All about Account Payee Cheque Vs Crossed Cheque: Difference between Account Payee Cheque and Crossed Cheque. Before we go too much into detail about account payee cheque & crossed cheque, it is important to know what are Negotiable Instruments! So, let us have a look on the definition & characteristics of Negotiable Instrument. check more details regarding “All about Account Payee Cheque Vs Crossed Cheque” from below…..

Quick Links

All about Account Payee Cheque Vs Crossed Cheque

Definition:

The law relating to negotiable instruments is contained in the Negotiable Instruments Act, 1881. The term “negotiable instrument” means a document transferable from one person to another. However the Act has not defined the term. It merely says that “A .negotiable instrument” means a promissory note, bill of exchange or cheque payable either to order or to bearer.

Must Read – Callable and non callable fixed deposits

Noteworthy Characteristics of Negotiable Instruments

Following are the important characteristics of negotiable instruments:

- They are freely transferable.

- The holder of the instrument is presumed to be the owner of the property contained in it.

- A holder in due course gets the instrument free from all defects of title of any previous holder.

- The holder in due course is entitled to sue on the instrument in his own name.

- The instrument is transferable till maturity and in case of cheques till it becomes stale (on the expiry of 3 months from the date of issue).

- Certain equal presumptions are applicable to all negotiable instruments unless the contrary is proved.

Negotiable Instruments include Cheques, Promissory Notes, Bills of Exchange, etc.

Must Read – balance enquiry number

Let us go into a detailed study about Cheques.

Features of a Cheque

- It is always payable on demand.

- It is always drawn on a banker.

- It does not require acceptance.

- A cheque can be drawn on the bank where the drawer has an account.

- Cheques may be payable to the drawer himself. It may be made payable to the bearer on demand unlike a bill or a note.

- A cheque is usually valid for three months. However, it is not invalid if it is post dated.

- No Stamp is required to be affixed on cheques.

Must Read – Hypothecation

What is crossing of cheque?

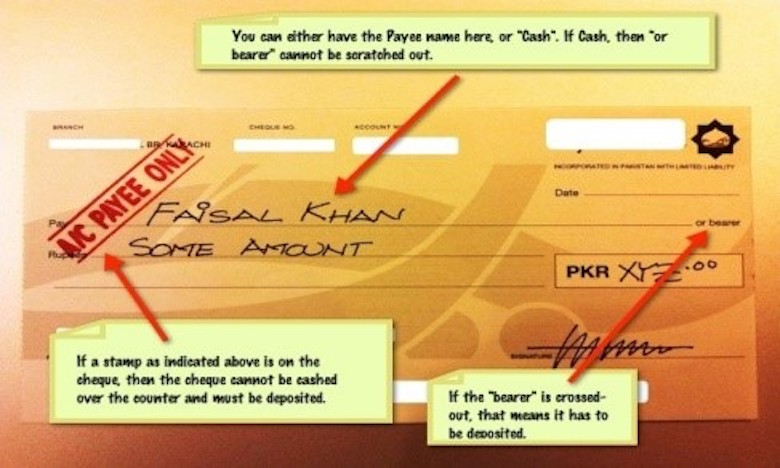

A cheque is either “open” or “crossed”. An open cheque can be presented by the payee to the paying banker and is paid over the counter. A crossed cheque cannot be paid across the counter but must be collected through a banker.

Modes of Crossing

There are two types of crossing which may be used on cheque, namely: (i) General & (ii) Special.

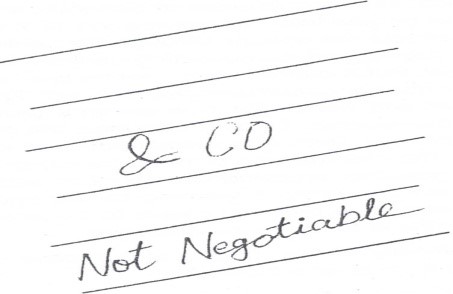

General Crossing: Where a cheque bears across its face, an addition of two parallel transverse lines and/or the addition of the words “and Co.” between them, or addition of “not negotiable”, it is a General Crossing.

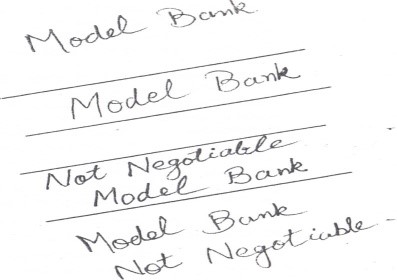

Special Crossing: In case of special crossing, the paying banker needs to honour the cheque only when it is prescribed through the bank mentioned in the crossing or it’s agent bank.

| Specimen of a general crossing | Specimen of a special crossing |

|  |

Account Payee’s Crossing:

Such crossing does, in practice, restrict negotiability of a cheque. It warns the collecting banker that the proceeds are to be credited only to the account of the payee, or the party named on the cheque, or his agent.

Recommended Articles