E-banking: The world is changing at a staggering rate and technology is considered to be the key driver for these changes around us. An analysis of technology and its uses show that it has permeated in almost every aspect of our life. Many activities are handled electronically due to the acceptance of information technology at home as well as at workplace. Slowly but steadily, the Indian customer is moving towards the internet banking.

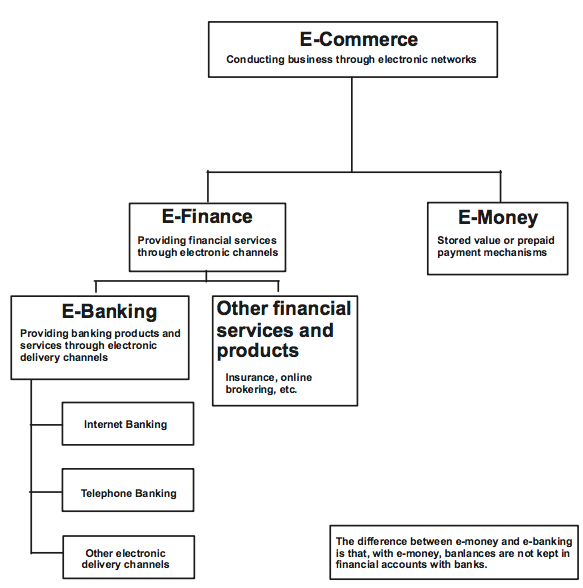

The ATM and the Net transactions are becoming popular. But the customer clear on one thing that he wants net-banking to be simple and the banking sector is matching its steps to the march of technology. E-banking or Online banking is a generic term for the delivery of banking services and products through the electronic channels such as the telephone, the internet, the cell phone etc. The concept and scope of e-banking is still evolving. It facilitates an effective payment and accounting system thereby enhancing the speed of delivery of banking services considerably.

Meaning E-banking :

Electronic banking is one of the truly widespread avatars of E-commerce the world over. E-banking refers to electronic banking. It is like E-business in banking industry. E-banking is also called as “Virtual Banking” or “Online Banking”. E-banking is a result of the growing expectations of bank’s customers. As, E-banking involves information technology based banking. Under this I.T. system, the banking services are delivered by way of a Computer-Controlled System. This system does involve direct interface with the customers.

The customers do not have to visit the bank’s premises. Online banking can simply be defined as the process of entering into transactions by a particular client and the bank using modern technology. With the various capabilities of the computer and other technological developments, online banking is one of the many businesses that benefited from it. Since banking plays a very important role in the economy of a nation, then there is truly a need to maximise and improve its features to be client friendly and easy to access.

Evolution of E-banking :

The story of technology in banking started with the use of punched card machines like Accounting Machines or Ledger Posting Machines. The use of technology, at that time, was limited to keeping books of the bank. It further developed with the birth of online real time system and vast improvement in telecommunications during late1970’s and 1980’s.it resulted in a revolution in the field of banking with “convenience banking” as a buzzword. Through Convenience banking, the bank is carried to the door step of the customer.

The 1990’s saw the birth of distributed computing technologies and Relational Data Base Management System. The banking industry was simply waiting for the technologies. Now with distribution technologies, one could configure dedicated machines called front-end machines for customer service and risk control while communication in the batch mode without hampering the response time on the front-end machine.

Traditional banking ⇒ Virtual or E-banking

Gunpowder ⇒ Nuclear charged

Personalised services, time consuming, limited access ⇒ Real time transactions, integrated platform, all time access

Intense competition has forced banks to rethink the way they operated their business. They had to reinvent and improve their products and services to make them more beneficial and cost effective. Technology in the form of E-banking has made it possible to find alternate banking practices at lower costs.

More and more people are using electronic banking products and services because large section of the banks future customer base will be made up of computer literate customer, the banks must be able to offer these customer products and services that allow them to do their banking by electronic means. If they fail to do this will, simply, not survive. New products and services are emerging that are set to change the way we look at money and the monetary system.

Recommended Articles