ICICI Personal Loan 2024: ICICI Bank is one of the biggest private sector banks of India and it has a massive no of customer support. The bank is also very reliable and trustworthy. It has been running for decades now, and there haven’t been any complaints about its services or anything. If you are planning on taking a personal loan, then there isn’t any place better than ICICI bank. In this article, we will discuss how one can get a Personal loan from ICICI bank.

Quick Links

ICICI Personal Loan

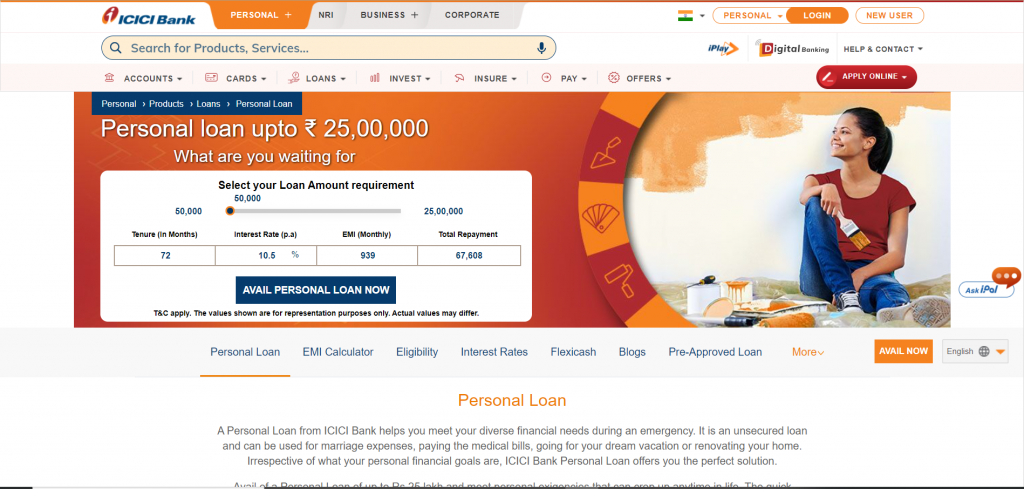

ICICI provides one of the best personal loans, with a variety of options to choose from and also at a very reasonable and affordable rate. The interest rate and processing fee are also quite acceptable. As an unsecured loan, the interest rate of personal loans are a little higher than others, but they also provide a great amount of flexibility and you can use the money for anything.

With ICICI Bank, you can also do what you want to do with that money, and the officials will give you all the proper help and support. Your loan amount will be transferred to your account within minutes. Also, the loan amount can reach as high as 25 lakhs, if you have the required credit score and if you are eligible for it.

| Interest rate | 10.5 % to 19 % per annum, Use EMI calculator to calculate EMI amount |

| Processing fee | Up to 2.50 % of loan amount plus taxes |

| Features | The loan can be approved very quickly. You can get up to 25 lakhs loan. Various personal loan options are available to simplify your choice |

| Eligibility criteria | You need to be an Indian to take a personal loan from ICICI bank. You need to have a minimum income of 15,000 to take a loan |

| Application process (Online/Offline) | You can either complete the application process online or offline. The process is very simple and hassle-free. Form filling is quite easy and documentation is also very minimal |

| Documents Required | Identity proof – Aadhaar card, passport, voter ID card, etc. Income proof, bank account details or salary slip Pan card and address proof |

Eligibility criteria

A personal loan from ICICI bank requires some points to be fulfilled. These are called eligibility criteria and you can’t take out a loan without passing all the eligibility criteria. Although there is nothing to be worried about. The eligibility criteria for a personal loan from ICICI bank is listed below:

- If you are living in Mumbai or Delhi, then you need to have a monthly salary or income of 25,000 in order to be able to take a loan from ICICI bank.

- If you are living in Kolkata, Chennai, Bangalore, Hyderabad and Pune, then your salary or income must have to be 20,000.

- For the citizens of the rest of India, you need to have a salary or income of 15,000.

- You need to be a citizen of India.

- The minimum age for salaried individuals is 23 and the maximum is 58, and for self-employed individuals, the minimum age limit is 25 and maximum is 65.

Documents required

The documents required before taking a personal loan from ICICI bank are:

- Identity proof

- Address proof

- Income proof – for salaried employee, latest salary slip, and for self employed person, bank statement of last 6 months.

- Pan card

- Two passport size photograph

ICICI Personal Loan Online Application

If you are planning to take a Personal loan from ICICI bank, then you need to know the application process. Although the application process is straightforward. Anyone can apply for the loan if only they are eligible as well. The hassle-free nature of the loan makes it one of the best in the market. You can either visit the bank or you can simply use the official website of the company. It is very simple either way, and you will surely gonna enjoy the experience.

Now, the steps to apply for the personal loan from ICICI bank is:

Step I – first of all, you need to visit the bank or its official website. Then you can select the desired loan which you want.

Step II – ask for the application form and if you are filling it online, simply search the apply now button. Then, fill the application form with proper care.

Step III – Now, you will need to attach all the documents with your application form, and in case of an online process, you need to upload the scanned image of all the documents.

Step IV – as per your credit score and your income and earlier stats, the maximum loan amount you can take will be provided to you. You need to select the amount, tenure and interest rate from all.

Step IV – once all the process is over and your documents are approved, the loan amount will be credited within minutes into your account.

Frequently asked questions

The minimum tenure is 12 months and the maximum is 60 months, although you can pay the amount before time is well.

Yes, ICICI Bank provides personal loans of up to 10 lakhs to NRIs. The interest rate starts from 15.49 % per annum and the maximum tenure is for 36 months.

You can approach the bank and apply for a Personal loan through the online process, Internet banking, Customer care or visiting an ICICI branch.

Yes. You can get a Personal Loan for business purposes, for self-employed individuals as well. To apply for a Business Loan, one needs to visit the nearest ICICI Bank branch along with your valid ID proof.

Recommended Articles: