10 Main features of Black Money Act, 2015. Key Highlights of The Black Money Act 2015, Check Salient Features Of Black Money Bill, Highlights of the Black Money Bill, Features of the Black Money Bill 2015. 10 Main Features of Black Money and Imposition of Tax Act, 2015. This article is basically talking about the features and consequences for undisclosed incomes and the undisclosed foreign incomes and the assets which are appearing in the foreign but which are undisclosed and the tax imposition has been there but has not been paid.

Basically Black Money means the income which is earned by way of cash and after that the fund is transferred to some other place located outside India and has not been disclosed in income computation in India.

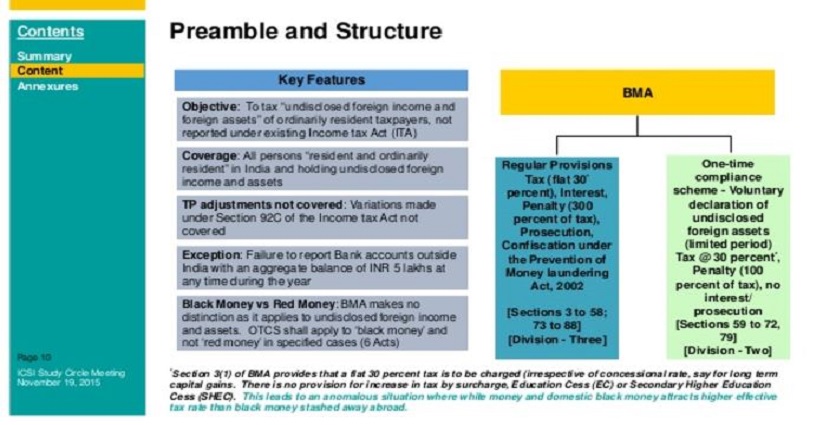

10 Main Features of the Black Money Act:

There has been so much of talks regarding the provisions of Black money act due to which the incomes of the people who had undisclosed incomes has been in pressure that whether they would be caught or would be left. This is to note that these are the features which would be applied if you have undisclosed income outside India

Must Read – China’s black Monday

- The tax rate which would be applied for such is 30% flat. Now that question which arises that how the tax would be calculated, the answer to it is the tax would be calculated @30% flat means, there would be not deductions, set off or carry forward, any exemptions etc.

- The next important thing to note is that this act would be applicable to banks and financial institutions too and they are not exempted from the same. In case of companies, the person in charge when the fraud took place would be responsible. But this Act would be levied only on persons resident in India.

- The effective date when this act would be enacted is 1st April 2016

- How the undisclosed income would be decided is :

- Total amount of undisclosed income outside India

- Fair Value of such income, whichever is higher

- The prosecution charges will also be levied if the assessee is not furnishing the above details in prescribed time. The charges which may be levied is from 3 to 10 years.

- The penalty provisions are also levied as follows :

- If undisclosed income disclosed in prescribed time – 30% of the undisclosed income.

- If undisclosed income not disclosed in prescribed time – 90% of the undisclosed income.

- If the assessee has not filed the return as per the undisclosed income or inaccurate particulars have been provided than would be leviable as follows :

- Prosecution details – From 6 months to 7 years

- Penalty details – Upto Rs 10 Lakhs

- The second and the subsequent offence would be considered as follows :

- Prosecution details – From 3 years to 10 years

- Penalty details – Rs 1 crore

- The only exemption provided is that the assessee who are having undisclosed foreign income of Rs 5 Lakhs or less are not covered under this Act and would not be liable for penalty or prosecution details.

- 10.The Act also authorizes the central government to make agreements with the other countries for the disclosures of the undisclosed amount.

So this Act has made the provisions very much stringent and no person would be left with black money if implemented effectively. Now we have to see how the implementation of this Act takes place.

Recommended Articles

Good thoughts overruled #yash shah