*99# for Mobile Banking 2024 – Dial USSD *99# for Check Bank Balance, Mini Statement & Fund Transfer by IMPS. Unlike UPI, it does not require a smartphone and access to the internet but uses specified codes for transactions. This USSD interface (also called *99# service) was developed by NUUP (National Unified USSD Platform) to overcome the problem of poor internet connectivity in rural areas. It came up with the option of 12 regional languages in addition to English. Currently, this service is being offered by 51 banks. BHIM app as mentioned above can come up with USSD features as well.

99#, a USSD-based mobile banking service of NPCI was initially launched in November 2012. The service had limited reach and only two TSPs were offering this service i.e. MTNL & BSNL. Understanding the importance of mobile banking in financial inclusion in general and of *99# in particular, various regulatory/trade bodies came together to ensure the onboarding of all TSPs on *99# (USSD 1.0). With the wider ecosystem (11 TSPs), *99# was dedicated to the nation by Hon’ble Prime minister on 28th August 2014, as part of Pradhan Manti Jan Dhan Yojna.

*99# is a USSD (Unstructured Supplementary Service Data) based mobile banking service from NPCI that brings together diverse ecosystem partners such as Banks & TSPs (Telecom Service Providers). Using *99# service, a customer can access financial services by dialing *99# from his/her mobile registered with the bank. The service works across all GSM service providers and handsets.

*99# service has been launched to take the banking services to every common man across the country. Banking customers can avail of this service by dialing *99#, a “Common number across all Telecom Service Providers (TSPs)” on their mobile phone and transact through an interactive menu displayed on the mobile screen. Key services offered under *99# service include Sending and Receiving interbank account to account funds, balance inquiry, setting / changing UPI PIN besides a host of other services.

*99# service is currently offered by 83 leading banks & all GSM service providers and can be accessed in 13 different languages including Hindi & English. *99# service is a unique interoperable direct to consumer service that brings together the diverse ecosystem partners such as Banks & TSPs (Telecom Service Providers).

Quick Links

Key Features of *99# Mobile Banking Service

- You can access your bank account without enabling internet service. This service uses voice connectivity

- Accessible through a common code *99# across all TSPs

- No additional charges while roaming for using the service But Rs 1.50 (per session) will be deducted from your mobile account balance for using this service.

- Works across all GSM service providers and mobile handsets

- Round the clock availability to customers (works even on holidays) The Funds remitted using the *99# service can be received by the beneficiary 24/7.

- No need to install any application on a mobile handset to use the service

- Additional channel for banking services and key catalyst for financial inclusion

List of Services Available Under *99#

*99# service can be used by the customers for the following purposes: a) Financial b) Non-Financial c) Value Added Services (VAS)

Currently, following Financial, Non-financial and Value Added Services (VAS) are offered through *99# service.

| Financial Services | Sending Money using Mobile No |

| Sending Money using UPI ID | |

| Sending Money using Aadhaar No. | |

| Sending Money using Account No. + IFSC | |

| Requesting Money using UPI ID / Mobile No. | |

| Non-Financial Services | Account Balance |

| Set UPI PIN | |

| Change UPI PIN | |

| Last 5 transactions | |

| Value Added Services(*99*99#) | Aadhaar linking Status |

| PMJDY A/C Overdraft Status |

How to Use or Access Mobile Banking Service Via *99#

The service can be availed by dialing *99# from any GSM mobile phone. As a pre-requisite, the customer is required to register his/her mobile number with his bank for the mobile banking services. The customers already using mobile banking will be able to use this service without any additional registration by dialling *99# from their GSM mobile handset. The customers not registered for mobile banking service will have to contact their respective banks for mobile banking registration

If you have not registered for mobile banking service, you will have to contact your respective bank(s) for mobile banking registration.

Balance Enquiry

Balance Enquiry, Mini Statement, Fund Transfer, Generate MPIN etc.

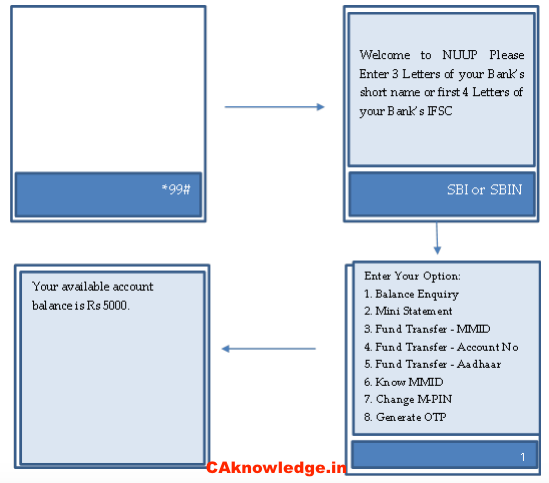

- Dial *99# from your Mobile handset.

- The welcome screen will appear asking you to enter your bank’s 3 letters short name or first 4 letters of IFSC.

