Marginal costing, also known as variable costing, is a cost accounting technique that focuses only on the variable costs associated with producing an additional unit of a product or service. It helps businesses understand how changes in production volumes affect costs and profits.

Here, we are making an effort to clear the basic concept of Marginal Costing.

The most important factor that distinguishes marginal costing from all other types of costing is that in marginal costing, the costs are divided into fixed, semi-variable, and variable costs. Semi-variable costs are again classified into fixed and variable elements. The cost of the product is ascertained by including the variable cost only. Must Check Revenue Expenditure.

Marginal Costing

Thus, Marginal cost is ascertained using variable costs which can be summarized as follows:

| Particulars (Cost) | Rs. |

| Direct Material | XXX |

| Direct Labour | XXX |

| Direct Expense | XXX |

| Variable Factory Overhead | XXX |

| Variable Selling and Distribution Overhead | XXX |

| Marginal Cost | XXX |

The fixed costs are charged against the year’s profit i.e. these are charged in the period in which these are incurred. The closing stock is also valued according to marginal cost i.e. without including fixed overheads. In short, marginal costing is a technique of ascertaining marginal cost and break-even/ cost-volume profit analysis. Marginal costing is also known as Direct costing, variable costing, and contributory costing.

Now, let us understand the detailed meaning of the three very backbones of marginal costing.

- Variable Cost: Variable cost is that part of the cost that varies with the level of output. The variable cost per unit does not change, but the total variable cost increases/decreases in proportion to the level of output.

- Fixed Cost: Fixed cost is that part of the cost which remains fixed irrespective of the level of output. The total fixed remains constant, but the fixed cost per unit keeps on changing with changes in the level of activity because the same amount will be divided over different numbers of units. You may also like Bridge Finance.

Also, remember that

Total Cost = Fixed Cost + Variable Cost

- Contribution: Contribution is the excess of sales over the variable cost. It is called a ‘contribution’ because it contributes towards the recovery of the fixed cost and profit.

So, these are simple formulae to derive contribution: - Contribution = Sale – Variable Cost

- Contribution = Sales x P.V. Ratio

- Contribution = Fixed Cost + Profit

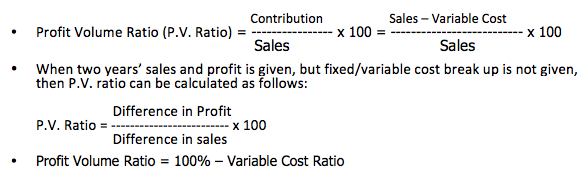

Now, another important topic is the P. V. Ratio. (Profit volume ratio)

It is a ratio of contribution as a percentage of sales. It remains fixed irrespective of the level of output. It can be also termed as contribution volume ratio. It does not get affected by a change in fixed cost. However, this ratio suffers from certain limitations in practical scenarios because the assumptions of break-even analysis may not hold.

Analysis of a concept is equally important for proper and complete understanding. Let us analyze how the PV Ratio can be improved:

- Increase in Selling Price.

- Improvement in Production Technology to reduce the variable cost.

- Reduction of variable selling and distribution costs.

- Buying raw materials in bulk to reduce the cost per unit.

This is the basic knowledge that one must possess before studying Marginal Costing. After being conceptually clear, we can solve difficult questions also. You may also like Accounting Concepts and Conventions.