Bankers Cheque: A cheque which is payable by a bank itself, as opposed to an ordinary cheque payable only out of the funds of a particular customer’s account. A bank cheque is normally obtained by a bank customer (by paying its face value), the point is that the person receiving the cheque has the security of knowing it’s payable by the bank and thus cannot bounce. read more on Bankers Cheque from below…

Banker’s cheque or bankers’ Draft is a cheque (or check) where the funds are withdrawn directly from a bank’s funds, not from an individual’s account.

Banker’s Cheques are negotiable instruments payable to order and attract all provisions applicable to an order cheque and are valid for six months from the date of issue and in genuine cases may be revalidated.

Quick Links

Normal Banking Cheques :

If an individual or company operates a current account (or checking account), they may draw cheques to transfer funds from their account to an account belonging to a creditor. The creditor passes that cheque to their own bank, which will use a clearing house or similar system to arrange for the funds to be moved from the debtor to the creditor during a clearance period of a few days. Any debt is thus settled.

Bankers Cheque as a Reduction of Risk :

The problem with normal cheques is that they are not as secure as cash. A cheque received in the post could be potentially worthless if there are insufficient funds for the cheque to be honoured. In this instance, the clearance house or bank will return the cheque to the creditor, who will receive no money. Therefore, any cheque carries the risk that it might be returned unpaid (or “bounced”, in the vernacular).

To reduce this risk, a person can request for a type of cheque where the funds are, in effect, drawn directly against the bank’s own funds, rather than that of one of their accounts. This is less risky for a creditor, because the cheque will be honoured unless the cheque has been forget or the issuing bank goes out of business before the draft is cashed.

In order that the issuing bank can be sure that its customer has sufficient funds to honour the draft, the bank will withdraw the value of the draft (plus any charges) from the customer account immediately

Advantages of Banker’s Cheques :

1) They are convenient in settling accounts with foreign partners. Banker’s cheques can be used for making payments for goods and services to foreign partners, i.e. to pay for subscription of books and publications, lotteries, goods, training in foreign schools, embassies for issue of visas and, to make gifts in cash, etc.

2) Banker’s cheques are very convenient for making payments when there is no need to make urgent money transfer.

3) It is cheap. A banker’s cheque is the cheapest international way of money transfer (payment).

4) Fits if there is no enough information about the payee. A banker’s cheque is the most convenient way of payment if there is no enough information about the payee: e.g.: when a firm that has submitted only its address and name is requested to pay. In which case international payment order is not possible.

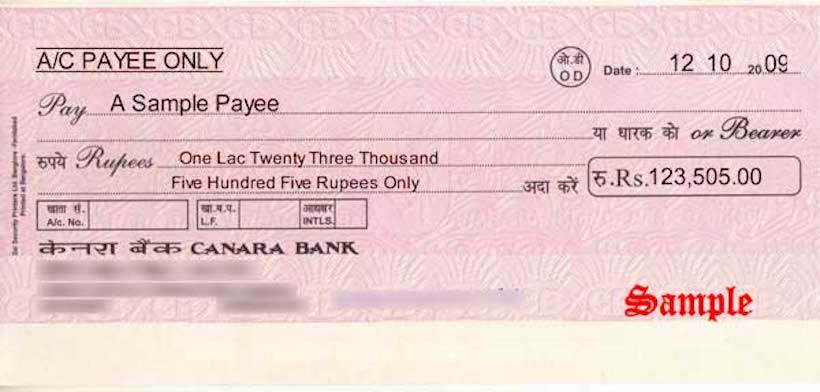

Sample Format of Banker’s Cheque

Recommended Articles