- After entering a valid IFS Code or short name, a menu will appear with different options of available services enabled for your bank. For example – The short name for SBI is SBI, the First 4 letters of the IFSC code are SBIN and the 2 digits direct code for SBI Bank is ’41’ (you can Dial *99*41# directly to access your SBI account). You may Find other banks’ shortcode or direct codes below in this article.

- Enter 1 for Balance Enquiry, Enter 2 for Mini Statement and submit, Enter 6 for Know Your MMID, Enter 7 for Change MPIN and submit.

- A confirmation screen will appear displaying the available balance or Mini Statement etc.

Fund Transfer using MMID and Mobile Number

User can transfer funds by using MMID and Mobile number of the Beneficiary. The transaction flow for the same is as follows:

- Dial *99# from your Mobile handset.

- Welcome screen will appear asking you to enter your bank’s 3 letters short name or first 4 letters of IFSC.

- After entering valid IFS Code or short name, menu will appear with different options of available services enabled for your bank.

- Enter 3 for Fund Transfer using MMID and Mobile Number and submit.

- Subsequent screen to enter Beneficiary Mobile number, MMID, Amount and Remarks (Optional) will appear.

- Enter MPIN and last 4 digits of account number (Optional).

- A confirmation screen will appear showing success response.

Fund Transfer using IFSC and Account Number

User can transfer funds by using IFS Code and Account Number of the Beneficiary. The transaction flow for funds transfer using Account Number and IFS Code is as follows:

- Dial *99# from your Mobile handset.

- Welcome screen will appear asking you to enter your bank’s 3 letters short name or first 4 letters of IFSC.

- After entering valid IFS code or short name, menu will appear with different options of available services enabled for your bank.

- Enter 4 for Fund Transfer using Account Number and IFSC and submit.

- Subsequent screen to enter Beneficiary Account Number, IFS Code, Amount and Remarks (Optional) will appear.

- Enter MPIN and last 4 digits of account number (Optional).

- A confirmation screen will appear showing success response

Fund Transfer using Aadhaar Number

User can transfer funds by using Aadhaar Number of the Beneficiary. The transaction flow for funds transfer using Aadhaar Number is as follows:

- Dial *99# from your Mobile handset.

- Welcome screen will appear asking you to enter your bank’s 3 letters short name or first 4 letters of IFSC.

- After entering valid IFS Code or short name, menu will appear with different options of available services enabled for your bank.

- Enter 5 for Fund Transfer using beneficiary Aadhaar number.

- Subsequent screen to enter Beneficiary Aadhaar Number will appear.

- Enter MPIN and last 4 digits of account number (Optional).

- A confirmation screen will appear showing success response.

Note: The above are the standard process, however for authentication, different banks may use additional security means such as:

- Enter Last 4 digit of your Account number OR

- Enter User Id

Is there a facility/option available to Stop/Cancel financial transactions initiated using *99# service?

No. Since the *99# service uses IMPS channel which is an immediate fund transfer service; hence, it will not be possible to stop/cancel financial transaction after it has been initiated.

List of Banks offering *99# service

Please Check List of all banks offering *99# service with Short Code, IFSC Code and Multimodal Code. In this file you may find (The banks’ short codes, first 4 letters of IFSC Codes and Direct codes)

