Types of Cheques: A cheque is a document that orders a payment of money from a bank account. The person writing the cheque, the drawer, usually has an account where their money was previously deposited. The drawer writes the various details including the monetary amount, date, and a payee on the cheque, and signs it, ordering their bank, known as the drawee, to pay that person or company the amount of money stated.

Quick Links

Various Types of Cheques:

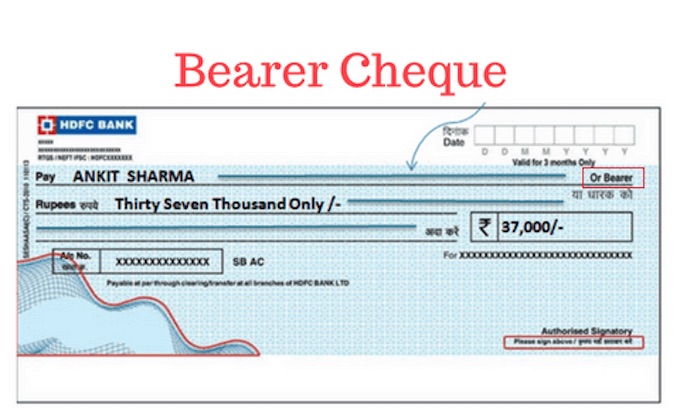

Bearer Cheque :

Generally, the cheque indicates the name of a person to whom the amount is to be paid. He is called the payee, paying bank is the drawee and the person who draws the cheques is the drawer. In case of bearer cheque, the wording of the cheque is pay to or bearer. It is not necessary for the payee to personally present the cheque and get the money. He can sign on the back and hand it over to any other person. Any person who holds the cheque lawfully can get payment.

The person who presents the cheque is called the bearer. Bank is not bound to verify the identity of the bearer. Thus, any bearer cheque lost or stolen is likely to be presented for payment. There is nothing to pin joint the identity of the person who accepted payment. Anybody who comes in possession of the cheque can encash it. Thus, bearer cheques are somewhat risky.

Order Cheque :

An order cheque specifically instructs the banker to ensure that the person mentioned only receives payment. The bank is duly bound to verify the identity of the person and see that the person presenting the cheque is the person whose name is mentioned on the cheque. If the word ‘bearer’ is struck off, the cheque becomes an order cheque. Thus, the order cheque is safer than the bearer cheque. If both the words i.e ‘bearer’ and ‘order’ are cancelled, the cheque becomes not negotiable, i.e. it cannot be legally transferred to any other person.

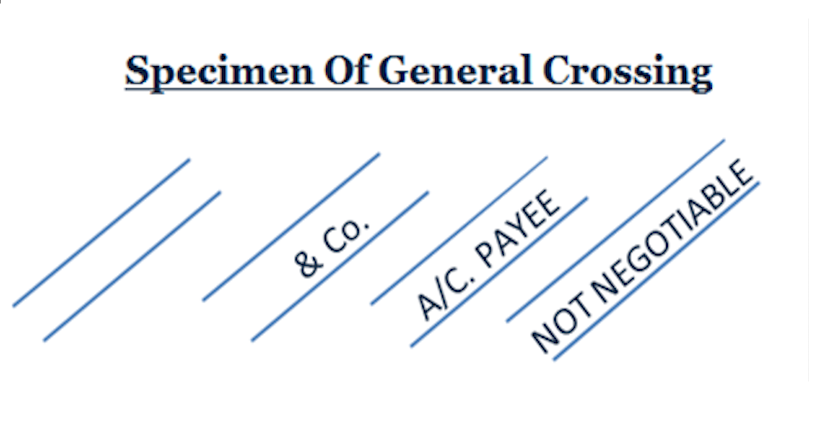

Crossed Cheque :

When two parallel lines are drawn on the top left side of the cheque, it is called crossed cheque. The lines should be conspicuous. The lines may or may not contain the words ‘& Co’. When a cheque is crossed, the payment is not made across the counter but the amount is credited to the payee’s account. He can then withdraw the amount from his account. A crossed cheque is an express instruction to the banker not to make cash payments. This is the safest type of cheque.

This is called general crossing. Sometimes, name of a specific bank and branch is wrIitten between the lines. It means the cheque must be presented through that bank only. This is called special crossing. In such case, the amount is paid to the specific bank which in turn credits the amount to the payee’s account. The words ‘not negotiable’ between the lines destroy the negotiability of the cheque.

Uncrossed/open cheque :

When a cheque is not crossed, it is known as an “Open Cheque” or an “Uncrossed Cheque”. The payment of such a cheque can be obtained at the counter of the bank. An open cheque may be a bearer cheque or an order one.

Anti Date Cheque : If a cheque bears a date earlier than the date on which it is presented to the bank, it is called as “anti-dated cheque”. Such a cheque is valid upto six months from the date of the cheque. For Example, a cheque issued on 10th Jan 2010 may bear a date 20th Dec 2009.

Post-dated Cheque: If a cheque bears a date which is yet to come (future date) then it is known as post-dated cheque. A post-dated cheque cannot be honoured earlier than the date on the cheque. For example, if a cheque presented on 10th Jan 2010 bears a date of 25th Jan 2010, it is a post-dated cheque. The bank will make payment only on or after 25th Jan 2010.

Stale Cheque : If a cheque is presented for payment after six months from the date of the cheque it is called stale cheque. A stale cheque is not honoured by the bank.

Multilated Cheque: When a cheque is torn into two or more pieces and presented for payment, such a cheque is called a mutilated cheque. The bank will not make payment against such a cheque without getting confirmation of the drawer.

Recommended Articles