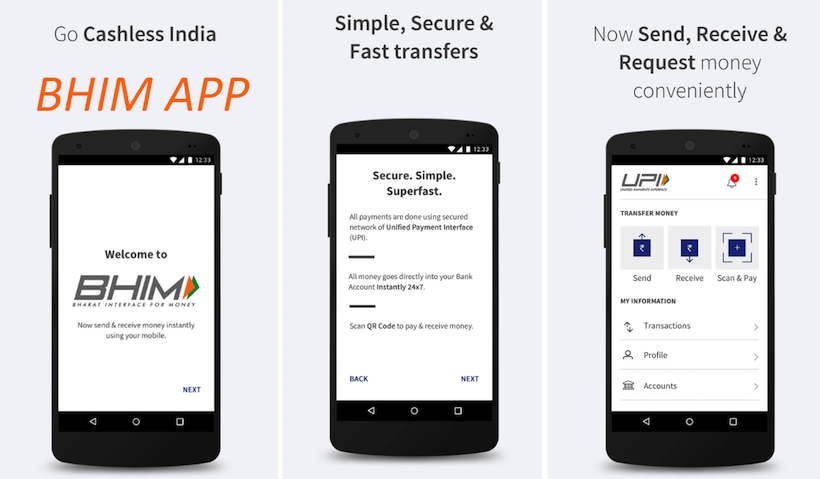

BHIM App 2024: Bharat Interface for Money (BHIM) is an initiative to enable fast, secure, reliable cashless payments through your mobile phone. BHIM is interoperable with other Unified Payment Interface (UPI) applications, and bank accounts. BHIM is developed by the National Payment Corporation of India (NPCI). BHIM is made in India and dedicated to the service of the nation.

| App Name | BHIM – MAKING INDIA CASHLESS |

| Offered By | National Payments Corporation of India (NPCI)Finance |

| Last Updated | May 29, 2024 |

| Total Installs | 100 Million + |

| Latest Version | 3.1.1 |

| Latest Bhim App | Click Here |

| Official Website | Click Here |

Quick Links

What is BHIM App (Bharat Interface for Money)?

Bharat Interface for Money is an app that lets you make easy and quick payment transactions using UPI. Its easier than Wallets! You will not have to fill-out those tedious bank account details again and again. You can easily make direct bank to bank payments and instantly collect money using just Mobile number or Payment address.

How does BHIM App is work?

Register your bank account with BHIM, and set a UPI PIN for the bank account. Your mobile number is your payment address (PA), and you can simply start transacting. Yes! It is that simple.

Send / Receive Money: Send money to or receive money from friends, family and customers through a mobile number or payment address. Money can also be sent to non UPI supported banks using IFSC and MMID. You can also collect money by sending a request and reverse payments if required.

Charges for Using BHIM APP

There are no charges for making transaction through Bharat Interface for Money. Note – Your bank might however levy a nominal charge as UPI or IMPS transfer fee which is not under our control. Please check with your bank for more details.

How to Download BHIM App

- Step 1 – Visit on Play Store by using following link https://play.google.com/store

- Step 1 – Now Please Type “BHIM App” in Search Box and Hit Enter

- Step 3 – Now you can see BHIM App by NPCI, please this App and Make Transfer Very Easily

Direct Download link for BHIM App

https://play.google.com/store/apps/details?id=in.org.npci.upiapp

Benefits of BHIM App

Check Balance: You can check your bank balance and transactions details on the go.

Custom Payment Address: You can create a custom payment address in addition to your phone number.

QR Code: You can scan a QR code for faster entry of payment addresses. Merchants can easily print their QR Code for display.

Bharat Interface for Money (BHIM) is an initiative to enable fast, secure, reliable cashless payments through your mobile phone. BHIM is interoperable with other Unified Payment Interface (UPI) applications, and bank accounts. BHIM is developed by the National Payment Corporation of India (NPCI). BHIM is made in India and dedicated to the service of the nation.

How does it work?

Register your bank account with BHIM, and set a UPI PIN for the bank account. Your mobile number is your payment address (PA), and you can simply start transacting. Yes! It is that simple.

Send / Receive Money: Send money to or receive money from friends, family and customers through a mobile number or payment address. Money can also be sent to non UPI supported banks using IFSC and MMID. You can also collect money by sending a request and reverse payments if required.

Check Balance: You can check your bank balance and transactions details on the go.

Custom Payment Address: You can create a custom payment address in addition to your phone number.

