BOI Net Banking 2024: Net Banking and Mobile Banking are the facilities which enable you to perform banking transactions at your choice of place and time. You can access Net Banking via personal computer or laptop and Mobile Banking via mobile or tab, subject to the availability of an internet connection.

Quick Links

Special features of BOI Net Banking

Available 24 hours a day, 365 days a year and you can operate your account anytime, anywhere at your convenience

- Net Banking and Mobile Banking services are secure

- Provide dashboard view of your entire relationship with the Bank

- Allows you to view recent and past transactions (Debits & Credits)

- Allows you to book deposits online

- Transfer money through various payment modes such as Internal Funds Transfer, Own Account Transfer and other Bank Transfer via. NEFT, RTGS & IMPS.

- Helps you place stop cheque instructions

- Allows you to order for a new cheque book

To know more, please visit nearest branch of Bank of India.

How to Activate BOI Net Banking Online

#Step 1: Visit BOI official website and from the sidebar click on retail (orange color link), you can find that link under internet banking. Or directly visit BOI internet banking website by following link (click here)

#Step 2: From BOI net banking homepage, click on “New User” button.

#Step 3: Now Enter your bank account number and registered mobile number. After entering captcha security text, click on continue. (Please note – Before starting the registration process, please ensure that you have the following handy: Account Number, ATM/Debit Card linked to the account number, ATM/Debit Card Credentials, Mobile number registered for the account number)

Note: Prefix country code to your mobile number without sign(+) e.g.- 9199*******33 not +9199******33.

#Step 4: In the next step, you will require to enter one time password (OTP) that you will receive on your registered mobile number. enter OTP received on your mobile and then click on continue button.

#Step 5: In the next step, you’ll have to enter your ATM card details. After entering your Debit-cum-ATM card credentials, hit continue button.

#Step 6: Now click on Read and accept terms and conditions of using e-banking facility of the bank. Click on check-box “I agree to the above mentioned Agreement-cum-Indemnity” then press accept to proceed.

#Step 7: In the next page, you will be asked to enter a password for your internet banking. Simply create a password containing special characters, alphabets, and numbers e.g.-@a2ab_12Z, and click on continue.

Step 8: Upon clicking on continue, following pop-up message will appear on your computer screen “Your request to create Internet Banking User ID is successful.” Click on “OK” and then note down your reference number, customer id, and login user id.

Important! Note down all details before pressing any key.

#Step 9: This service takes one working day to activate, now you are able to access your account after 24 Hours.

BOI Net Banking Login and Register

- Click here to login at BOI Net Banking

- Click here to register at BOI Net Banking

- New User Request

- Transaction Password

Important Requirements

BOI Retail Internet Banking

Benefits of Internet Banking?

Internet Banking offers you a convenient way of carrying out your Banking needs without visiting the branch. It saves your time and money, which usually get spent in visiting the branch for carrying out such banking transactions.

Difference between Login Password and Transaction Password?

Login password will be used to enter into the Internet Banking Application (expiry period – 2 yrs). Transaction password will be used to do Funds transfer (expiry period – 180 days)

How to forget my password?

Download the Unblock / regenerate password form from our Website. (Home Page-> Internet Banking -> Retail -> Unblock / regenerate password). Fill in the details and submit to our branch.

How to unblock / regeneration of password online, without visiting the branch?

Yes. You can do unblock / Regeneration of password online if you are having debit card linked to any A/c of the customer Id on which Internet banking is issued. Home Page > Internet Banking > Retail > Forgot Password. Input the debit card credential for validation. On successful validation, you will get following option

I am getting the message “Invalid Login Id and Password”. What does it mean?

This message means either of the following –

- You are inputting incorrect User ID / Login Password. OR

- Your user ID has been temporarily disabled due successive attempts of wrong password.

I have not yet received my User Id and Password?

- Please check your communication address registered with the Bank.

- Please contact Starconnect department. Email – [email protected]

Call at 1800 220 229 / (022) – 40919191

I have received only Login password and not Transaction Password?

- For security reasons, Login and Transaction Password are sent on different dates in different cover. Hence, you may not get both passwords at the same time but after a time gap.

- You have only View facility. Hence transaction password was not issued.

- For more details contact your Bank of India Branch.

I wish to avail transaction facility, but have View facility only?

Submit your request for transaction password form to our branch for generation of transaction password.

I wish to deactivate the fund transfer facility.

Inform your Branch for deletion of transaction facility.

Can I transfer fund in my PPF accounts through Internet Banking?

Yes. This facility is available to you in Retail Internet Banking, if your PPF account is linked to your customer ID having Internet Banking. However, if your PPF a/c is not linked to your customer ID, contact your Branch.

Can I view my TAX Credit Statement (26AS) over Internet Banking?

Yes. The facility is available to you in Retail Internet Banking.

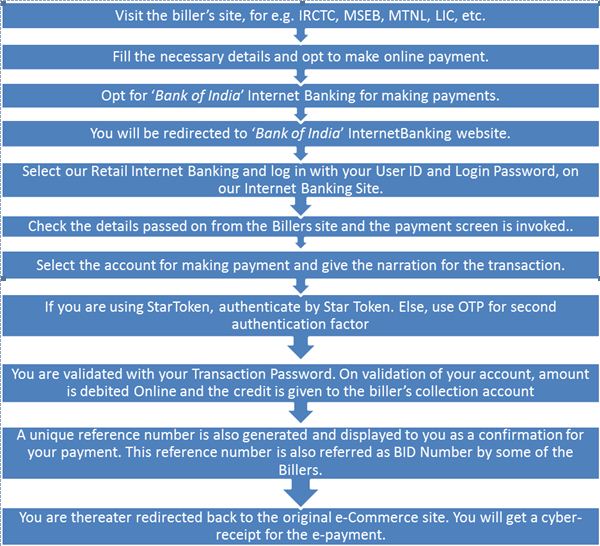

How can I make Online e-Payments ?

You need to initiate the payment by visiting to the billers site. The process is as under:

I am getting message while making e-payment “daily limit / maximum amount limit exceeded”? What does it mean?

The message indicates that the daily limit/per transaction has been consumed. You need to submit the limit enhancement form to the branch for enhancement in daily / per transaction limit. The limit will be enhanced by IB Administrator on receipt of branch recommendation for the same.

Recommended

Interested in learning more!