Difference between Atal Pension Yojana & New Pension Scheme 2024. Atal Pension Yojana (APY) Vs New Pension Scheme (NPY), Recently I have come across many queries asking the difference between New Pension Scheme (NPS) and Atal Pension Yojana (APY). In particular many people were asking about the major differences that make it (APY) quite better than NPS.

In this article, you can find complete details regarding the Difference between NPS & APY, APY vs NPS – Which is a better option for Retirement?. Now you can scroll down below and check more details regarding Atal Pension Yojana & New Pension Scheme 2024.

Quick Links

Atal Pension Yojana & New Pension Scheme

Here I discuss the difference between these two:

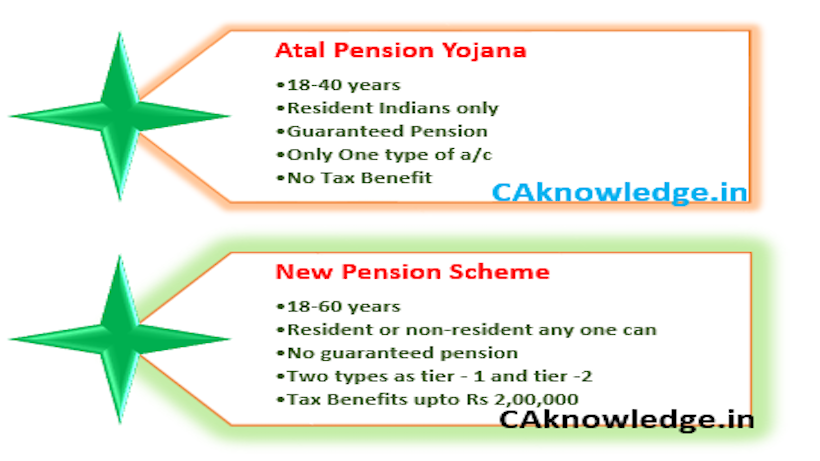

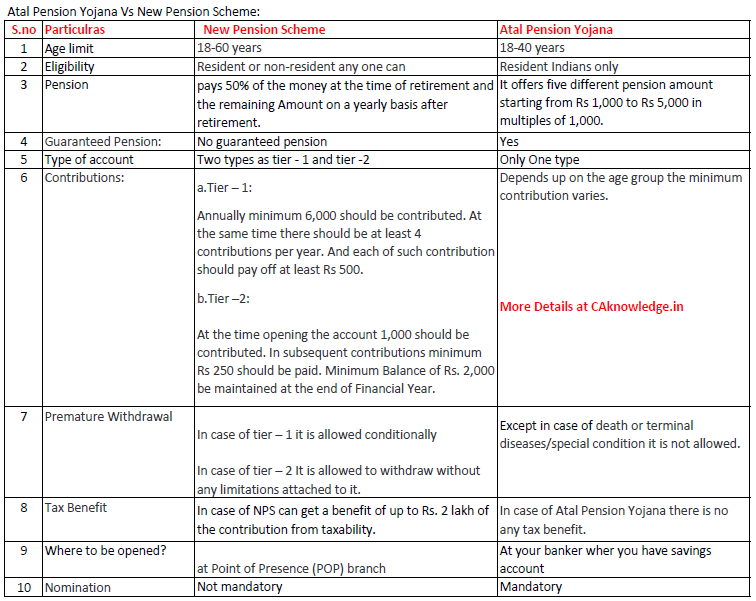

1. Joining Age:

One can join these schemes if they are of the age group between

- 18-60 years – In case of New Pension Scheme

- 18-40 years – In case of Atal Pension Yojana

2. Eligible Candidates

- Resident or non-resident any one – In case of New Pension Scheme

- Resident Indians only – In case of Atal Pension Yojana

Must Read – Atal Pension Yojana

3. Pension Catered :

- National Pension Scheme pays 50% of the money at the time of retirement and the remaining Amount on a yearly basis after retirement.

- Atal Pension Scheme offers five different pension amount starting from Rs 1,000 to Rs 5,000 in multiples of 1,000.