QR Code: You can scan a QR code for faster entry of payment addresses. Merchants can easily print their QR Code for display.

Transaction Limits of BHIM App

Transaction limit is Rs. 1,00,000 per transaction and per day. (Please note that your Bank’s Transaction Limit may vary from BHIM’s limit.)

Language supported: Hindi and English. More languages coming soon!

List of Banks Supported BHIM APP

Allahabad Bank, Andhra Bank, Axis Bank, Bank of Baroda, Bank of Maharashtra, Canara Bank, Catholic Syrian Bank, Central Bank of India, DCB Bank, Dena Bank, Federal Bank, HDFC Bank, ICICI Bank, IDBI Bank, IDFC Bank, Indian Bank, Indian Overseas Bank, IndusInd Bank, Karnataka Bank, Karur Vysya Bank, Kotak Mahindra Bank, Oriental Bank of Commerce, Punjab National Bank, RBL Bank, South Indian Bank, Standard Chartered Bank, State Bank of India, Syndicate Bank, Union Bank of India, United Bank of India, Vijaya Bank.

Complete Details for BHIM App

- As per our PM statement, in next few years all the transactions will be done via BHIM app in India.

- This app will have very strong security features so that all of your money will be safe.

- All payments can be done easily via one click.

- This app is created especially for poor people, especially for Dalits, farmers, SCs & STs etc.

- Mr. Narendra Modi requested Indians to do atleast 5 transactions via this app daily.

- BHIM app will allow people to send & request money or scan and pay using QR Code.

- To send money, all you need is UPI Address of other guy. This app is quite similar to other cashless apps like PayTM.

- In BHIM App, it’s very easy to switch between your multiple bank accounts as well.

- It is based on IMPS (Immediate Payment Service).

- It will work 365 days a year and 24 hours a day.

- Currently maximum of Rs. 10,000 per transaction is allowed.

How to Setup UPI Address?

Please Follow below steps to setup your bank account with BHIM.

- Register your bank account with BHIM.

- Setup a UPI PIN for your bank account.

- Now your mobile number will be your payment address. (You can change it later).

- You can start doing transactions via BHIM App now.

UPI Address – What’s mine UPI Address?

By default, your UPI Address will be your mobile number. For example, if your mobile number is 9999912345, then your UPI Address will be 9999912345@upi. Though, you can get your own custom UPI Address as well (both text and numbers are supported).

Payment Address is an Address which uniquely identifies a person’s bank a/c. For instance, the Payment Address for Bharat Interface for Money customers is in the format xyz@upi. You can just share your Payment Address with anyone to receive payments (no need for bank account number/ IFSC code, etc.). You can also send money to anyone by using their Payment Address. Note – Do not share your confidential UPI PIN with anyone.

To start using Bharat Interface for Money all you need is a Smartphone, Internet access, an Indian bank account that supports UPI payments and mobile number linked to the bank account. Link your bank account to UPI through the app.

Why is my UPI transaction failing?

When you shop-online, you can pay through UPI when you see UPI as a payment option. On clicking that, you will need to enter your Payment Address (xyz@upi). Once entered, you will receive a collect request on your Bharat Interface for Money app. Enter your UPI-PIN here and your payment will be complete. As easy as this!

Can I send money to anyone using Bharat Interface for Money?

Yes, you can send money using the Bharat Interface for Money app from your UPI enabled bank account. You will need to register and set a UPI PIN using the debit card details linked to the bank account. If your beneficiary’s bank account is also linked to UPI, you can simply use their mobile mobile number or Payment Address to transfer.If not, you can use IFSC code, Bank account or MMID , Mobile number to send money.

How do I send money?

From the Bharat Interface for Money app Home screen,

- Click Send Money Option;

- Enter or select the receiver’s mobile number or Payment Address (you can select from your contact list or enter it) or Aadhaar number

- Enter the amount you want to send

- Your default bank a/c gets selected

- Enter UPI PIN and send

- Alternately, you can also scan a QR code and pay via the ‘Scan & Pay’ option.

Recommended Articles

There is problem in the app launched pe Shri PM Modi Sir.The UPI code generated by bank is of 4 digit and App asks for 6 digit code.So therefore I am facing an issue regarding this. I am unable to move further.Plz help me someone regarding this issue.

Bank of India is not shown in the list

Aaccount does not exit show I will click on ICICI BANK plzzzz resolve this problem…

RAmkrishna das