*99# bank list 2021

| Sr. No. | Bank Name | IFSC | Short Code |

|---|---|---|---|

| 1 | DCB Bank | DCBL | DCB |

| 2 | Axis Bank | UTIB | AXI |

| 3 | Andhra Bank | ANDB | ANB |

| 4 | Karnataka Bank | KARB | KBL |

| 5 | Union Bank of India | UBIN | UOB |

| 6 | Vijaya Bank | VIJB | VJB |

| 7 | Punjab National Bank | PUNB | PNB |

| 8 | YES Bank | YESB | YBL |

| 9 | IndusInd Bank | INDB | IIB |

| 10 | Bank of Maharashtra | MAHB | BOM |

| 11 | The Thane Janta Sahakari Bank Ltd(TJSB) | TJSB | TSB |

| 12 | The Ratnakar Bank Limited | RATN | RBL |

| 13 | ICICI Bank | ICIC | ICI |

| 14 | Canara Bank | CNRB | CNB |

| 15 | UCO Bank | UCBA | UCO |

| 16 | South Indian Bank | SIBL | SIB |

| 17 | IDFC | IDFB | IDF |

| 18 | IDBI Bank | IBKL | IDB |

| 19 | Allahabad Bank | ALLA | ALB |

| 20 | Kotak Mahindra Bank | KKBK | KMB |

| 21 | Bank Of Baroda | BARB | BOB |

| 22 | HDFC | HDFC | HDF |

| 23 | State Bank Of India | SBIN | SBI |

| 24 | Dena Bank | BKDN | DNB |

| 25 | Karur Vysaya Bank | kvbl | vysya |

| 26 | Standard Chartered | SCBL | SCB |

| 27 | Indian Bank | IDIB | INB |

| 28 | Central Bank of india | CBIN | CBI |

| 29 | Syndicate Bank | SYNB | SYB |

| 30 | Indian Overseas Bank | IOBA | IOB |

| 31 | Bank Of India | BKID | BOI |

| 32 | Punjab and Sind Bank | PSIB | PSB |

| 33 | City Union Bank | CIUB | CUB |

| 34 | The Lakshmi Vilas Bank Limited | LAVB | |

| 35 | G P Parsik Bank | PJSB | GPB |

| 36 | Vasai Vikas Co-op Bank Ltd | VVSB | VVS |

| 37 | Thane Bharat Sahakari Bank | TBSB | TBS |

| 38 | Apna Sahakari Bank | ASBL | APN |

| 39 | Janta Sahakari Bank Pune | JSBP | JSB |

| 40 | Rajkot Nagari Sahakari Bank Ltd | RNSB | RKN |

| 41 | Punjab and Maharastra Co. bank | PMCB | PMC |

| 42 | Jammu & Kashmir Bank | JAKA | JKB |

| 43 | The Mehsana Urban Co-Operative Bank | MSNU | MUC |

| 44 | Bandhan Bank | BDBL | BDN |

| 45 | The Saraswat Co-Operative Bank | SRCB | SRC |

| 46 | The Kalyan Janta Sahkari Bank | KJSB | KJB |

| 47 | Kallappanna Awade Ichalkaranji Janata Sahakari Bank Ltd. | KAIJ | KIJ |

| 48 | The Gujarat State Co-operative Bank Limited | GSCB | GSC |

| 49 | The Hasti Co-operative Bank Ltd | HCBL | HTI |

| 50 | The Mahanagar Co-Op. Bank Ltd | MCBL | MCB |

| 51 | Airtel Payments Bank | AIRP | ARL |

| 52 | FINO Payments Bank | FINO | FIN |

| 53 | Kerala Gramin Bank | KLGB | KLG |

| 54 | Pragathi Krishna Gramin Bank | PKGB | PKB |

| 55 | Karnataka vikas Gramin Bank | KVGB | KVG |

| 56 | Andhra Pragathi Grameena Bank | APGB | AND |

| 57 | Prathama Bank | PRTH | PRT |

| 58 | Maharashtra Grameen Bank | MAHG | MGB |

| 59 | Purvanchal Bank | SBIN0RRPUGB | PUR |

| 60 | Rajasthan Marudhara Gramin Bank | SBIN0RRMRGB | RMG |

| 61 | Telangana Gramin Bank | SBIN0RRDCGB | TGB |

| 62 | Chhattisgarh Rajya Gramin Bank | SBIN0RRCHGB | CHB |

| 63 | Saurashtra Gramin Bank | SBIN0RRSRGB | SAG |

| 64 | Andhra Pradesh Grameena Vikas Bank | SBIN0RRAPGB | AVP |

| 65 | Uttarakhand Gramin Bank | SBIN0RRUTGB | UKG |

| 66 | Meghalaya Rural Bank | SBIN0RRMEGB | MRB |

| 67 | Mizoram Rural Bank | SBIN0RRMIGB | MZR |

| 68 | Vananchal Gramin Bank | SBIN0RRVCGB | VGB |

| 69 | Baroda Rajasthan Kshetriya Gramin Bank | BARBOBRGBXX | BKG |

| 70 | Dena Gujarat Gramin Bank | BKDN0700000 | DGB |

| 71 | Chaitanya Godavari Grameena Bank | ANDB0CGGBHO | CGG |

| 72 | Baroda Uttar Pradesh Gramin Bank | BARBOBUPGBX | BUB |

| 73 | Baroda Gujarat Gramin Bank | BARB0BGGBXX | BGI |

| 74 | Dhanlaxmi Bank | DLXB | DLB |

| 75 | Paschim Banga Gramin Bank | UCBA0RRBPBG | PBG |

| 76 | Ujjivan Small Finance Bank Limited | UJVN | UIJ |

| 77 | Federal Bank | FDRL | FBL |

| 78 | Jana Small Finance Bank | JSFB | JSF |

| 79 | J & K Grameen Bank | JAKA0GRAMEN | JKG |

| 80 | Punjab Gramin Bank | PUNB0PGB003 | PGB |

| 81 | Himachal Pradesh Gramin Bank | PUNB0HPGB04 | HGB |

| 82 | Sarva Haryana Gramin Bank | PUNB0HGB001 | SBG |

| 83 | AU Small Finance Bank | AUBL | AUS |

List of Telecom Service Providers offering *99# service

| S. No. | Telco Name |

| 1 | AIRCEL |

| 2 | AIRCEL |

| 3 | BSNL |

| 4 | IDEA |

| 5 | MTNL |

| 6 | QUADRANT |

| 7 | RELIANCE |

| 8 | TATA |

| 9 | UNINOR |

| 10 | VODAFONE |

| 11 | VIDEOCON |

Recommended Articles