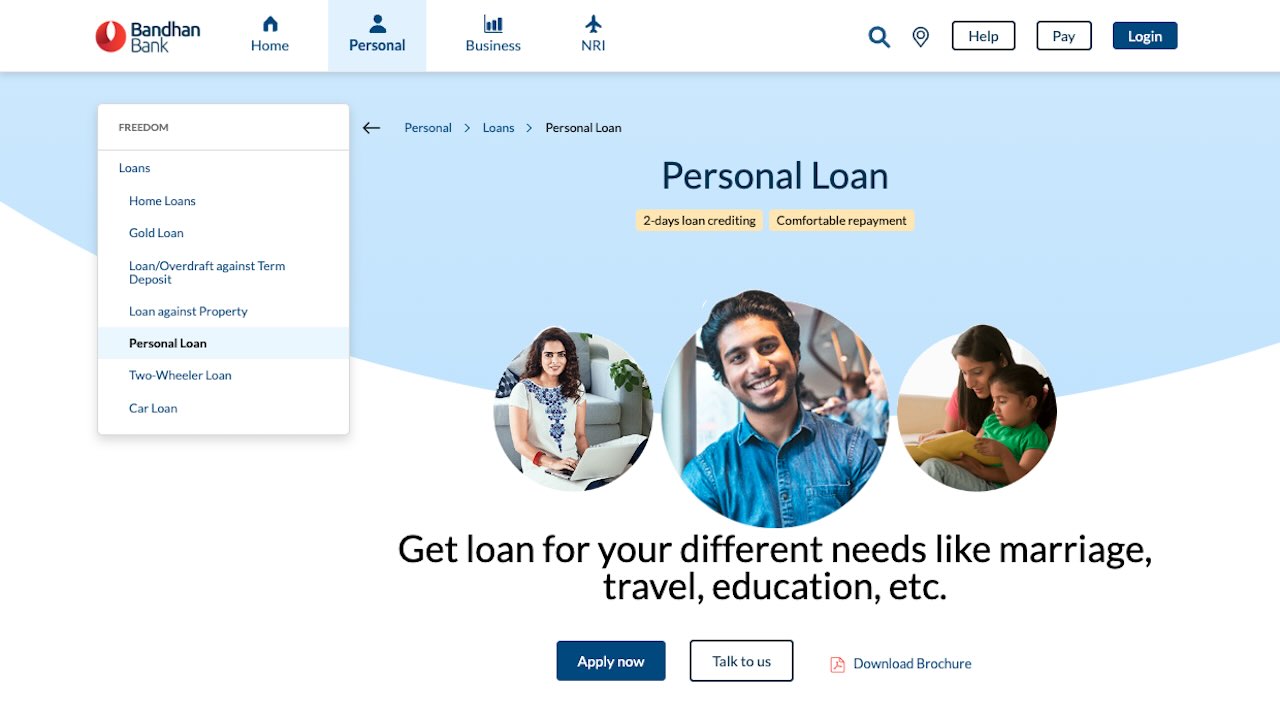

Bandhan Bank loan 2024: Bandhan Bank offers a variety of loans, and it is one of the best and most efficient lender’s available in the market. You can get a lot of Variety with enough flexibility for your needs. The process is both online and offline, which makes it even more accessible and convenient for everyone.

Quick Links

Bandhan Bnak loan

Suppose you live in an isolated area with no bank available nearby; you can get the loan from the online process. Both the process is straightforward, and it can be applied by following only a few steps. Loans like personal loans, business loans, and others don’t require any collateral, and they are considered unsecured loans.

You can also opt for secured loans with lower interest rates and processing fees. You also get excellent service and customer support, which makes life very easy. Every loan offers a variety of amounts, tenure, offers, and various other things.

| Features | Bandhan Bank offers a variety of loans to its customers with a lot of ease and convenience. You take various loans depending on your need like personal, business, education, home, and many more. There are a variety of options for interest rate, processing fee and tenure. You can choose from a wide range of loan amounts which provides a lot of flexibility |

| Eligibility criteria | There are some eligibility criteria you need to know like, the applicant needs to be a citizen of India, though NRIs can also take loans with some different standards. You also need to have a regular source of income, and your age must have to be under the limit. |

| Application process (Online/Offline) | The application process can be completed both online and offline, which gives customers a lot of flexibility. You can reach the bank for offline form filling, or you can fill it from your home. |

| Documents Required | You need to have a variety of documents to take a loan from Bandhan Bank. Documents like aadhaar card, Voter ID card, passport, driving license, etc., are required. You also need to submit income proof. |

Eligibility criteria

There are a variety of eligibility criteria available that must be looked at closely if you want to get a loan from Bandhan Bank. There are a variety of loans available as well, so the eligibility criteria depend a lot on the type of loan you want to take.

We have mentioned all the eligibility criteria below:

- First of all, you need to be a citizen of India, although you can still take out a loan if you are a NRI. Though for NRIs the eligibility criteria is little different.

- You need to have a salary account or savings account in Bandhan Bank to be eligible for a loan.

- Your age must have to be according to the type of loan and it’s conditions. For example, to take a personal loan you need to be under the age limit of 21 to 60.

- You also need to have a regular source of income, so that loan repayment remains smooth.

Application process (Online/Offline)

The application process to take any loan from Bandhan Bank is very easy and convenient. The entire process is completely hassled free and without requiring a lot of paperwork and documentation. However, you need to do some of it in the offline process. You can opt for either online or offline according to your comfort.

First of all, we will see the online process:

#Step I – first of all, you need to visit the official website, www.bandhanbank.com

#Step II – you can start filling the application form after visiting the official website. You need to first log in to it and then submit all your details of yours. You need to have a bank account as well.

#Step III – You need to choose the loan you want and start filling the application form. You need to select the loan amount, tenure, and other essential things in the application form.

#Step IV – now, you need to upload the documents required. You need first to scan the documents and then upload them with the application form.

#Step V – once the documents are submitted, you need to wait for some time. The verification and confirmation take some time.

#Step VI – the loan amount gets transferred into your bank account within a few days.

Now, we will see the offline process:

#Step I – first of all, you need to go to the bank branch closest to you.

#Step II – then, you need to find a bank official there who will help you with all sorts of things.

Step III – you need to fill the application form with all the relevant details and information about your income and other things. You need to choose the loan type, amount, tenure, and other things.

#Step IV – after filling the application form, you must submit copies of the documents required for the loan you want.

#Step V – after submitting all the relevant documents and details, you can expect the loan amount to be in your bank account within a few days.

Also read about: Register Mobile Number in Bank of India

Documents required

- Identity proof – Aadhaar card, passport, voter ID card, etc.

- Address proof – Aadhaar card, passport, driving license, etc.

- Income proof, for which you can either submit the bank statement of the last few months or the recent salary slip. You can also use Income tax return or form 16 or any other.

- Pan card for an easy KYC.

Frequently asked questions

The maximum personal loan amount is five lakhs, which one can take.

The age limit starts from 23 and ends at 60. You need to be under this age limit to take a personal loan.

You can quickly repay the loan in easy EMIs in the tenure provided. You can use various payment methods as well.

There are various types of loans offered by Bandhan Bank, which are also very easily accessible. Loans like personal loans, business loans, home loans, and many others are available.