4. Guaranteed Pension:

- In Atal Pension Yojana there is guaranteed pension after retirement.

- In case of New Pension Schemethere is no guaranteed pension. But NPS gives the subscriber an option decide as to how his/her NPS pension wealth is to be invested in the following three options:

- Investments in predominantly equity market instruments.

- Investments in fixed income instruments other than Government securities.

- Investments in Government securities.

Must Read – Pradhan Mantri Mudra Yojana (Pmmy)

5. Type of account:

In Atal Pension Yojana only one type of account is there. Where as in NPS there are two types of account namely Tier-I and Tier-II.

6. Contributions:

- Atal Pension Yojana:

Depends up on the age group the minimum contribution varies.

- New Pension Scheme:

- Tier– 1: Annually minimum 6,000 should be contributed. At the same time there should be at least 4 contributions per year. And each of such contribution should pay off at least Rs 500.

- Tier–2: At the time opening the account 1,000 should be contributed. In subsequent contributions minimum Rs 250 should be paid. Minimum Balance of Rs. 2,000 be maintained at the end of Financial Year.

7. Premature Withdrawal:

- Atal Pension Yojana:

Except in case of death or terminal diseases/special condition it is not allowed.

- New Pension Scheme:

In case of tier – 1 it is allowed conditionally

In case of tier – 2 It is allowed to withdraw without any limitations attached to it.

Must Read – Pradhan Mantri Suraksha Bandhan Yojana

Atal Pension Yojana and New Pension Scheme

8. Government’s Contribution:

- New Pension Scheme:

In case of NPS the Central Government and State Government employee’s contribution is fixed at 10% of salary and Dearness Allowance (DA) per month which is matched by an employer contribution of the same amount.

- Atal Pension Yojana:

In APY the Government contributes 50% of the total contribution or Rs. 1,000/- per annum, whichever is lower, to the eligible APY account holders who join the scheme during the period 1st June, 2015 to 31st December, 2015 for 5 years.

9. Tax Benefit:

- New Pension Scheme:

In case of NPS can get a benefit of up to Rs. 2 lakh of the contribution from taxability.

- Atal Pension Yojana:

In case of Atal Pension Yojana, there is no any tax benefit.

Must Read – Pradhan Mantri Suraksha Bima Yojana

10. Where to be opened?

- New Pension Scheme:

In case of NPS account can be opened at Point of Presence (POP) branch to open the account. This account could also be opened online through CAMS online, or providers such as ICICI Direct and Funds India.

- Atal Pension Yojana:

This can be opened at any branch of a bank where you have a savings bank account.

11. Nomination:

- New Pension Scheme:

One can nominate a maximum of 3 members. The total sum sharing of all these nominees must be equal to 100%. But the nomination is not mandatory

- Atal Pension Yojana:

In this the nomination is mandatory, Details of nominee are to be submitted at the time of opening the account.

Must Read – Jan Aushadhi Scheme: Everything you want to know

12. Permanent Retirement Account Number:

- New Pension Scheme:

In case of NPS, you will get the unique Permanent Retirement Number (PRAN). By quoting this PRAN, you can operate NPS sitting across India.

- Atal Pension Yojana:

No such Number is provided.

13. Administered by:

- New Pension Scheme:

This is managed by Pension Fund Regulatory and Authority (PFRDA)

- Atal Pension Yojana:

This is managed by Pension Fund Regulatory And Authority (PFRDA).

Difference between NPS & APY, APY

Recommended Articles

- History of Mutual Funds

- Best SIP Mutual Funds

- Mutual Funds

- 7 Golden Rules

- Profitability Index (PI)

- Retail Investors and Mutual Funds

- Interest Rate of NSC, PPF, KYP, SSY, SCSS

- EPFO Mobile App

- Sectoral Mutual Funds

- Best Long Term Investment Plans

- KVP, PPF, NSC Which is best?

- National Savings Certificate (NSC)

- Startup Companies

If you have any query regarding “Atal Pension Yojana & New Pension Scheme” then please tell us via below comment box…..