HDFC Credit Card Status, Check latest update for how to check HDFC Credit Card Application Status Online. How to Apply for HDFC Bank Credit Card Application Status Online 2024. Steps to Check HDFC Bank Credit Card Status. HDFC Credit Card is much important these days for making the online money transaction. HDFC is one of the top Bank that understands the changing solution and creating a better solution with the suitable benefits.

The bank has developed many strategies to bring out best deals and provide best money solution to the users. In this article we provide complete details for how to check HDFC Bank Credit Card via Online mode and how we can approve HDFC Credit Credit Card.

Quick Links

Types of HDFC Credit Cards

- HDFC MoneyBack Credit Card

- HDFC Titanium Edge Credit Card

- HDFC Platinum Edge Credit Card

- HDFC JetPrivilege HDFC Bank World

- HDFC JetPrivilege HDFC Bank Platinum

- Platinum Times Card HDFC Card

- Platinum Plus HDFC Card

- World MasterCard Card

- Doctor’s Superia Card

- Teacher’s Platinum Credit Card

- Visa Signature HDFC Card

- And Many More……

Steps to Check HDFC Credit Card Status online

- Step 1 – Visit on HDFC Credit Card Official Website https://www.hdfcbank.com/

- Step 2 – After Visit on official HDFC Credit Card Website, Please click on “Credit Card” Menu

- Step 3 – Now you may reach at official HDFC Credit Card Page, please scroll down this page and you may see “Track Application” Link, Please click on above link…

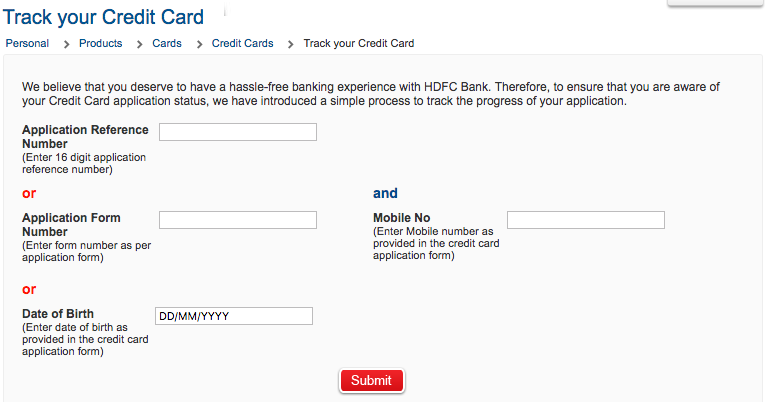

- Step 4 – Now you may reach at official tracking page, you may directly reach at this page by using following link “http://www.hdfcbank.com/personal/credit_card/cc_track“

- Step 5 – Now Please Enter your 16 Digit Application Number, Mobile Number or Date of Birth and then click on “Track Status” Button

- Step 6 – Now you credit card status is appeared in your computer or mobile screen

Please Note – If you credit card is rejected or not approved then please don’t apply Again for HDFC Credit Card till Next 6 Months

How to Approve HDFC Credit Card Instantly

If you want to approve your HDFC credit card instantly, then please submit following documents…

- Submit Last 2 Year ITR Copy More then Rs 2,50,000

- Provide Postpaid Mobile Bill or Landline Bill

- If you have any other bank credit card, then please provide last 3 statements of your credit card

- PAN Card Copy

- And Other ID Proof and Address Proof

Important Question’s Related to your HDFC Credit Card

Q. I have applied for a Credit Card – would like to know the status?

Click here to check the status of your credit card application. You are required to input the 16 digit Application reference number and Mobile number or Date of Birth (DDMMYYYY)

Q. I have not received my HDFC Credit Card?

Generally, your Credit Card is delivered within 21 working days of submitting your application. If you have registered your mobile number with us, you will receive timely alerts informing you about the status and details of the dispatch of your Credit Card.

If you have received the alert on Airway Bill number (courier reference) on your mobile number provided in Credit card application form.

You can track the status of the shipment using the Airway Bill number by visiting the courier websites.

Q. I had applied for an HDFC Card 3 months back and now when I try to apply again, I am not able to do so.

In the normal course, you should be able to apply after 3 months of your previous application. There are some exceptional circumstances in which you may not be able to re-apply for longer.

Q. When is late payment charge levied?

Late Payment charges will be applicable if Minimum Amount Due is not paid by the payment due date, Clear funds need to be credited to HDFC Bank Card account on or before the payment due date, to avoid Late Payment charges. Late payment charges are applicable as:

| Statement | Late Payment Charges |

|---|---|

| Less than Rs.100 – Nil | Nil |

| Rs.100 to Rs.500 | Rs.100/- |

| Rs.501 to Rs.5,000 | Rs.400/- |

| Rs.5 ,001 to Rs.20,000 | Rs.500/- |

| Rs.20,001 and above | Rs.700/- |

If you have any other query regarding “HDFC Credit Card Status” then please tell us via below comment box…

Recommended Articles:

Credit card

Plz reply

please credit card send me

I have applied for a credit card online ,but I have not application no. So what I can do to get the application no.

i have no found any information for credit card status

Application no: 17112115082670S2

Kindly provide the status

Application No : 17122111656290N1

Kindly Provide The Status Pliz

Vishnu Kant JHA Application no -17122310951860S2 kindly provide the status plz

Application no:- 17122919586970EB

Nishant Kumar kindly provide the status please……

Credit Card Application no 18011512315070O1.

Vikram kumar kindly provide the status pls hurry

I have received a credit card and message for generate PIN by calling a PIN generate number but the message is you are not authorised What could be a reason.How PIN will be generated.

app no 18012317455970O1

cont no 8510900420

plz share the status

18020717143390N1 HDFC BANK

Plz final states my no 9899202563

Name parveen

HDFC BANK CRDIT CARD APPLICATIONS

NO 18020717143390N1

NAME PARVEEN

Kindly provide the status final

Plz my no 9899202563