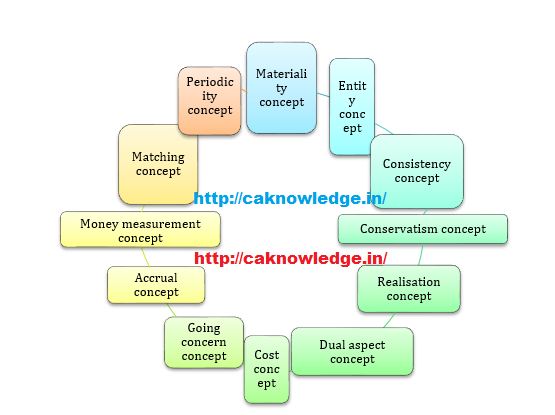

Accounting Concepts are the assumptions and conditions based on which financial statements of an entity are prepared. These are the concepts that are adopted by organizations in the preparation of financial statements to achieve uniformity in reporting. Accounting concepts are the base for the formulation of accounting principles. Accounting concepts have universal application. Here I’m going to discuss some basic details about these concepts.

Quick Links

(1) Entity concept :

The entity concept assumes that a business Enterprise is separate from its owners. Accounting transactions should be recorded with this concept only. The main intention of this concept is to keep business transactions away from the influence of personal transactions of their owners. Must Check Suspense Account.

(2) Periodicity Concept :

As per the going concern concept, an entity is assumed to have an indefinite life. If we want to measure the financial performance of an entity then we need to divide the operations of the entity for a specific period, otherwise, it’s very difficult to ascertain the performance of the business. The periodicity concept assumes a small but workable fraction of the period for measuring the business performance. Generally, it assumes 1 year is taken for this purpose.

(3) Money measurement concept :

As per this concept transactions that can be measured in monetary terms only are to be recorded in books of accounts. Any transactions which can not be converted into monetary terms should not be recorded in books. Since money is the medium of exchange and unit of measurement for showing financial performance, it doesn’t accept transactions other than monetary to record in books of accounts. You may also like Net Present Value.

(4) Accrual concept :

As per this concept transactions should be recognized in the books of accounts only when they occur and not on any cash basis. The main advantage of this concept is that financial Statements prepared as per this concept inform the users not only about past events involving payment and receipt of cash but also about obligations to pay cash in the future and resources that represent cash to be received in the future.

(5) Matching concept :

As per this concept, all the expenses that can be matched with the revenue of that period only should be taken into consideration for financial reporting. This concept is based on the Accrual concept as it gives importance to the occurrence of an expense that is spent for generating revenue. This concept leads to adjustments at the end like outstanding expenses, income, and Prepaid expenses, incomes.

(6) Going concern concept :

As per this concept, financial statements are prepared on the assumption that the enterprise will continue its operations for the foreseeable future. Thus, it says that the enterprise has neither the intention nor the need to liquidate or curtail the scale of its operations. The valuation of assets of a business entity is dependent on this assumption.

(7) Cost concept :

As per this concept valuation of assets should be done at historical costs/acquisition cost.

(8) Realisation concept :

This concept says that any change in the value of an asset is to be recorded only when the business realizes it. This concept highly prefers the Realisation of the value for which we want to give effect in books of accounts. Must Check Trial Balance.

(9) Dual Aspect concept :

This concept is based on double entry Accounting.s of a transaction. Under the system, aspects of transactions are classified into two main types:

- Debit

- Credit

Every transaction should have a Debit and credit. Debit is the portion of transaction that accounts for the increase in assets and expenses, and the decrease in liabilities, equity, and income. Credit is the portion that is a result of decreasing the asset, and increasing the liability, income, gains, and equity.

Accounting conventions:

Accounting conventions are the generally accepted guidelines in the preparation of financials. They arise from customs and practical application. They are not legally documented policies.

Following r the accounting conventions

(1) Conservatism :

As per this concept while Accounting one should not anticipate the income but should provide for all possible losses. When there are many alternative values to account for an asset then we should choose the lesser value. Inventory valuation is done as per this concept only, as cost or Market value whichever is lower.

(2) Consistency :

As per this concept, the accounting policies followed in the preparation and presentation of financial statements should be consistent from one period to another period. A change in Accounting policy can be made only when it is required by law, or for better presentation of accounts or change in Accounting standards.

(3) Materiality :

As per this concept items having significant economic effect on the business of the enterprise should be disclosed in financial statements and any insignificant item that is not relevant to the users should not be disclosed in financial statements.