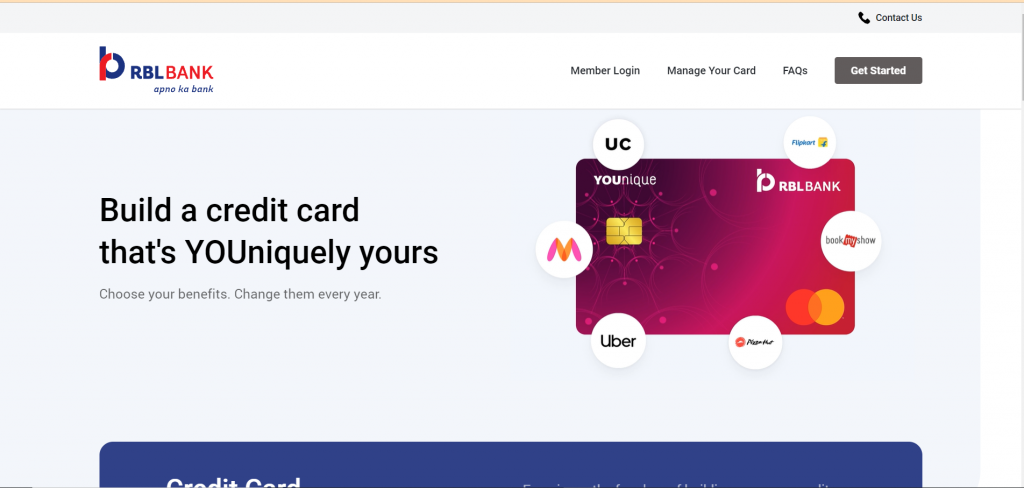

RBL bank YOUnique credit card 2024: RBL bank has presented a very different idea which is known as RBL bank YOUnique credit card. This is not like your everyday credit card, as it allows the user to build their unique credit card. You can make the card entirely yours by setting it according to your needs. You also have the option of changing the RBL Bankcard features in it every year.

Quick Links

RBL bank YOUnique credit card

Like any other credit card, there are a lot of features as well. You can expect to have a lot of reward points and cashback on every transaction made from the card. You can earn one reward point on trade of 100 rupees. There is also a special 1% credit for fuels if you spend 500 to 4000 on them.

There are also various brand partners as well, and they provide excellent discounts and cashback. E-commerce websites like Flipkart, Myntra, and many more have a lot to offer you. There are also free movie tickets every month from the BookMyShow app or site.

| Features | With RBL Bank YOUnique credit card, you can do everything which seems impossible. You can choose the features and benefits of the card, and you can build it from the beginning. On every transaction, you will get some reward points that later will convert into real cash. The credit card is also quite handy in online shopping, primarily through partner shops and merchants. |

| Eligibility criteria | The applicant must be a citizen of an Indian bank that doesn’t provide its services to the country, so you need to be in a good location. Your age must be either equal to 23 or more than that but should be less than 60 years. |

| Application process (Online/Offline) | The application process is straightforward and convenient to fill. You can apply for the card directly from your home via an online process. Although you also have an option for the offline application process. You need to fill the application form and choose the card according to your need. |

| Documents Required | Identity proof like Aadhaar card, passport, voter ID card, etc., Address proof like Aadhaar card, driving license, passport, etc., Income proof and some other relevant documents |

| Official Website | Click Here |

Eligibility criteria

Some eligibility criteria are pretty essential for everyone, as without the knowledge of all the eligibility criteria, you can have the card. Although if you are an experienced one in these things, you should be aware of all that, or if you have a credit card, then getting this one should be easy.

We have mentioned all the eligibility criteria below:

- The applicant must have to be a citizen of India to be able to use the card.

- You need to have a regular source of income and your monthly income must have to be either equal to 25,000 or more than that, if you want the card to be yours.

- Your age must have to be either equal to 23 or more than that, but it should be less than 60 years.

- You also need to have a very good credit score to be eligible for the card.

Application process (Online/Offline)

The application process for the RBL bank YOUnique credit card is straightforward and convenient to fill. You need to be eligible and have all the documents in your possession. The latter part of the form only requires a few formalities to be done. However, you need to select the benefits and features of your card in the form filling process. You can design the card the way you want to, and you can also change its features every year.

First of all, we will see the online process:

Step I – first of all, you need to visit the official website of RBL Bank, www.rblbank.com, to apply for the card.

Step II – in this step, you need to get yourself registered with the bank, and you also need to have an account on it. You can do that simply by providing some details about you and a short KYC.

Step III – now, you need to fill the application form and choose the benefits of your card. You can easily design your card according to your usage and needs.

Step IV – once the form is filled and the card is chosen, you must upload the required documents. After uploading the documents, you need to submit the form.

Step V – after submitting, you can expect the card to be yours within a few days or hours (depending on the situation).

Now, we will see the offline process:

Step I – first of all, you need to visit the branch of RBL bank which is closest to you.

Step II – now, you need to find a bank official who will assist with all your paperwork and documentation.

Step III – you need to fill the application form and choose the features for your card. You can decide the limit and other relevant things on your card.

Step IV – now, you need to submit the copies of the documents required.

Step V – Once the process is over, the card will be approved within a few hours or days.

Documents required

- Identity proof – Aadhaar card, passport, voter ID card, etc.

- Address proof – Aadhaar card, driving license, passport, etc.

- Income proof, for which you can either use the bank statement of the last few months or the most recent salary slip. You can also submit the income tax return or other documents related to your income.

- A pan card is required for a successful KYC.

Frequently asked questions

Yes, it might get better or even worse. It depends on your records and relationship with the card and bank. If you keep up with the credit repayment, then your credit score will keep getting better.

You can quickly check the available location from the official website, or you can also call customer service to know more about it.

Then, you need to do the application process online. You can easily apply for it through the online process.

No, the reward points don’t have any expiry date. They will remain yours till the card is active.