Swing trading is a short-term investment strategy that involves holding securities for periods ranging from a few days to a few weeks with the aim of profiting from short-term price fluctuations. This is a type of trading in which the trader tries to profit from short-term price movements by holding securities for a period ranging from 2-3 days to a few weeks.

It involves buying at a low price with the expectation that the swing pattern will push the price of the security higher in a few days/weeks after which a profit can be made by selling at a higher price. When securities are showing long-term trends due to fundamentally strong events, swing traders profit from price movements by holding them for a short period.

Check out – Cash Reserve Ratio (CRR).

Quick Links

Features of Swing Trading:

1. Trading Approach:

Swing traders use fundamental and technical analysis to evaluate long-term oriented trends and patterns in the price movements of securities. Their approach will be more radical than that of a day trader. One should learn enough to quickly analyze the market for stable and long-term oriented price movements.

2. Swing Charts:

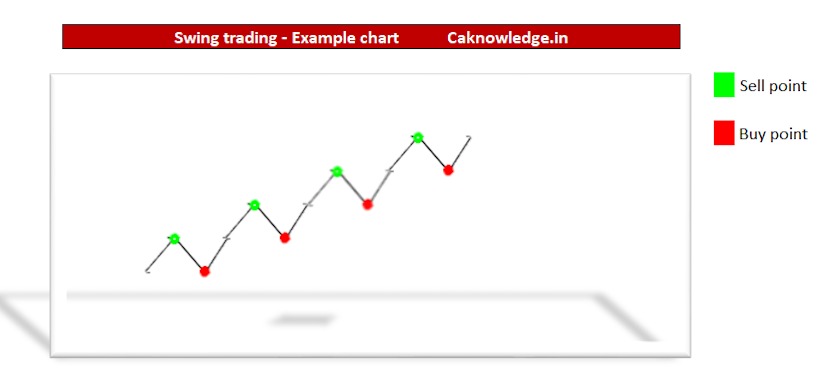

Swing charts are used to identify price trends in the short term. They simplify the effort of choosing the right stock at the right time. Therefore, one needs to learn to analyze these charts if one wants to become a swing trader.

3. Invest in the right swing:

The success of swing trading is based on the time at which one invests in a stock. Generally, the price of a security keeps changing constantly. It moves upward for some time after which it stabilizes and then starts falling for some time and then there is an upward trend. This is the trend that generally occurs in most stocks. Therefore, swing traders should invest in stocks when they are about to move upwards from lower levels.

4. Trade only in liquid stocks:

Swing traders trade only in highly liquid stocks. There is no point in buying stocks that do not have minimum price volatility.

Also, check – Electronic Fund Transfer (EFT).

Advantages of Swing Trading:

- Swing trading does not require you to analyze trends, patterns, and fundamentals too much. Once you learn to read swing charts, very good decisions can be made in the shortest possible time.

- Swing trading is less risky as compared to intraday trading. In the case of intraday, a lot of effort has to be put in to formulate a strategy. But this is not the case in swing trading.

- One does not need to be a full-time investor to earn through swing trading.

Disadvantages of Swing Trading:

- Traders should have more investment discipline while indulging in swing trading. Decisions once taken take time to show predictable behaviour.

- In conditions of high volatility due to large orders executed by bug players, the probability of reaching the stop loss is very high.

Recommended Articles